Please answer all questions!!!

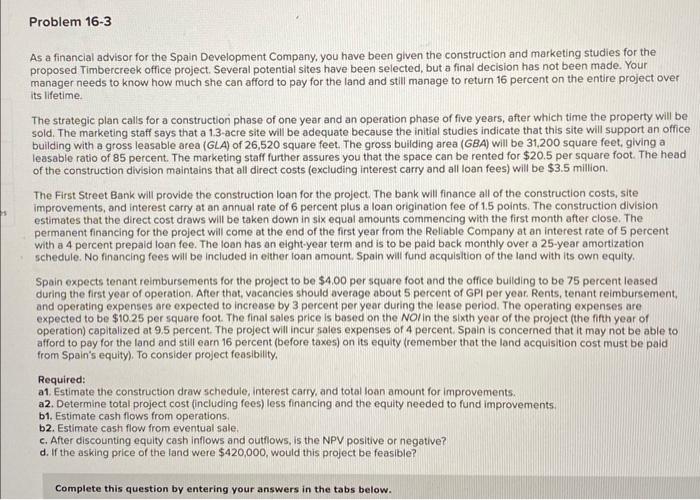

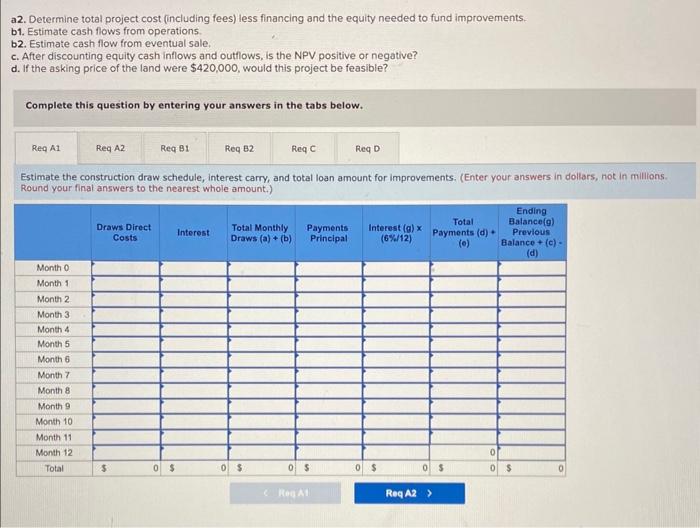

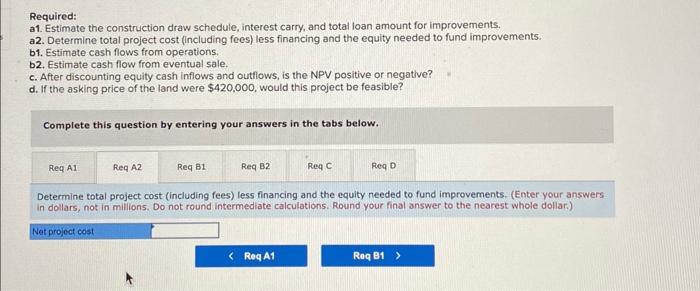

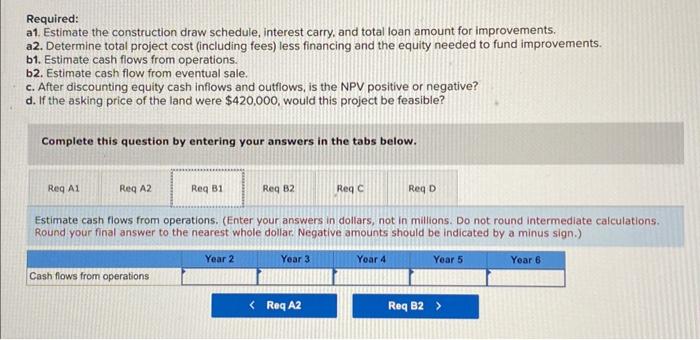

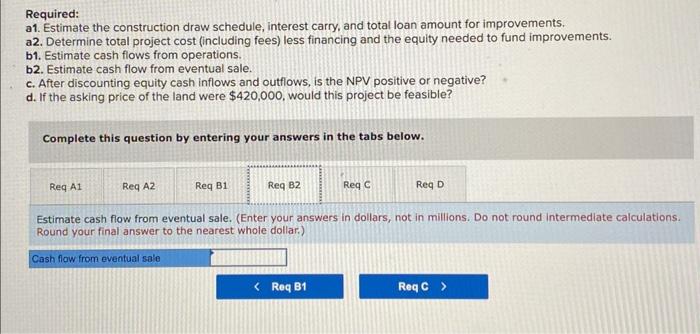

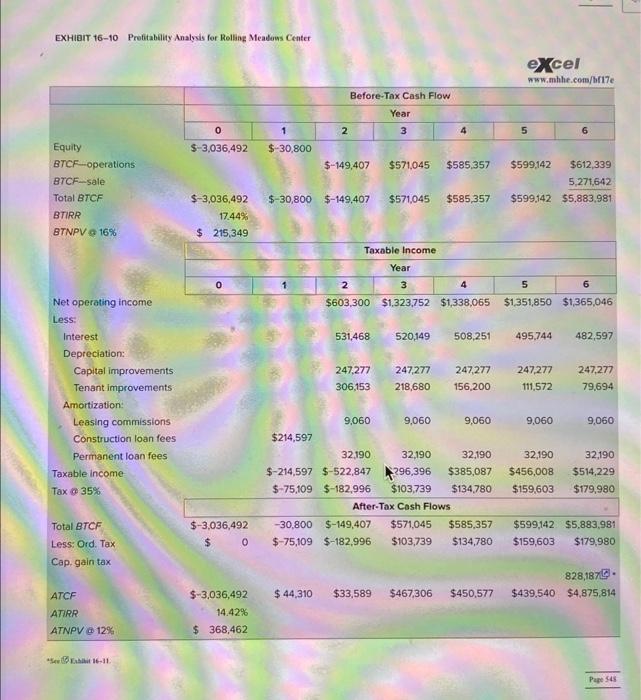

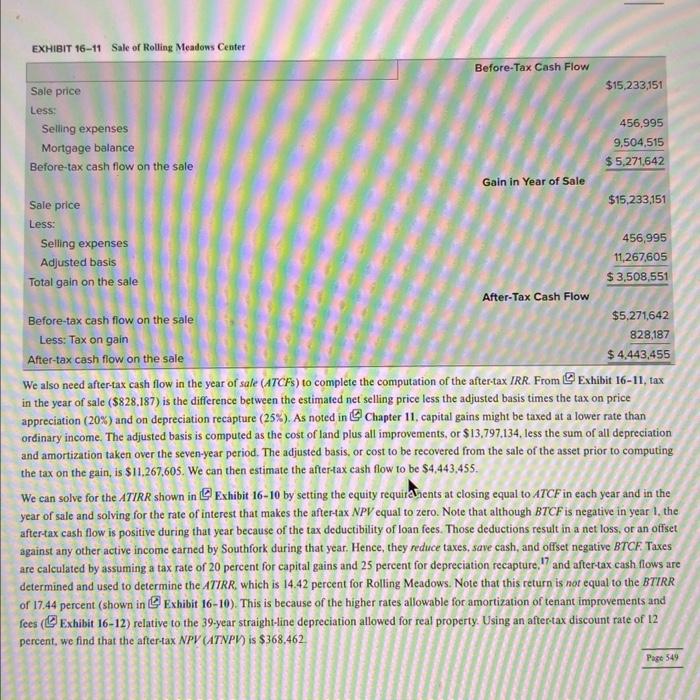

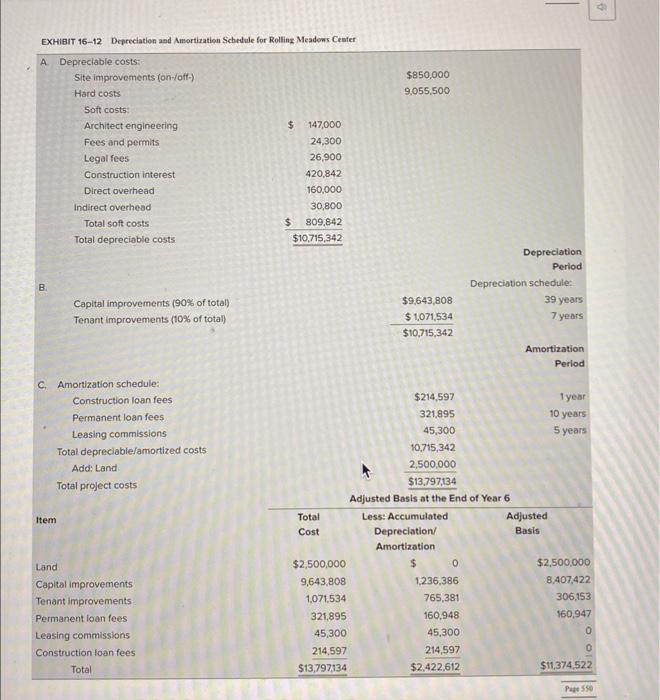

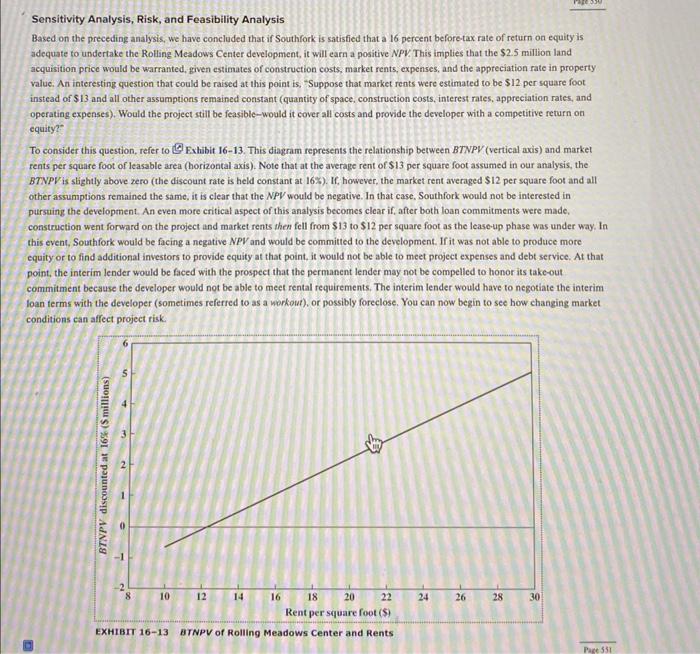

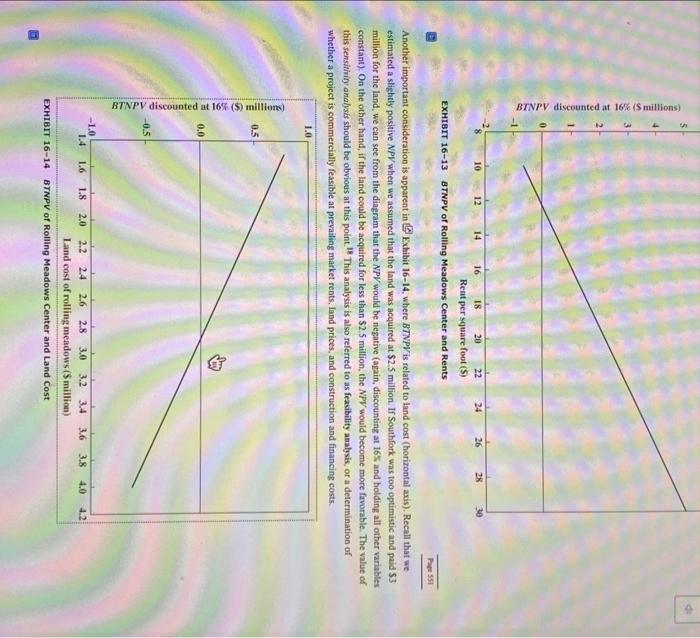

i answered parts C and D for you

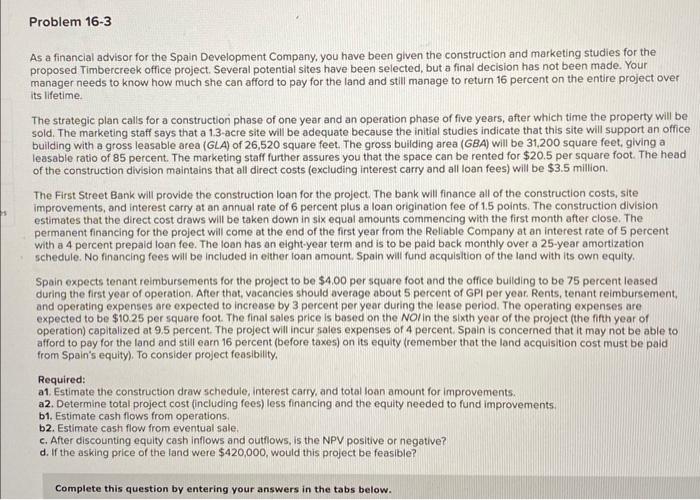

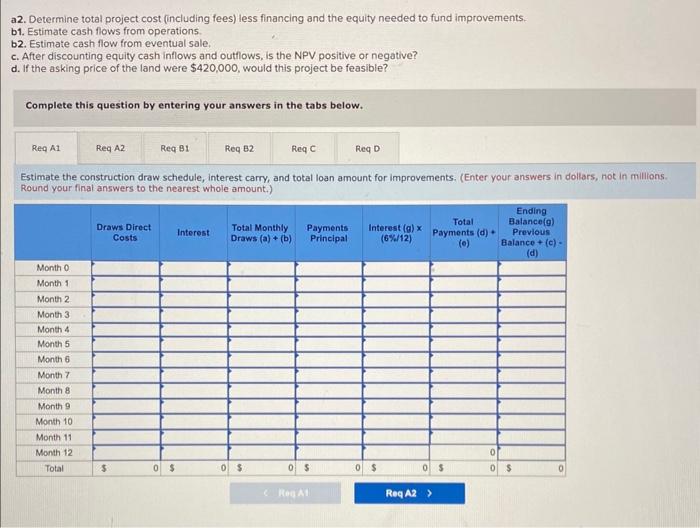

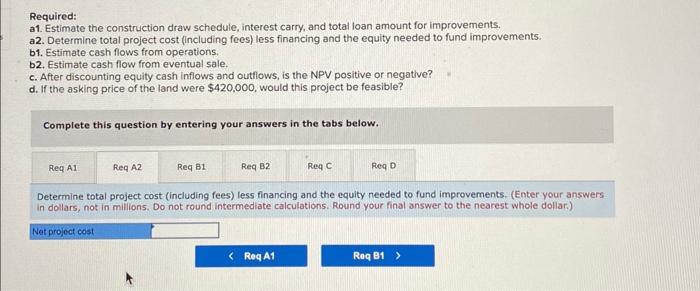

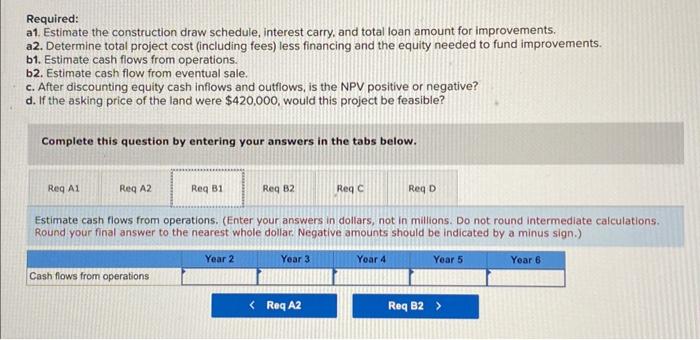

As a financial advisor for the Spain Development Company. you have been given the construction and marketing studies for the proposed Timbercreek office project. Several potential sites have been selected, but a final decision has not been made. Your manager needs to know how much she can afford to pay for the land and still manage to return 16 percent on the entire project over its lifetime. The strategic plan calls for a construction phase of one year and an operation phase of five years, after which time the property will be sold. The marketing staff says that a 1.3-acre site will be adequate because the initial studies indicate that this site will support an office building with a gross leasable area (GLA) of 26,520 square feet. The gross building area (GBA) will be 31,200 square feet, giving a leasable ratio of 85 percent. The marketing staff further assures you that the space can be rented for $20.5 per square foot. The head of the construction division maintains that all direct costs (excluding interest carry and all loan fees) will be $3.5 million. The First Street Bank will provide the construction loan for the project. The bank will finance all of the construction costs, site improvements, and interest carry at an annual rate of 6 percent plus a loan origination fee of 1.5 points. The construction division estimates that the direct cost draws will be taken down in six equal amounts commencing with the first month after close. The permanent financing for the project will come at the end of the first year from the Reliable Company at an interest rate of 5 percent with a 4 percent prepaid loan fee. The loan has an eight-year term and is to be paid back monthly over a 25-year amortization schedule. No financing fees will be included in either loan amount. Spain will fund acquisition of the land with its own equity. Spain expects tenant reimbursements for the project to be $4.00 per square foot and the office building to be 75 percent leased during the first year of operation. After that, vacancies should average about 5 percent of GPI per year. Rents, tenant reimbursement, and operating expenses are expected to increase by 3 percent per year during the lease period. The operating expenses are expected to be $10.25 per square foot. The final sales price is based on the NOl in the sixth year of the project (the fifth year of operation) capitalized at 9.5 percent. The project will incur sales expenses of 4 percent. Spain is concerned that it may not be able to afford to pay for the land and still earn 16 percent (before taxes) on its equity (remember that the land acquisition cost must be paid from Spain's equity). To consider project feasibility. Required: a1. Estimate the construction draw schedule, interest carry, and total loan amount for improvements. a2. Determine total project cost (including fees) less financing and the equity needed to fund improvements. b1. Estimate cash flows from operations. b2. Estimate cash flow from eventual sale. c. After discounting equity cash inflows and outliows, is the NPV positive or negative? d. If the asking price of the land were $420,000, would this project be feasible? a2. Determine total project cost (including fees) less financing and the equity needed to fund improvements. b1. Estimate cash flows from operations. b2. Estimate cash flow from eventual sale. c. After discounting equity cash inflows and outhows, is the NPV positive or negative? d. If the asking price of the land were $420,000, would this project be feasible? Complete this question by entering your answers in the tabs below. Estimate the construction draw schedule, interest carry, and total loan amount for improvements. (Enter your answers in dollars, not in millions. Round your final answers to the nearest whole amount.) Required: a1. Estimate the construction draw schedule, interest carry, and total loan amount for improvements. a2. Determine total project cost (including fees) less financing and the equity needed to fund improvements. b1. Estimate cash flows from operations. b2. Estimate cash flow from eventual sale. c. After discounting equity cash inflows and outflows, is the NPV positive or negative? d. If the asking price of the land were $420,000, would this project be feasible? Complete this question by entering your answers in the tabs below. Determine total project cost (including fees) less financing and the equity needed to fund improvements. (Enter your answers in dollars, not in milions. Do not round intermediate calculations. Round your final answer to the nearest whole dollar.) Required: a1. Estimate the construction draw schedule, interest carry, and total loan amount for improvements. a2. Determine total project cost (including fees) less financing and the equity needed to fund improvements. b1. Estimate cash flows from operations. b2. Estimate cash flow from eventual sale. c. After discounting equity cash inflows and outflows, is the NPV positive or negative? d. If the asking price of the land were $420,000, would this project be feasible? Complete this question by entering your answers in the tabs below. Estimate cash flows from operations. (Enter your answers in dollars, not in millions. Do not round intermediate calculations. Round your final answer to the nearest whole dollar. Negative amounts should be indicated by a minus sign.) Required: a1. Estimate the construction draw schedule, interest carry, and total loan amount for improvements. a2. Determine total project cost (including fees) less financing and the equity needed to fund improvements. b1. Estimate cash flows from operations. b2. Estimate cash flow from eventual sale. c. After discounting equity cash inflows and outflows, is the NPV positive or negative? d. If the asking price of the land were $420,000, would this project be feasible? Complete this question by entering your answers in the tabs below. Estimate cash flow from eventual sale. (Enter your answers in dollars, not in millions. Do not round intermediate calculations. Round your final answer to the nearest whole dollar.) Required: a1. Estimate the construction draw schedule, interest carry, and total loan amount for improvements. a2. Determine total project cost (including fees) less financing and the equity needed to fund improvements. b1. Estimate cash flows from operations. b2. Estimate cash flow from eventual sale. c. After discounting equity cash inflows and outflows, is the NPV positive or negative? d. If the asking price of the land were $420,000, would this project be feasible? Complete this question by entering your answers in the tabs below. After discounting equity cash inflows and outfiows, is the NPV positive or negative? Required: a1. Estimate the construction draw schedule, interest carry, and total loan amount for improvements. a2. Determine total project cost (including fees) less financing and the equity needed to fund improvements. b1. Estimate cash flows from operations. b2. Estimate cash flow from eventual sale. c. After discounting equity cash inflows and outflows, is the NPV positive or negative? d. If the asking price of the land were $420,000, would this project be feasible? Complete this question by entering your answers in the tabs below. If the asking price of the land were $420,000, would this project be feasible? The First Street Bank will provide the construction loan for the project. The bank will finance all of the construction costs, site improvements, and interest carry at an annual rate of 6 percent plus a loan origination fee of 1.5 points. The construction division estimates that the direct cost draws will be taken down in six equal amounts commencing with the first month after close. The permanent financing for the project will come at the end of the first year from the Reliable Company at an interest rate of 5 percent with a 4 percent prepaid loan fee. The loan has an eight-year term and is to be paid back monthly over a 25 -year amortization schedule. No financing fees will be included in elther loan amount. Spain will fund acquisition of the land with its own equity. Spain expects tenant reimbursements for the project to be $4.00 per square foot and the office building to be 75 percent leased during the first year of operation. After that, vacancies should average about 5 percent of GPI per year. Rents, tenant reimbursement, and operating expenses are expected to increase by 3 percent per year during the lease period. The operating expenses are expected to be $10.25 per square foot. The final sales price is based on the Norin the sixth year of the project fthe fifth year of operation) capitalized at 9.5 percent. The project will incur sales expenses of 4 percent. Spain is concerned that it may not be able to afford to pay for the land and still eam 16 percent (before taxes) on its equity (remember that the land acquisition cost must be paid from Spain's equity). To consider project feasibility. Required: a1. Estimate the construction draw schedule, interest carry, and total loan amount for improvements. a2. Determine total project cost (including fees) less financing and the equity needed to fund improvements. b1. Estimate cash flows from operations. b2. Estimate cash flow from eventual sale. c. After discounting equity cash inflows and outflows, is the NPV positive or negative? d. If the asking price of the land were $420,000, would this project be feasible? (x) Answer is not complete. Complete this question by entering your answers in the tabs below. After discounting equity cash inflows and outflows, is the NPV pos tive or negative? The First Street Bank will provide the construction loan for the project. The bank will finance all of the construction costs, site improvements, and interest carry at an annual rate of 6 percent plus a loan origination fee of 1.5 points. The construction division estimates that the direct cost draws will be taken down in six equal amounts commencing with the first month after close. The permanent financing for the project will come at the end of the first year from the Reliable Company at an interest rate of 5 percent with a 4 percent prepaid loan-fee. The loan has an eight-year term and is to be paid back monthly over a 25 -year amortization schedule. No financing fees will be included in either loan amount. Spain will fund acquisition of the land with its own equity. Spain expects tenant reimbursements for the project to be $4.00 per square foot and the office building to be 75 percent leased during the first year of operation. After that, vacancies should average about 5 percent of GPI per year. Rents, tenant reimbursement. and operating expenses are expected to increase by 3 percent per year during the lease period. The operating expenses are expected to be $10.25 per square foot. The final sales price is based on the NOr in the sixth year of the project (the fifth year of operation) capitalized at 9.5 percent. The project will incur sales expenses of 4 percent. Spain is concerned that it may not be able to afford to pay for the land and still earn 16 percent (before taxes) on its equity (remember that the land acquisition cost must be paid from Spain's equity). To consider project feasibility, Required: a1. Estimate the construction draw schedule, interest carry, and total loan amount for improvements. a2. Determine total project cost (including fees) less financing and the equity needed to fund improvements. b1. Estimate cash flows from operations. b2. Estimate cash flow from eventual sale. c. After discounting equity cash inflows and outflows, is the NPV positive or negative? d. If the asking price of the land were $420,000, would this project be feasible? (x) Answer is not complete. Complete this question by entering your answers in the tabs below. If the asking price of the land were $420,000, would this project be feasible? EXHIBIT 16-10 Profitability Analysis for Rolling Meaduos Center in the year of sale ( $828.187 ) is the difference between the estimated net selling price less the adjusted basis times the tax on price appreciation (20\%) and on depreciation recapture (25\%). As noted in ( Chapter 11. capital gains might be taxed at a lower rate than ordinary income. The adjusted basis is computed as the cost of land plus all improvements, or $13,797,134, less the sum of all depreciation and amortization taken over the seven-year period. The adjusted basis, or cost to be recovered from the sale of the asset prior to computing the tax on the gain, is $11,267,605. We can then estimate the aftertax cash flow to be $4,443,455. We can solve for the ATIRR shown in Exhibit 16-10 by setting the equity requirthents at closing equal to ATCF in each year and in the year of sale and solving for the rate of interest that makes the after-tax NPV equal to zero. Note that although BTCF is negative in year I, the aftertax cash flow is positive during that year because of the tax deductibility of loan fees. Those deductions result in a net loss, or an offset against any other active income earned by Southfork during that year. Hence, they reduce taxes, save cash, and offset negative BTCF. Taxes are calculated by assuming a tax rate of 20 percent for capital gains and 25 percent for depreciation recapture, 17 and after-tax cash flows are determined and used to determine the ATIRR, which is 14.42 percent for Rolling Meadows. Note that this return is not equal to the BTIRR of 17.44 percent (shown in ( ) Exhibit 16-10). This is because of the higher rates allowable for amortization of tenant improvements and fees (\$ Exhibit 16-12) relative to the 39-year straight-line depreciation allowed for real property. Using an aftertax discount rate of 12 percent, we find that the aftertax NPV (ATNPV) is $368.462 EXHIBIT 16-12. Depreciation and Amortization Schedule for Rollins Meadons Center A. Depreciable costs: Depreciation Period B. Depreciation schedule: Capital improvements ( 90% of total) 39 years Tenant improvements (to\% of total) 7 years Amortization Period Period C. Amortization schedule: Construction loan fees Permanent loan fees Leasing commissions Total depreciabie/amortized costs Add: Land Total project costs Sensitivity Analysis, Risk, and Feasibility Analysis Based on the preceding analysis, we have concluded that if Southfork is satisfied that a 16 percent beforetax rate of return on equity is adequate to undertake the Rolling Meadows Center development, it will earn a positive NPV. This implies that the \$2.5 million land acquisition price would be warranted, given estimates of construction costs, market rents, expenses, and the appreciation rate in property value. An interesting question that could be raised at this point is, "Suppose that market rents were estimated to be $12 per square foot instead of $13 and all other assumptions remained constant (quantity of space, construction costs, interest rates, appreciation rates, and operating expenses). Would the project still be feasible-would it cover all casts and provide the developer with a competitive return on equity? To consider this question, refer to (0) Exhibit 16-13. This diagram represents the relationship between BTNPV (vertical axis) and market rents per square foot of leasable area (horizontal axis). Note that at the average rent of $13 per square foot assumed in our analysis, the BTNPV is slightly above zero (the discount rate is held constant at 16% ). If, however, the market rent averaged $12 per square foot and all other assumptions remained the same, it is clear that the NPV would be negative. In that case, Southfork would not be interested in pursuing the development. An even more critical aspect of this analysis becomes clear if, after both loan commitments were made. construction went forward on the project and market rents then fell from $13 to $12 per square foot as the leaseup phase was under way. In this event, Sourhfork would be facing a negative NPV and would be committed to the development. If it was not able to produce more equity or to find additional investors to provide equity at that point, it would not be able to meet project expenses and debt service. At that point, the interim lender would be faced with the prospeet that the permanent lender may not be compelled to honor its take-out commitment because the developer would not be able to meet rental requirements. The interim lender would have to negotiate the interim loan terms with the developer (sometimes referred to as a workout), or possibly foreclose. You can now begin to see how changing market conditions can affect project risk. EXHIBT 16-13 BTNPV of Rolling Meadows Center and Rents EXHIBIT 16-13 BTNPV of Rolling Meadows Center and Rents . Another important consideration is apparent in [ Exibit 16-14. where. BTNPV is related to land cost (horizontal axis). Recall that we estimated a slightly positive NPV when we assumed that the land was acquired at $2.5 million. If Southfork was too optimistic and paid $3 million for the land, we can see from the diagram that the NPV would be negative (again, discounting at 165 and holding all other variables constant). On the other hand, if the land could be acquired for less than $2.5 million, the NPV would become more favorable. The value of this sensifiviry analysis should be obvious at this point. 18 This analysis is also referred to as feasibility amalysis, or a determination of whether a project is commercially feasible at prevailing market rents, land prices, and construction and financing costs. EXHIBIT 16-14 BTNPV of Rolling Meadows Center and Land Cost (6)