Please answer all questions

Please answer all questions

Please answer all questions

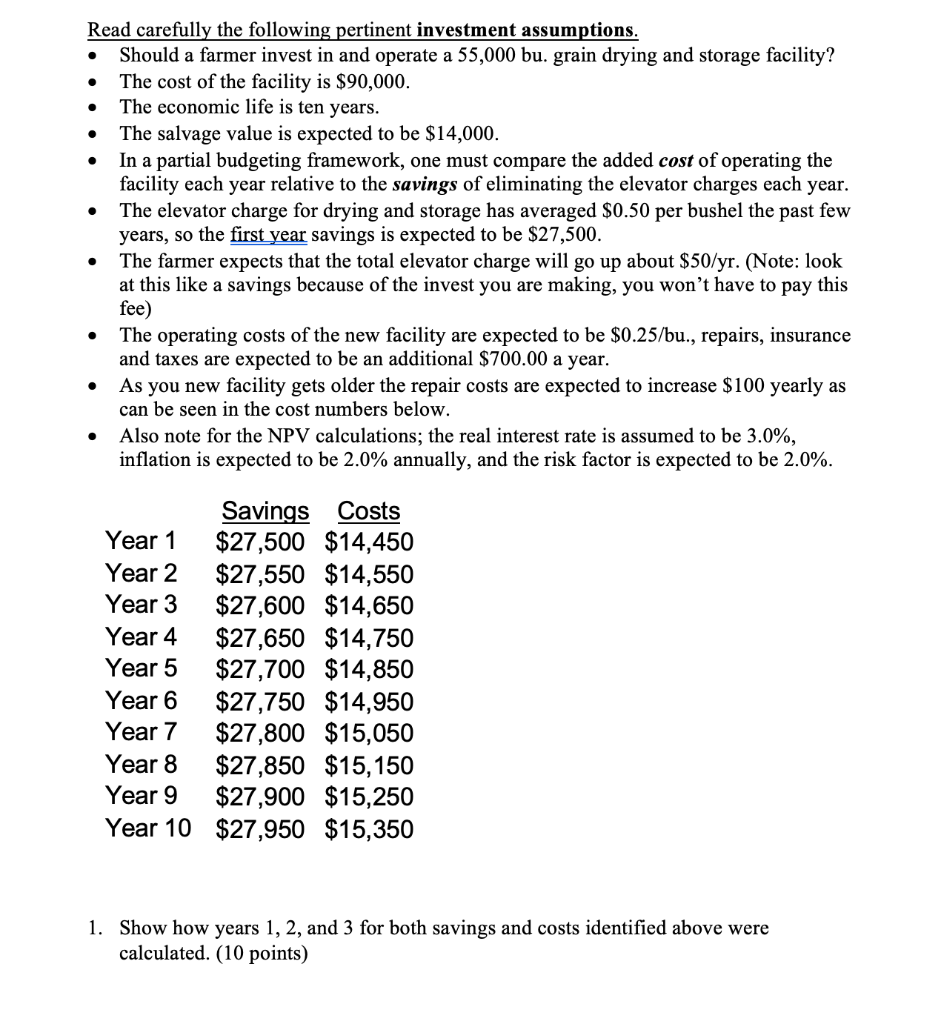

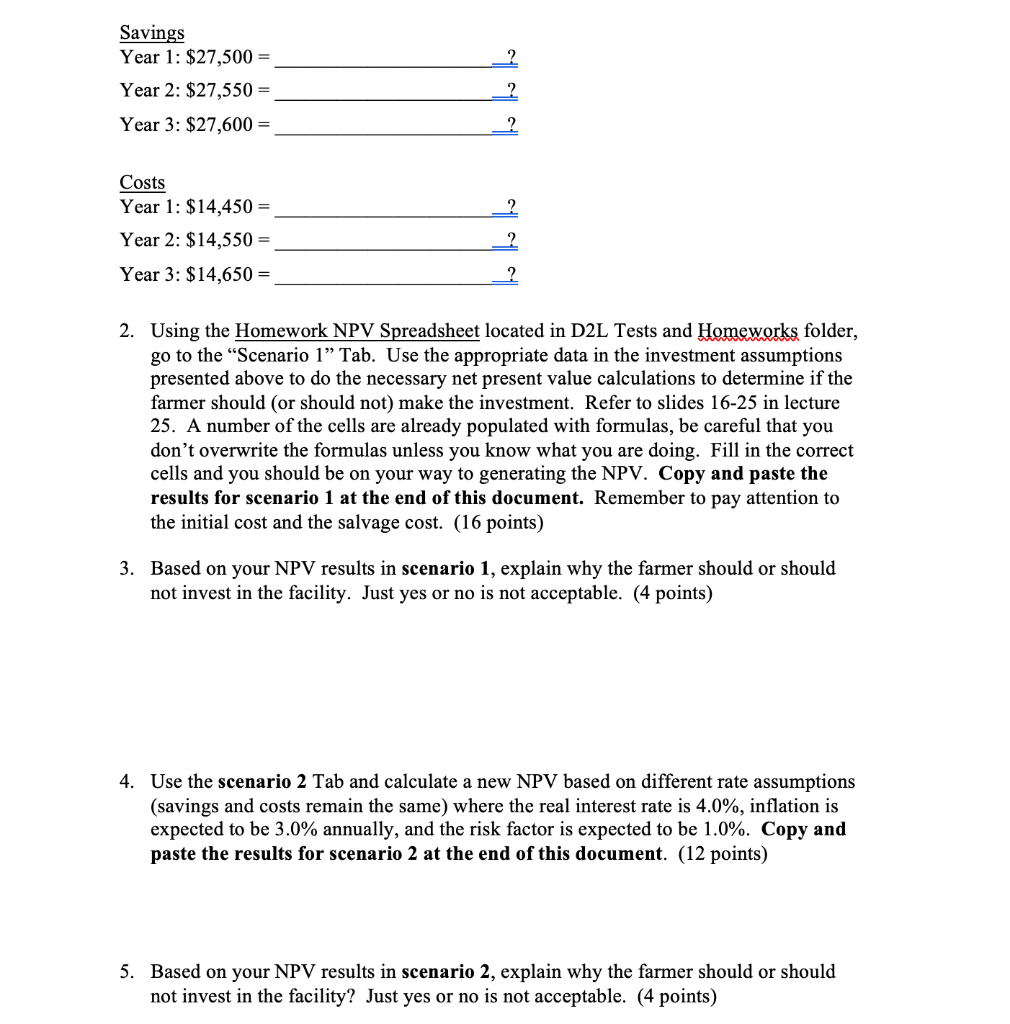

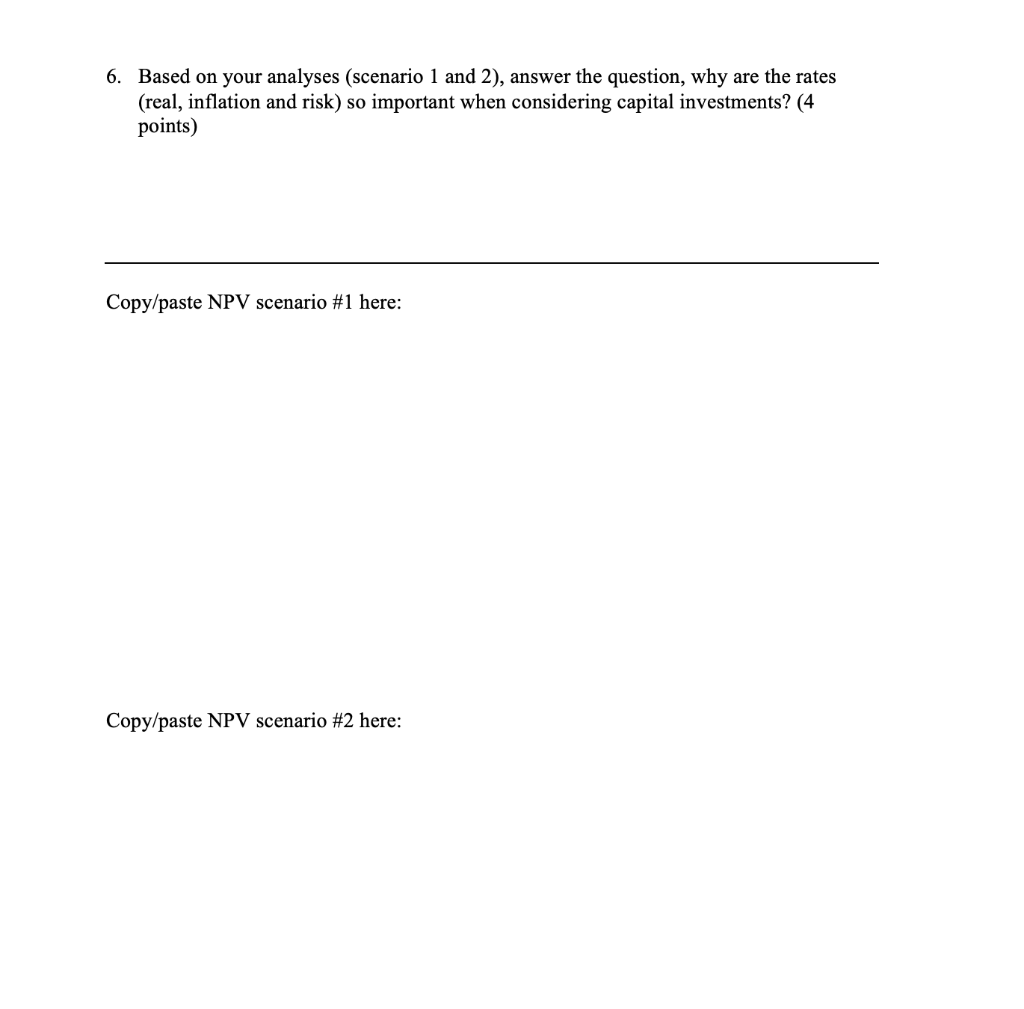

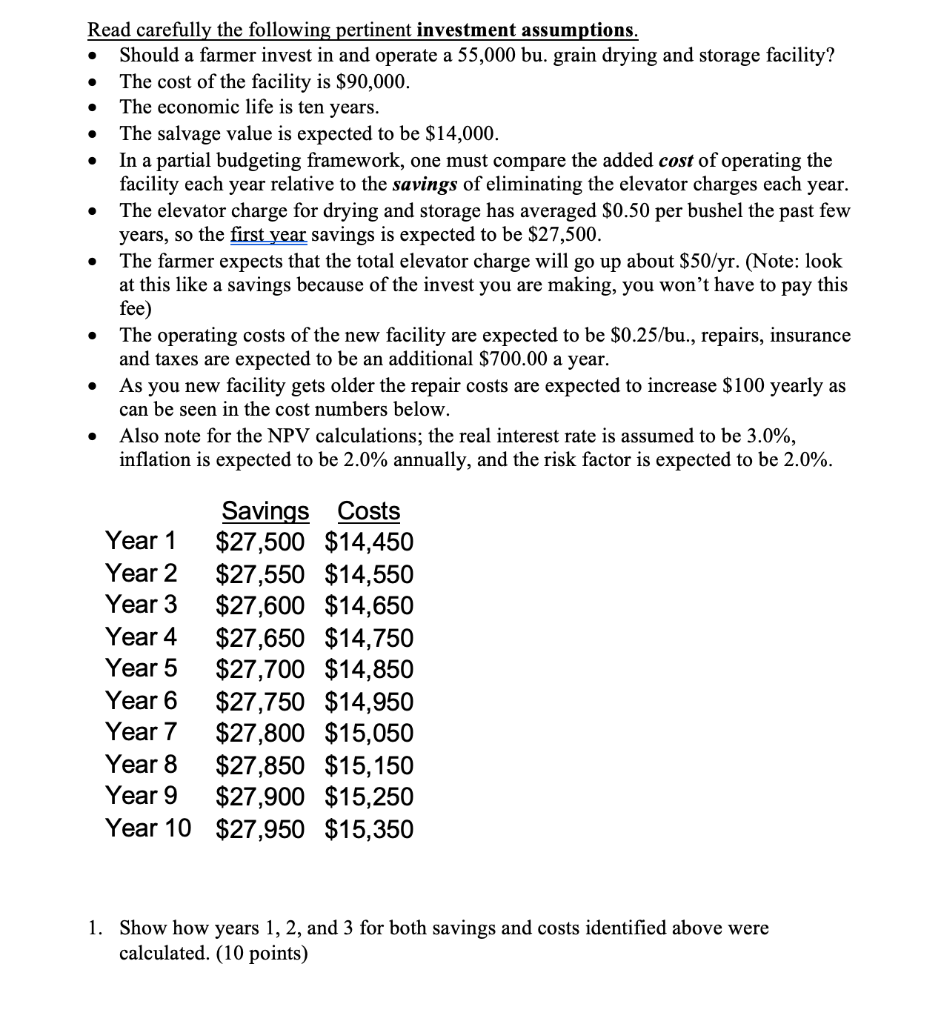

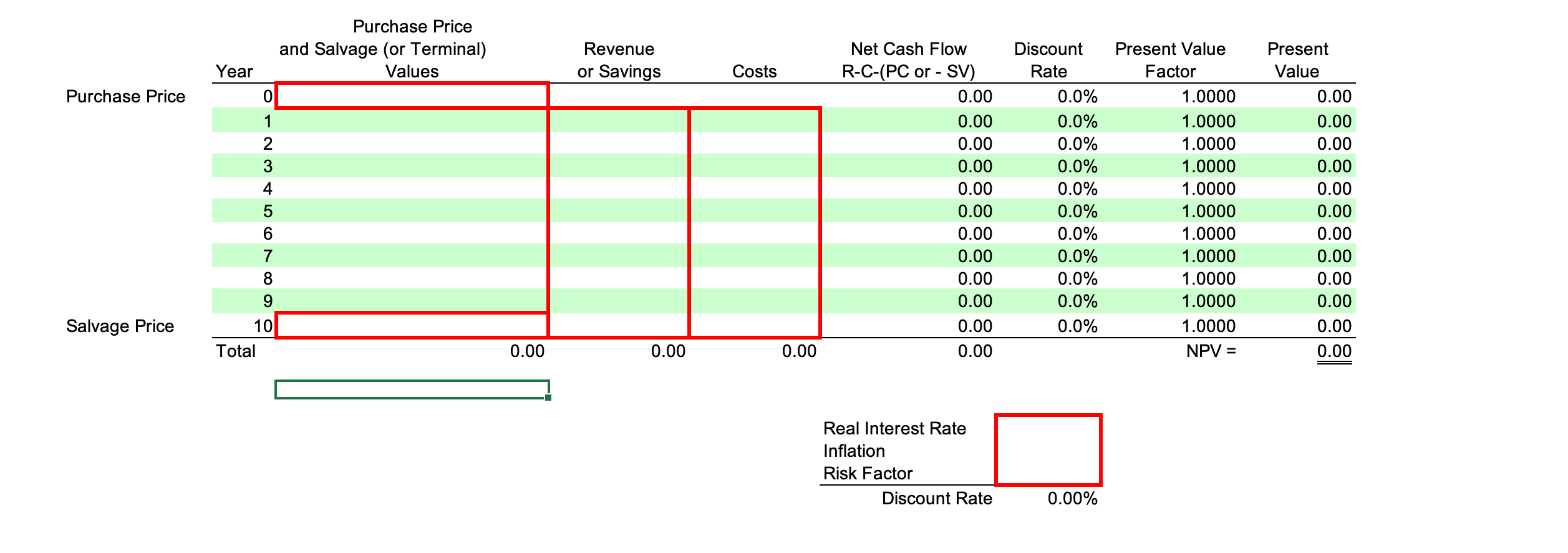

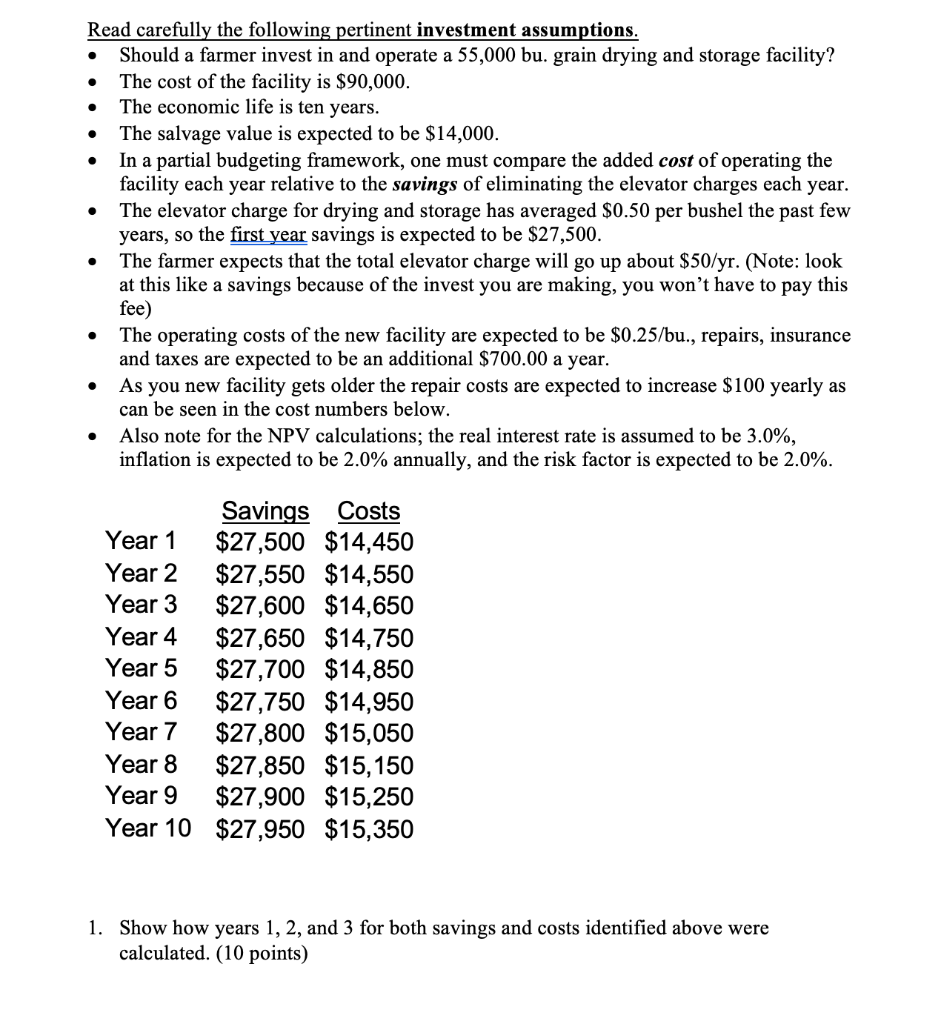

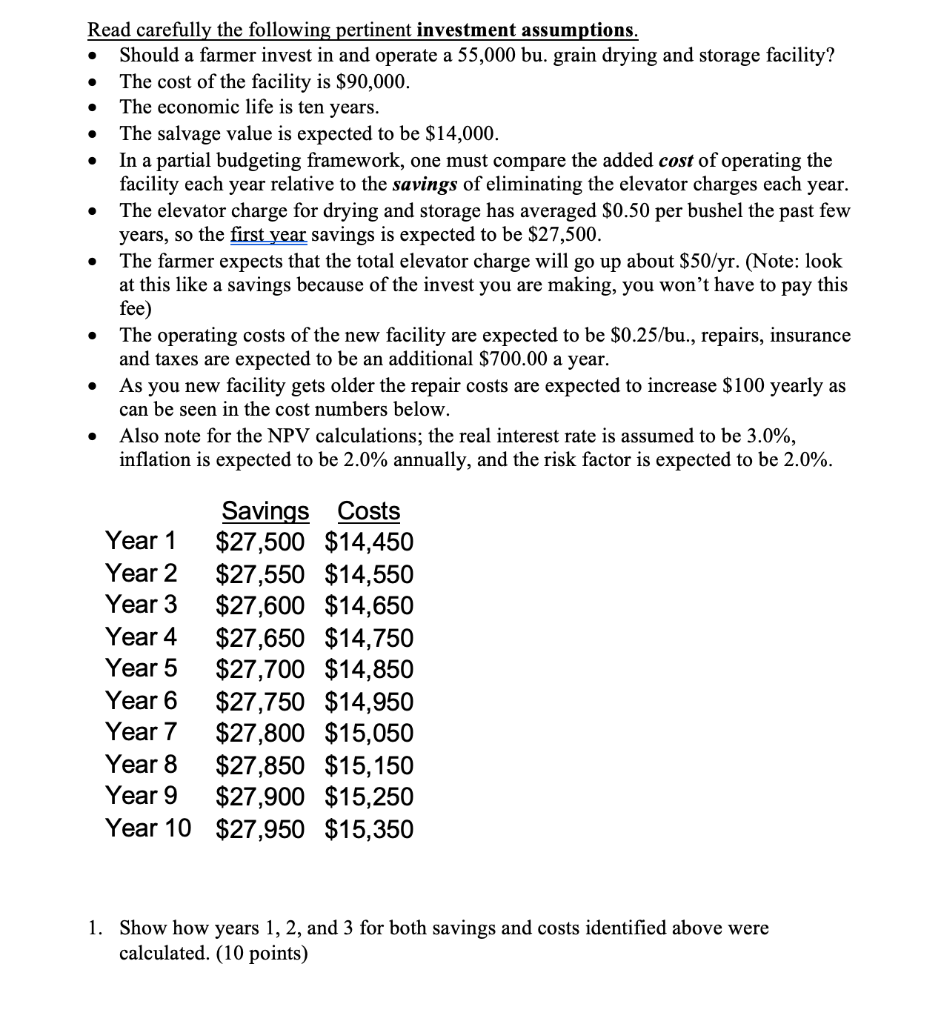

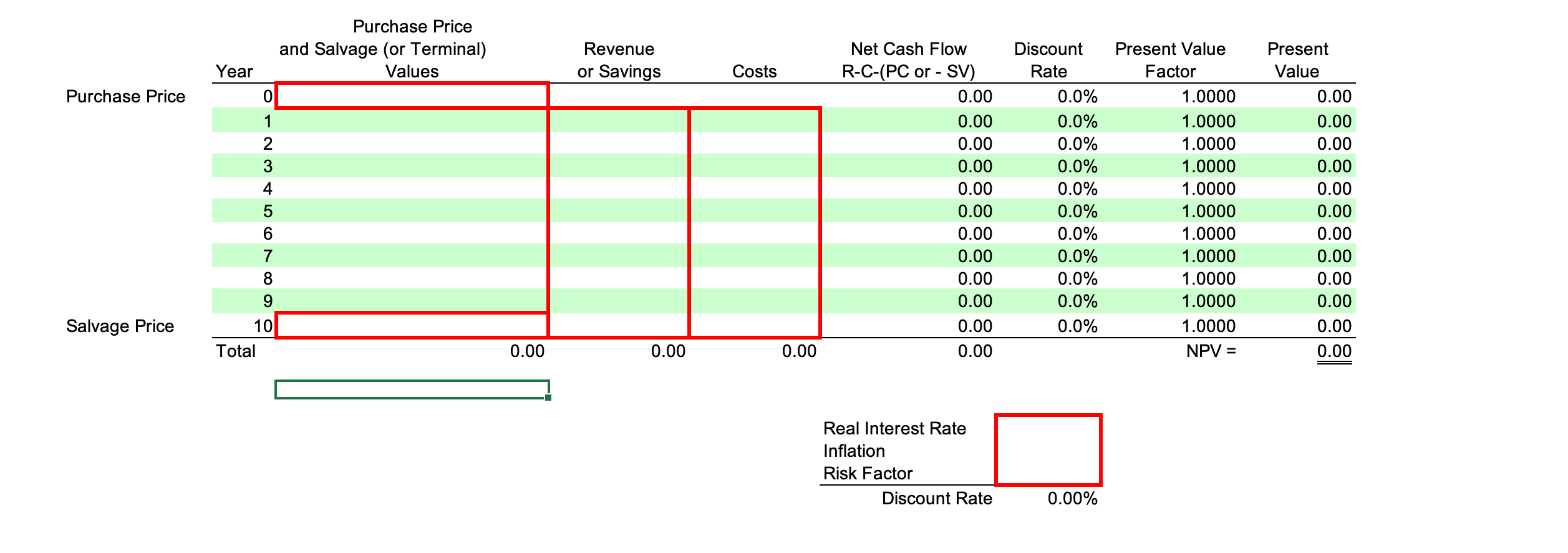

. . Read carefully the following pertinent investment assumptions. Should a farmer invest in and operate a 55,000 bu. grain drying and storage facility? The cost of the facility is $90,000. The economic life is ten years. The salvage value is expected to be $14,000. In a partial budgeting framework, one must compare the added cost of operating the facility each year relative to the savings of eliminating the elevator charges each year. The elevator charge for drying and storage has averaged $0.50 per bushel the past few years, so the first year savings is expected to be $27,500. The farmer expects that the total elevator charge will go up about $50/yr. (Note: look at this like a savings because of the invest you are making, you won't have to pay this fee) The operating costs of the new facility are expected to be $0.25/bu., repairs, insurance and taxes are expected to be an additional $700.00 a year. As you new facility gets older the repair costs are expected to increase $ 100 yearly as can be seen in the cost numbers below. Also note for the NPV calculations, the real interest rate is assumed to be 3.0%, inflation is expected to be 2.0% annually, and the risk factor is expected to be 2.0%. . . . Savings Costs Year 1 $27,500 $14,450 Year 2 $27,550 $14,550 Year 3 $27,600 $14,650 Year 4 $27,650 $14,750 Year 5 $27,700 $14,850 Year 6 $27,750 $14,950 Year 7 $27,800 $15,050 Year 8 $27,850 $15,150 Year 9 $27,900 $15,250 Year 10 $27,950 $15,350 1. Show how years 1, 2, and 3 for both savings and costs identified above were calculated. (10 points) Savings Year 1: $27,500 = Year 2: $27,550 = 2 Year 3: $27,600 = ? Costs Year 1: $14,450 = Year 2: $14,550 = Year 3: $14,650 = 2. Using the Homework NPV Spreadsheet located in D2L Tests and Homeworks folder, go to the Scenario 1 Tab. Use the appropriate data in the investment assumptions presented above to do the necessary net present value calculations to determine if the farmer should (or should not) make the investment. Refer to slides 16-25 in lecture 25. A number of the cells are already populated with formulas, be careful that you don't overwrite the formulas unless you know what you are doing. Fill in the correct cells and you should be on your way to generating the NPV. Copy and paste the results for scenario 1 at the end of this document. Remember to pay attention to the initial cost and the salvage cost. (16 points) 3. Based on your NPV results in scenario 1, explain why the farmer should or should not invest in the facility. Just yes or no is not acceptable. (4 points) 4. Use the scenario 2 Tab and calculate a new NPV based on different rate assumptions (savings and costs remain the same) where the real interest rate is 4.0%, inflation is expected to be 3.0% annually, and the risk factor is expected to be 1.0%. Copy and paste the results for scenario 2 at the end of this document. (12 points) 5. Based on your NPV results in scenario 2, explain why the farmer should or should not invest in the facility? Just yes or no is not acceptable. (4 points) 6. Based on your analyses (scenario 1 and 2), answer the question, why are the rates (real, inflation and risk) so important when considering capital investments? (4 points) Copy/paste NPV scenario #1 here: Copy/paste NPV scenario #2 here: . . Read carefully the following pertinent investment assumptions. Should a farmer invest in and operate a 55,000 bu. grain drying and storage facility? The cost of the facility is $90,000. The economic life is ten years. The salvage value is expected to be $14,000. In a partial budgeting framework, one must compare the added cost of operating the facility each year relative to the savings of eliminating the elevator charges each year. The elevator charge for drying and storage has averaged $0.50 per bushel the past few years, so the first year savings is expected to be $27,500. The farmer expects that the total elevator charge will go up about $50/yr. (Note: look at this like a savings because of the invest you are making, you won't have to pay this fee) The operating costs of the new facility are expected to be $0.25/bu., repairs, insurance and taxes are expected to be an additional $700.00 a year. As you new facility gets older the repair costs are expected to increase $ 100 yearly as can be seen in the cost numbers below. Also note for the NPV calculations, the real interest rate is assumed to be 3.0%, inflation is expected to be 2.0% annually, and the risk factor is expected to be 2.0%. . . . Savings Costs Year 1 $27,500 $14,450 Year 2 $27,550 $14,550 Year 3 $27,600 $14,650 Year 4 $27,650 $14,750 Year 5 $27,700 $14,850 Year 6 $27,750 $14,950 Year 7 $27,800 $15,050 Year 8 $27,850 $15,150 Year 9 $27,900 $15,250 Year 10 $27,950 $15,350 1. Show how years 1, 2, and 3 for both savings and costs identified above were calculated. (10 points) Savings Year 1: $27,500 = Year 2: $27,550 = 2 Year 3: $27,600 = ? Costs Year 1: $14,450 = Year 2: $14,550 = Year 3: $14,650 = 2. Using the Homework NPV Spreadsheet located in D2L Tests and Homeworks folder, go to the Scenario 1 Tab. Use the appropriate data in the investment assumptions presented above to do the necessary net present value calculations to determine if the farmer should (or should not) make the investment. Refer to slides 16-25 in lecture 25. A number of the cells are already populated with formulas, be careful that you don't overwrite the formulas unless you know what you are doing. Fill in the correct cells and you should be on your way to generating the NPV. Copy and paste the results for scenario 1 at the end of this document. Remember to pay attention to the initial cost and the salvage cost. (16 points) 3. Based on your NPV results in scenario 1, explain why the farmer should or should not invest in the facility. Just yes or no is not acceptable. (4 points) 4. Use the scenario 2 Tab and calculate a new NPV based on different rate assumptions (savings and costs remain the same) where the real interest rate is 4.0%, inflation is expected to be 3.0% annually, and the risk factor is expected to be 1.0%. Copy and paste the results for scenario 2 at the end of this document. (12 points) 5. Based on your NPV results in scenario 2, explain why the farmer should or should not invest in the facility? Just yes or no is not acceptable. (4 points) 6. Based on your analyses (scenario 1 and 2), answer the question, why are the rates (real, inflation and risk) so important when considering capital investments? (4 points) Copy/paste NPV scenario #1 here: Copy/paste NPV scenario #2 here: Purchase Price and Salvage (or Terminal) Values Revenue or Savings Year Costs Purchase Price 0 1 2 3 4 Net Cash Flow R-C-(PC or - SV) 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Discount Rate 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Present Value Factor 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 NPV = Present Value 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 5 6 7 8 9 Salvage Price 10 Total 0.00 0.00 0.00 Real Interest Rate Inflation Risk Factor Discount Rate 0.00% . . Read carefully the following pertinent investment assumptions. Should a farmer invest in and operate a 55,000 bu. grain drying and storage facility? The cost of the facility is $90,000. The economic life is ten years. The salvage value is expected to be $14,000. In a partial budgeting framework, one must compare the added cost of operating the facility each year relative to the savings of eliminating the elevator charges each year. The elevator charge for drying and storage has averaged $0.50 per bushel the past few years, so the first year savings is expected to be $27,500. The farmer expects that the total elevator charge will go up about $50/yr. (Note: look at this like a savings because of the invest you are making, you won't have to pay this fee) The operating costs of the new facility are expected to be $0.25/bu., repairs, insurance and taxes are expected to be an additional $700.00 a year. As you new facility gets older the repair costs are expected to increase $ 100 yearly as can be seen in the cost numbers below. Also note for the NPV calculations, the real interest rate is assumed to be 3.0%, inflation is expected to be 2.0% annually, and the risk factor is expected to be 2.0%. . . . Savings Costs Year 1 $27,500 $14,450 Year 2 $27,550 $14,550 Year 3 $27,600 $14,650 Year 4 $27,650 $14,750 Year 5 $27,700 $14,850 Year 6 $27,750 $14,950 Year 7 $27,800 $15,050 Year 8 $27,850 $15,150 Year 9 $27,900 $15,250 Year 10 $27,950 $15,350 1. Show how years 1, 2, and 3 for both savings and costs identified above were calculated. (10 points) Savings Year 1: $27,500 = Year 2: $27,550 = 2 Year 3: $27,600 = ? Costs Year 1: $14,450 = Year 2: $14,550 = Year 3: $14,650 = 2. Using the Homework NPV Spreadsheet located in D2L Tests and Homeworks folder, go to the Scenario 1 Tab. Use the appropriate data in the investment assumptions presented above to do the necessary net present value calculations to determine if the farmer should (or should not) make the investment. Refer to slides 16-25 in lecture 25. A number of the cells are already populated with formulas, be careful that you don't overwrite the formulas unless you know what you are doing. Fill in the correct cells and you should be on your way to generating the NPV. Copy and paste the results for scenario 1 at the end of this document. Remember to pay attention to the initial cost and the salvage cost. (16 points) 3. Based on your NPV results in scenario 1, explain why the farmer should or should not invest in the facility. Just yes or no is not acceptable. (4 points) 4. Use the scenario 2 Tab and calculate a new NPV based on different rate assumptions (savings and costs remain the same) where the real interest rate is 4.0%, inflation is expected to be 3.0% annually, and the risk factor is expected to be 1.0%. Copy and paste the results for scenario 2 at the end of this document. (12 points) 5. Based on your NPV results in scenario 2, explain why the farmer should or should not invest in the facility? Just yes or no is not acceptable. (4 points) 6. Based on your analyses (scenario 1 and 2), answer the question, why are the rates (real, inflation and risk) so important when considering capital investments? (4 points) Copy/paste NPV scenario #1 here: Copy/paste NPV scenario #2 here: . . Read carefully the following pertinent investment assumptions. Should a farmer invest in and operate a 55,000 bu. grain drying and storage facility? The cost of the facility is $90,000. The economic life is ten years. The salvage value is expected to be $14,000. In a partial budgeting framework, one must compare the added cost of operating the facility each year relative to the savings of eliminating the elevator charges each year. The elevator charge for drying and storage has averaged $0.50 per bushel the past few years, so the first year savings is expected to be $27,500. The farmer expects that the total elevator charge will go up about $50/yr. (Note: look at this like a savings because of the invest you are making, you won't have to pay this fee) The operating costs of the new facility are expected to be $0.25/bu., repairs, insurance and taxes are expected to be an additional $700.00 a year. As you new facility gets older the repair costs are expected to increase $ 100 yearly as can be seen in the cost numbers below. Also note for the NPV calculations, the real interest rate is assumed to be 3.0%, inflation is expected to be 2.0% annually, and the risk factor is expected to be 2.0%. . . . Savings Costs Year 1 $27,500 $14,450 Year 2 $27,550 $14,550 Year 3 $27,600 $14,650 Year 4 $27,650 $14,750 Year 5 $27,700 $14,850 Year 6 $27,750 $14,950 Year 7 $27,800 $15,050 Year 8 $27,850 $15,150 Year 9 $27,900 $15,250 Year 10 $27,950 $15,350 1. Show how years 1, 2, and 3 for both savings and costs identified above were calculated. (10 points) Savings Year 1: $27,500 = Year 2: $27,550 = 2 Year 3: $27,600 = ? Costs Year 1: $14,450 = Year 2: $14,550 = Year 3: $14,650 = 2. Using the Homework NPV Spreadsheet located in D2L Tests and Homeworks folder, go to the Scenario 1 Tab. Use the appropriate data in the investment assumptions presented above to do the necessary net present value calculations to determine if the farmer should (or should not) make the investment. Refer to slides 16-25 in lecture 25. A number of the cells are already populated with formulas, be careful that you don't overwrite the formulas unless you know what you are doing. Fill in the correct cells and you should be on your way to generating the NPV. Copy and paste the results for scenario 1 at the end of this document. Remember to pay attention to the initial cost and the salvage cost. (16 points) 3. Based on your NPV results in scenario 1, explain why the farmer should or should not invest in the facility. Just yes or no is not acceptable. (4 points) 4. Use the scenario 2 Tab and calculate a new NPV based on different rate assumptions (savings and costs remain the same) where the real interest rate is 4.0%, inflation is expected to be 3.0% annually, and the risk factor is expected to be 1.0%. Copy and paste the results for scenario 2 at the end of this document. (12 points) 5. Based on your NPV results in scenario 2, explain why the farmer should or should not invest in the facility? Just yes or no is not acceptable. (4 points) 6. Based on your analyses (scenario 1 and 2), answer the question, why are the rates (real, inflation and risk) so important when considering capital investments? (4 points) Copy/paste NPV scenario #1 here: Copy/paste NPV scenario #2 here: Purchase Price and Salvage (or Terminal) Values Revenue or Savings Year Costs Purchase Price 0 1 2 3 4 Net Cash Flow R-C-(PC or - SV) 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Discount Rate 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Present Value Factor 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 NPV = Present Value 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 5 6 7 8 9 Salvage Price 10 Total 0.00 0.00 0.00 Real Interest Rate Inflation Risk Factor Discount Rate 0.00%

Please answer all questions

Please answer all questions