Answered step by step

Verified Expert Solution

Question

1 Approved Answer

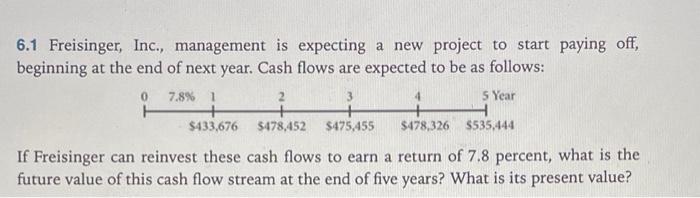

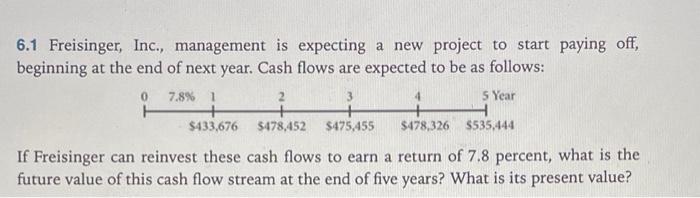

please answer all questions thank you! 6.1 Freisinger, Inc., management is expecting a new project to start paying off, beginning at the end of next

please answer all questions thank you!

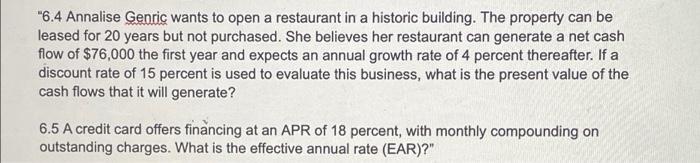

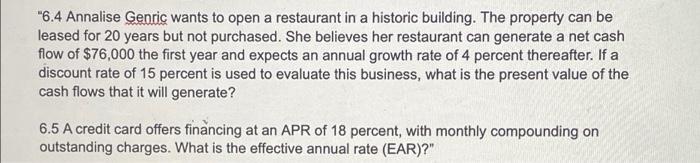

6.1 Freisinger, Inc., management is expecting a new project to start paying off, beginning at the end of next year. Cash flows are expected to be as follows: 0 7.8 % 1 2 5 Year $433,676 $478,452 $475,455 $478,326 $535,444 If Freisinger can reinvest these cash flows to earn a return of 7.8 percent, what is the future value of this cash flow stream at the end of five years? What is its present value? "6.4 Annalise Genric wants to open a restaurant in a historic building. The property can be leased for 20 years but not purchased. She believes her restaurant can generate a net cash flow of $76,000 the first year and expects an annual growth rate of 4 percent thereafter. If a discount rate of 15 percent is used to evaluate this business, what is the present value of the cash flows that it will generate? 6.5 A credit card offers financing at an APR of 18 percent, with monthly compounding on outstanding charges. What is the effective annual rate (EAR)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started