please answer all the following questions

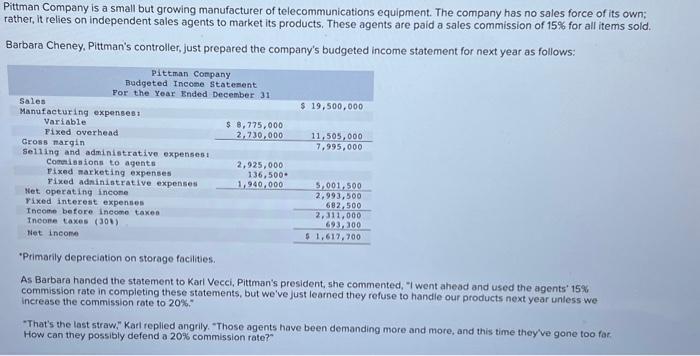

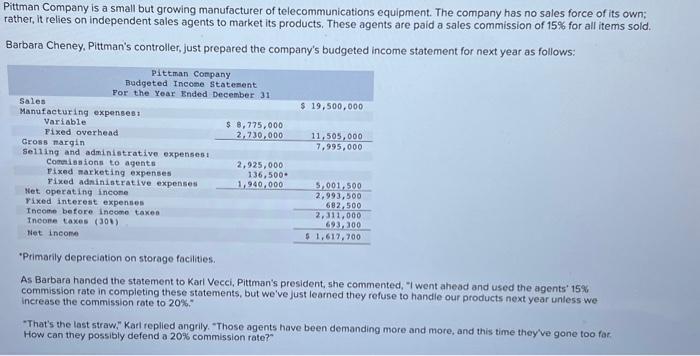

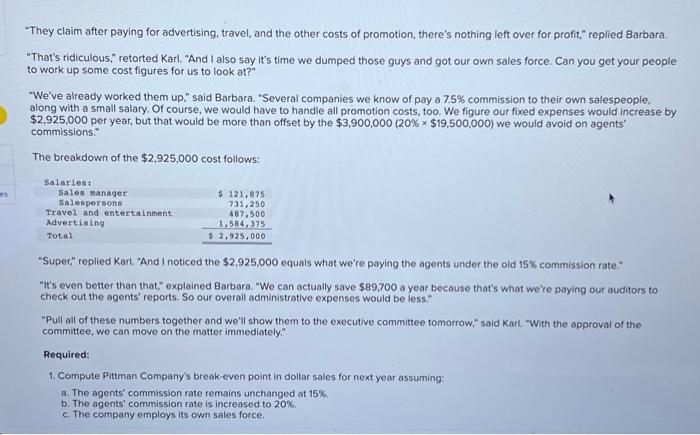

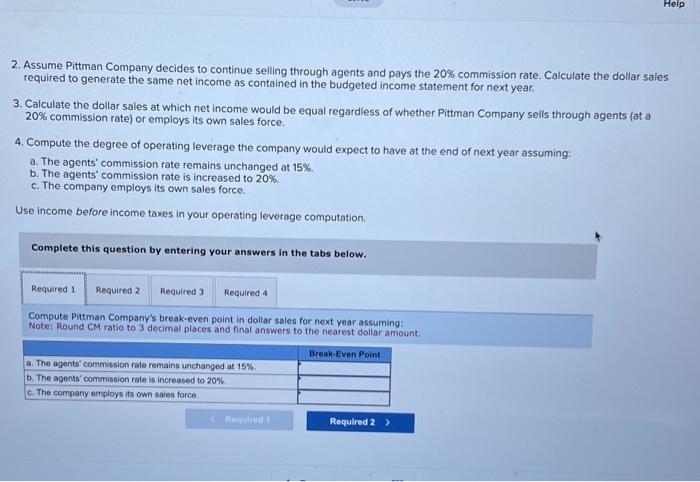

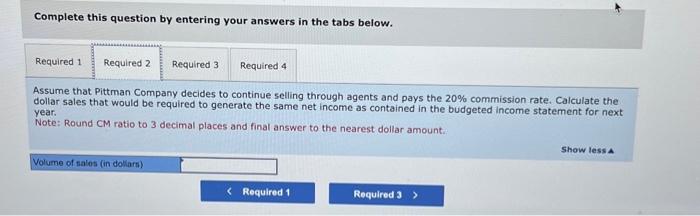

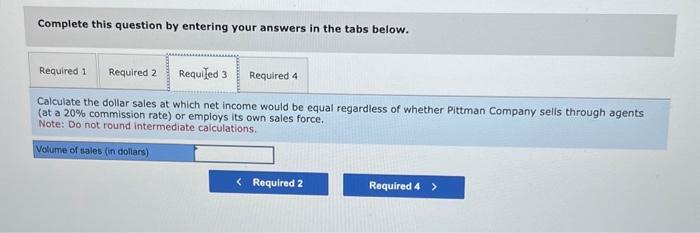

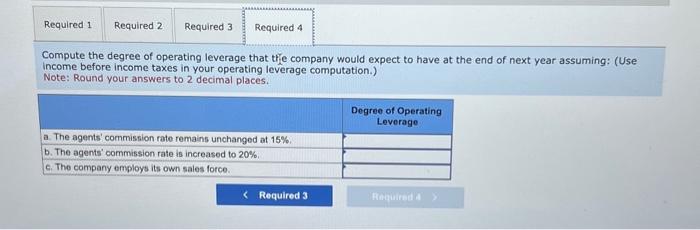

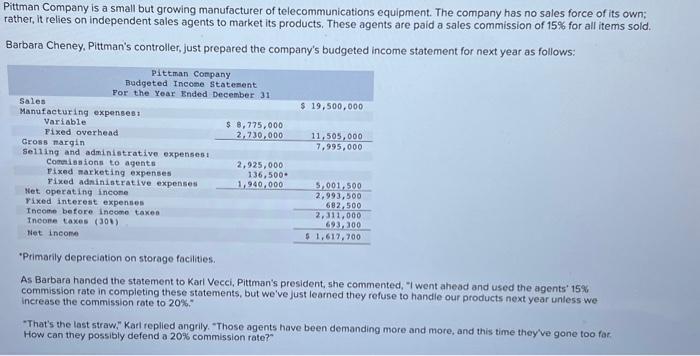

ittman Company is a small but growing manufacturer of telecommunications equipment. The company has no sales force of its own; ather, it relies on independent sales agents to market its products. These agents are paid a sales commission of 15% for all items sold. Barbara Cheney, Pittman's controller, just prepared the company's budgeted income statement for next year as follows: -Primarily depreciation on storage facilites. As Barbara handed the statement to Karl Vecci, Pittman's president, she commented, "I went ahead and used the agents' 15% commission rate in completing these statements, but we 've just learned they refuse to handie our products next year unless we increase the commission rate to 20%. "That's the last straw," Kat replied angrily. "Those agents have been demanding more and more, and this time they've gone too far. How can they possibly defend a 20% commission rate? 2. Assume Pittman Company decides to continue selling through agents and pays the 20% commission rate. Calculate the dollar sales required to generate the same net income as contained in the budgeted income statement for next year. 3. Calculate the dollar sales at which net income would be equal regardless of whether Pittman Company sells through agents (at a 20% commission rate) or employs its own sales force. 4. Compute the degree of operating leverage the company would expect to have at the end of next year assuming: a. The agents' commission rate remains unchanged at 15%. b. The agents' commission rate is increased to 20%. c. The company employs its own sales force. Use income before income taxes in your operating leverage computation. Complete this question by entering your answers in the tabs below. Compute Pittman Company's break-even point in dollar sales for next year assuming: Note: Round CM ratio to 3 decimal places and final answers to the nearest dollar amount. Complete this question by entering your answers in the tabs below. Calculate the dollar sales at which net income would be equal regardless of whether Pittman Company sells through agents (at a 20% commission rate) or employs its own sales force. Note: Do not round intermediate calculations. Compute the degree of operating leverage that trie company would expect to have at the end of next year assuming: (Use income before income taxes in your operating leverage computation.) Note: Round your answers to 2 decimal places