Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer and show the formulas used in excel.. show work. thank you in advance. D E F G H J B $1,075.84 26 Price

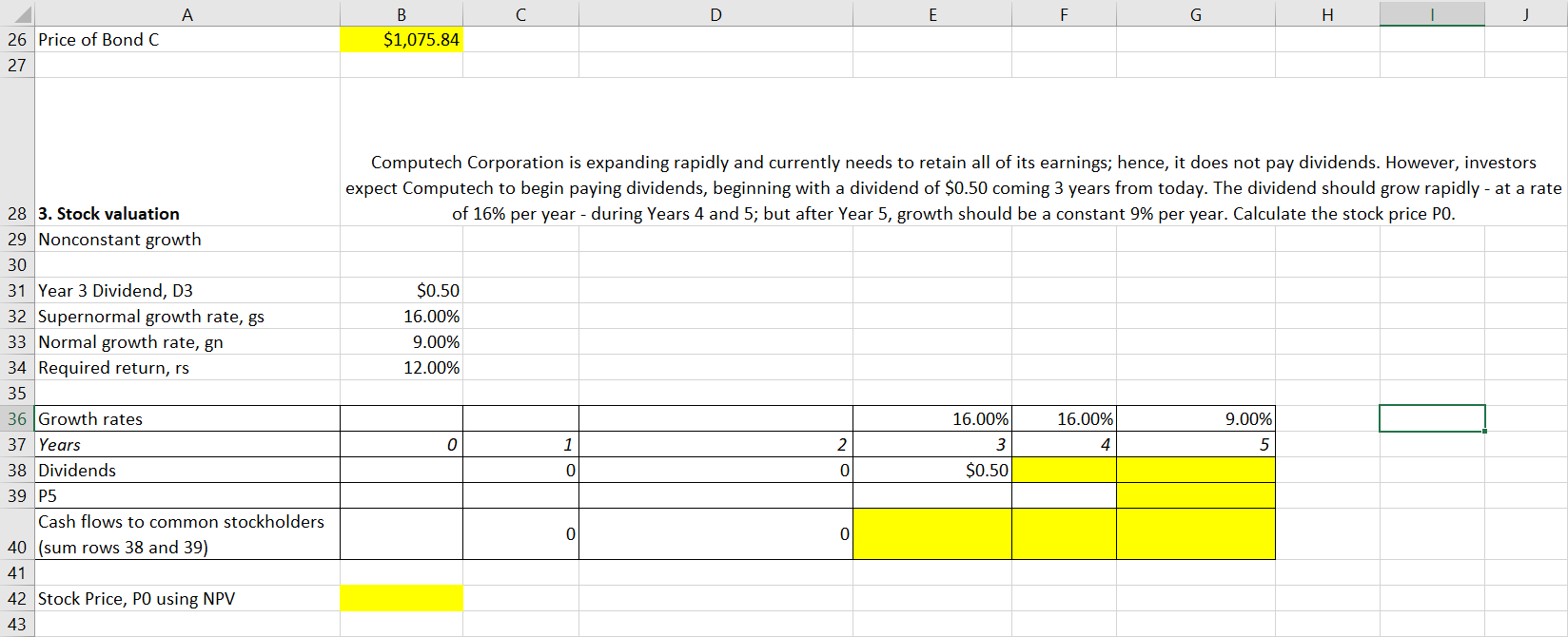

Please answer and show the formulas used in excel.. show work. thank you in advance.

D E F G H J B $1,075.84 26 Price of Bond C 27 Computech Corporation is expanding rapidly and currently needs to retain all of its earnings; hence, it does not pay dividends. However, investors expect Computech to begin paying dividends, beginning with a dividend of $0.50 coming 3 years from today. The dividend should grow rapidly - at a rate of 16% per year - during Years 4 and 5; but after Year 5, growth should be a constant 9% per year. Calculate the stock price PO. $0.50 16.00% 9.00% 12.00% 28 3. Stock valuation 29 Nonconstant growth 30 31 Year 3 Dividend, D3 32 Supernormal growth rate, gs 33 Normal growth rate, gn 34 Required return, rs 35 36 Growth rates 37 Years 38 Dividends 39 P5 Cash flows to common stockholders 40 (sum rows 38 and 39) 41 42 Stock Price, PO using NPV 43 16.00% 9.00% 5 0 1 16.00% 3 $0.50 2 4 0 0 0 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started