please answer as many as you can this is the last question i can ask for the month. ill give you a thumps up

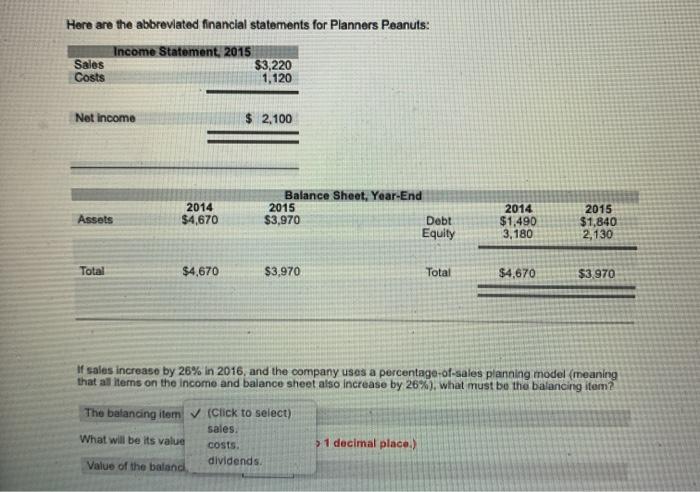

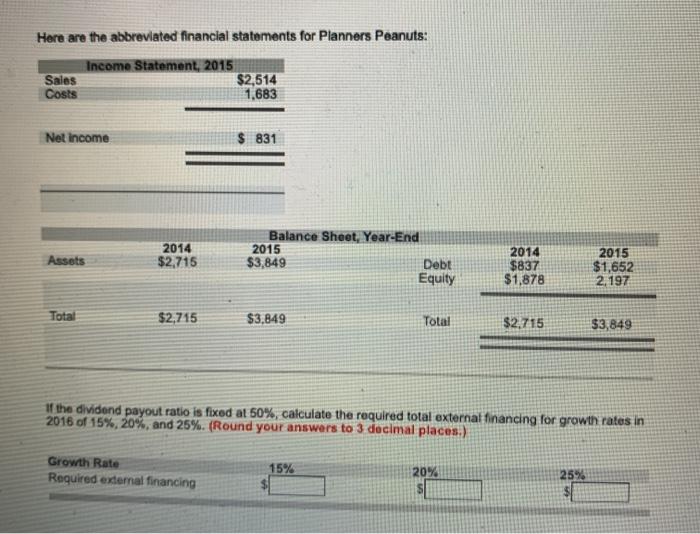

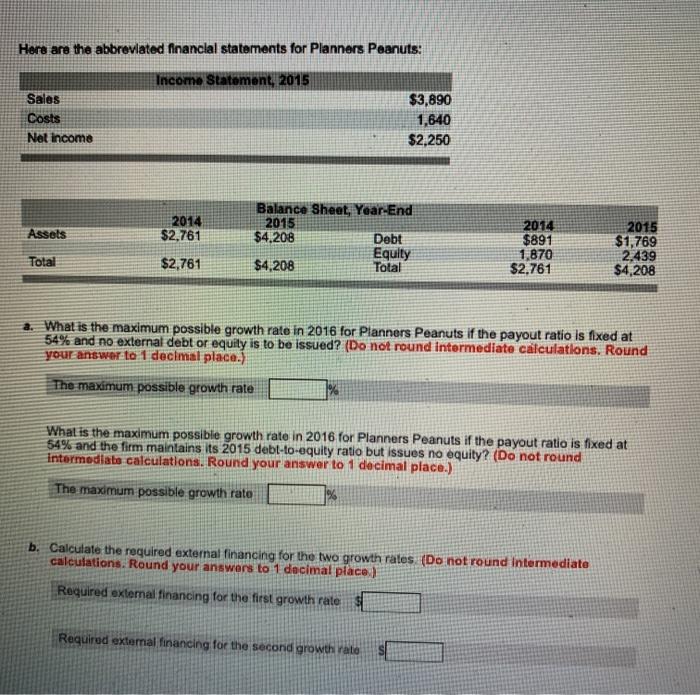

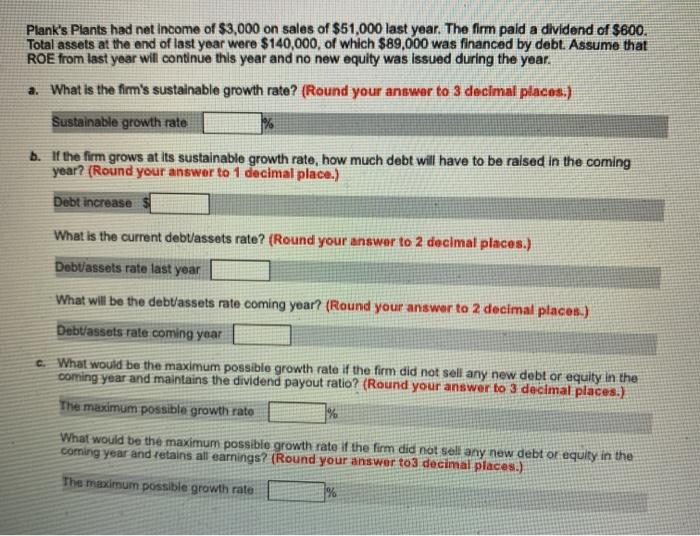

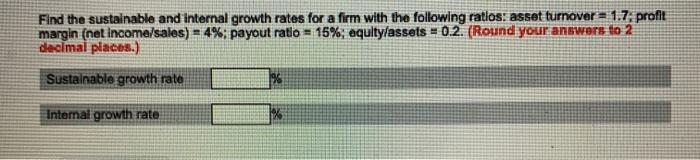

Here are the abbreviated financial statements for Planners Peanuts: Income Statement 2015 Sales $3,220 Costs 1,120 Net income $ 2,100 Assets 2014 $4,670 Balance Sheet, Year-End 2015 $3,970 Debt Equity 2014 $1,490 3,180 2015 $1,840 2,130 Total $4,670 $3,970 Total $4,670 $3.970 of sales increase by 26% in 2016, and the company uses a percentage-of-sales planning model (meaning that all items on the income and balance sheet also increase by 26%), what must be the balancing item? The balancing item (Click to select) What will be its value sales. costs. dividends. > 1 decimal place.) Value of the balanci Here are the abbreviated financial statements for Planners Peanuts: Sales Costs Income Statement, 2015 $2,514 1,683 Net Income $ 831 Assets 2014 $2.715 Balance Sheet, Year-End 2015 $3,849 Debt Equity 2014 $837 $1,878 2015 $1,652 2,197 Total $2,715 $3,849 Total $2.715 $3,849 If the dividend payout ratio is fixed at 50%, calculate the required total external financing for growth rates in 2016 of 15%, 20%, and 25%. (Round your answers to 3 decimal places.) Growth Rate Required external financing 15% 25% 20% s Here are the abbreviated financial statements for Planners Peanuts: Income Statement, 2015 Sales Costs Net Income $3,890 1,640 $2,250 Assets 2014 $2,761 Balance Sheet, Year-End 2015 $4,208 Debt Equity $4,208 Total 2014 $891 1,870 $2,761 2015 $1,769 2.439 $4,208 Total $2,761 a. What is the maximum possible growth rate in 2016 for Planners Peanuts if the payout ratio is fixed at 54% and no external debt or equity is to be issued? (Do not round Intermediate calculations. Round your answer to 1 decimal place.) The maximum possible growth rate What is the maximum possible growth rate in 2016 for Planners Peanuts if the payout ratio is fixed at 54% and the firm maintains its 2015 debt-to-equity ratio but issues no equity? (Do not round intermediate calculations. Round your answer to 1 decimal place.) The maximum possible growth rato b. Calculate the required external financing for the two growth rates (Do not round Intermediate calculations. Round your answers to 1 decimal place ) Required external financing for the first growth rates Required external financing for the second growth rato Plank's Plants had net income of $3,000 on sales of $51,000 last year. The firm pald a dividend of $600. Total assets at the end of last year were $140,000, of which $89,000 was financed by debt. Assume that ROE from last year will continue this year and no new equity was issued during the year. a. What is the firm's sustainable growth rate? (Round your answer to 3 decimal places.) Sustainable growth rate b. If the firm grows at its sustainable growth rate, how much debt will have to be raised in the coming year? (Round your answer to 1 decimal place.) Debt increase $ What is the current debt/assets rate? (Round your answer to 2 decimal places.) Debuassets rate last year What will be the debu'assets rate coming year? (Round your answer to 2 decimal places.) Debtassets rate coming year 6. What would be the maximum possible growth rate if the firm did not sell any new debt or equity in the coming year and maintains the dividend payout ratio? (Round your answer to 3 decimal places.) The maximum possible growth rato What would be the maximum possible growth rate if the firm did not sell any new debt or equity in the coming year and retains all earnings? (Round your answer to 3 decimal places.) The maximum possible growth rate % Find the sustainable and internal growth rates for a firm with the following ratios: asset turnover = 1.7. profit margin (net income/sales) = 4%; payout ratio - 15%; equity/assets - 0.2. (Round your answers to 2 decimal places.) Sustainable growth rate Internal growth rate