Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer asap and i will give thumbs up thank you so much #1 On September 1,2022, GBC Corporation purchased a new machine for its

please answer asap and i will give thumbs up

thank you so much

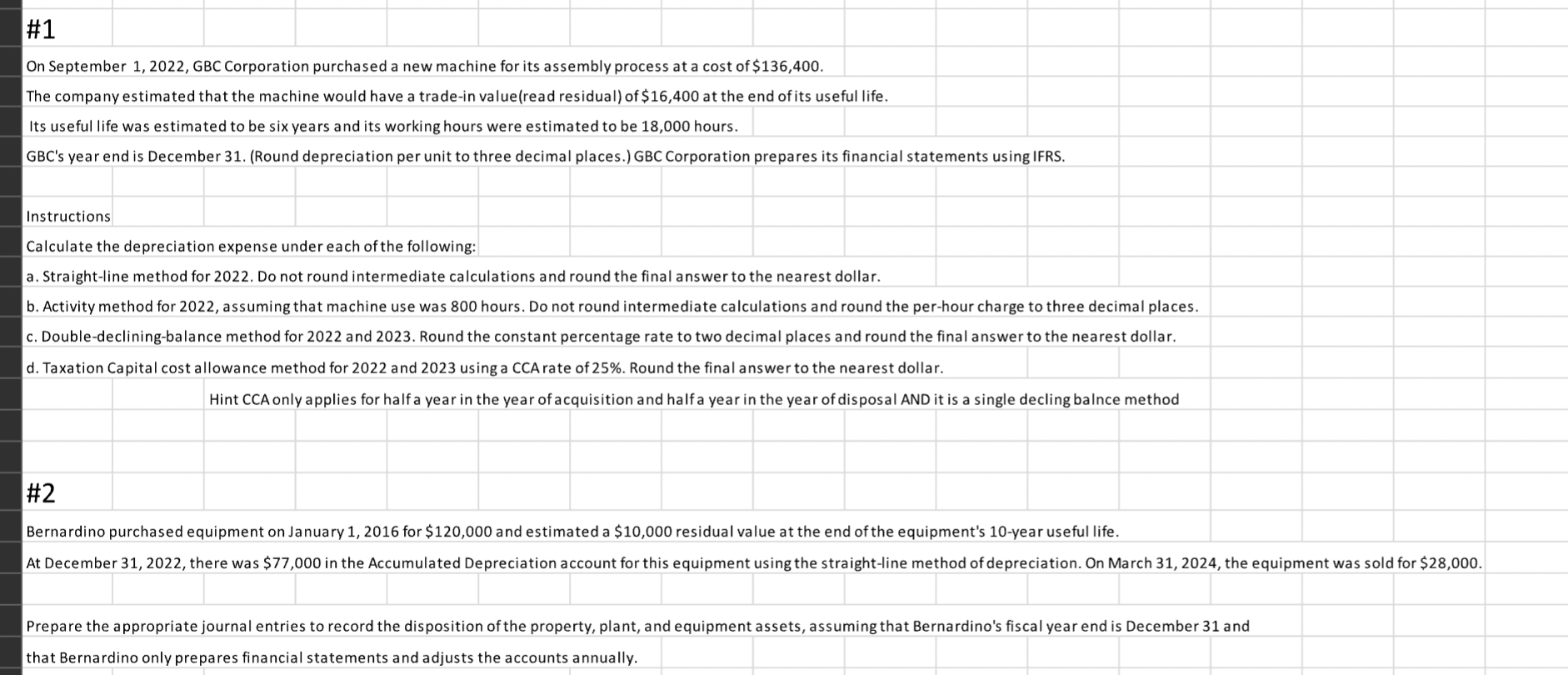

\\#1 On September 1,2022, GBC Corporation purchased a new machine for its assembly process at a cost of \\( \\$ 136,400 \\). The company estimated that the machine would have a trade-in value(read residual) of \\( \\$ 16,400 \\) at the end of its useful life. Its useful life was estimated to be six years and its working hours were estimated to be 18,000 hours. GBC's year end is December 31. (Round depreciation per unit to three decimal places.) GBC Corporation prepares its financial statements using IFRS. Instructions Calculate the depreciation expense under each of the following: a. Straight-line method for 2022. Do not round intermediate calculations and round the final answer to the nearest dollar. b. Activity method for 2022, assuming that machine use was 800 hours. Do not round intermediate calculations and round the per-hour charge to three decimal places. c. Double-declining-balance method for 2022 and 2023. Round the constant percentage rate to two decimal places and round the final answer to the nearest dollar. d. Taxation Capital cost allowance method for 2022 and 2023 using a CCA rate of \25. Round the final answer to the nearest dollar. Hint CCA only applies for half a year in the year of acquisition and half a year in the year of disposal AND it is a single decling balnce method \\( \\# 2 \\) Bernardino purchased equipment on January 1,2016 for \\( \\$ 120,000 \\) and estimated a \\( \\$ 10,000 \\) residual value at the end of the equipment's 10 -year useful life. Prepare the appropriate journal entries to record the disposition of the property, plant, and equipment assets, assuming that Bernardino's fiscal year end is December 31 and that Bernardino only prepares financial statements and adjusts the accounts annuallyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started