Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer if you are able to cover the points listed below thanks All of the transactions of Harding Trading Company for the year have

please answer if you are able to cover the points listed below thanks

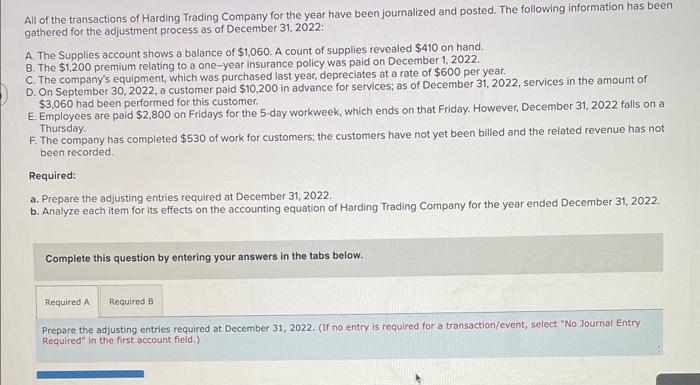

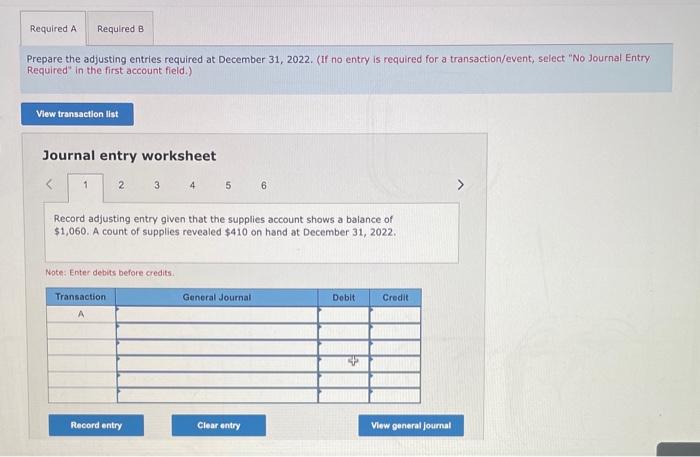

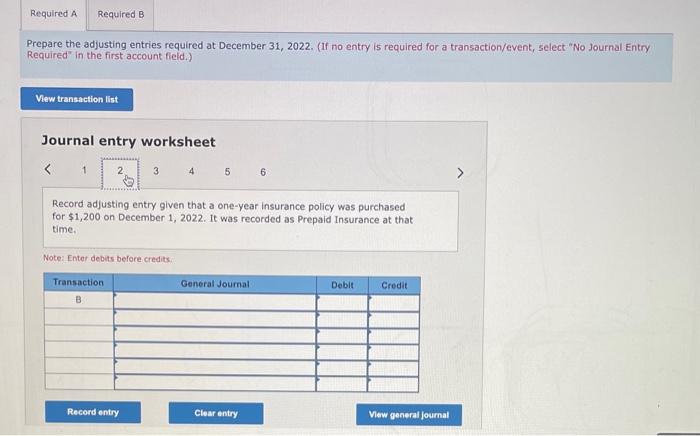

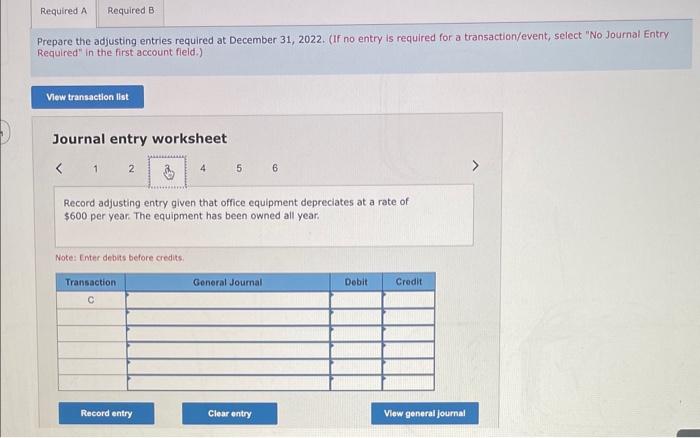

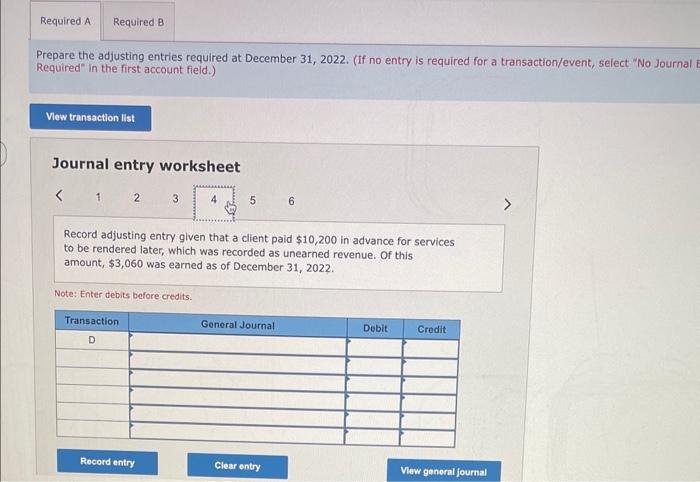

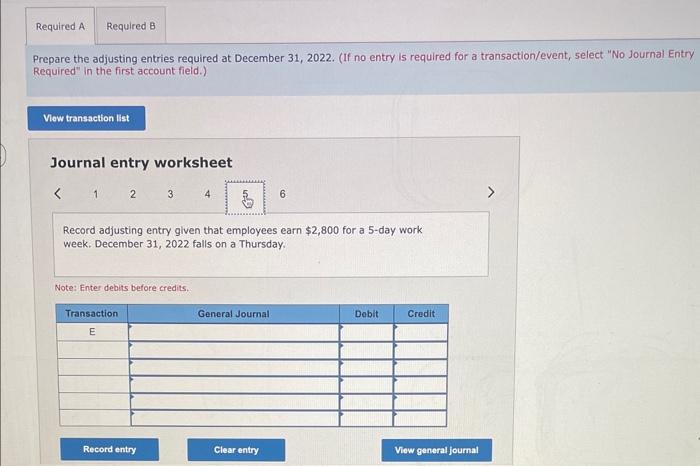

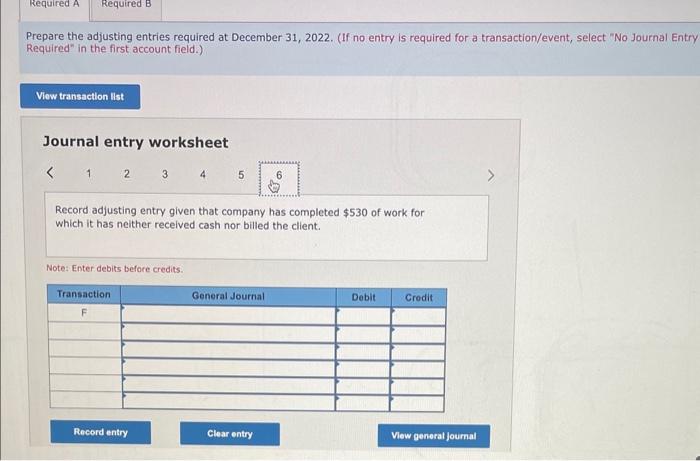

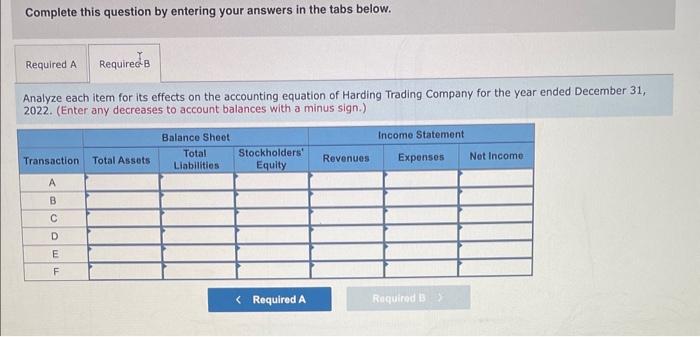

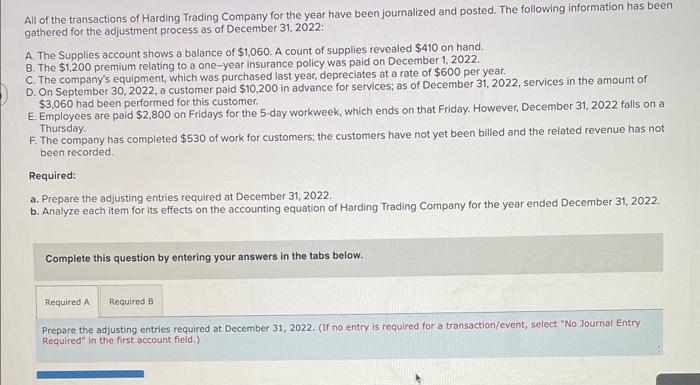

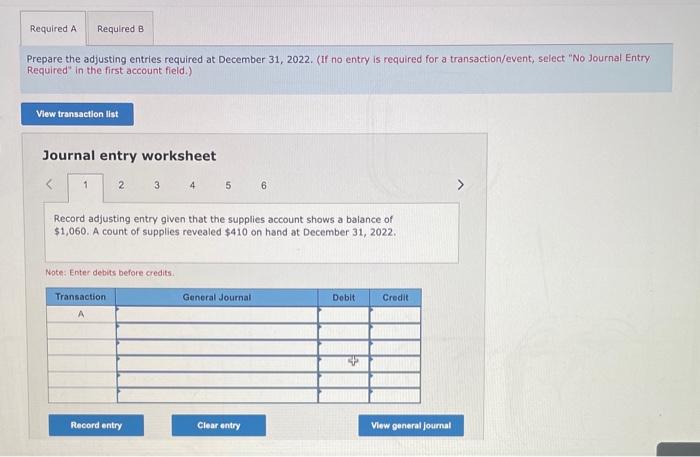

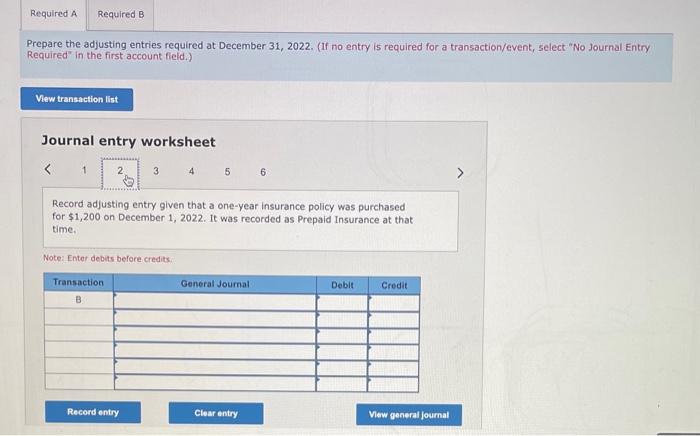

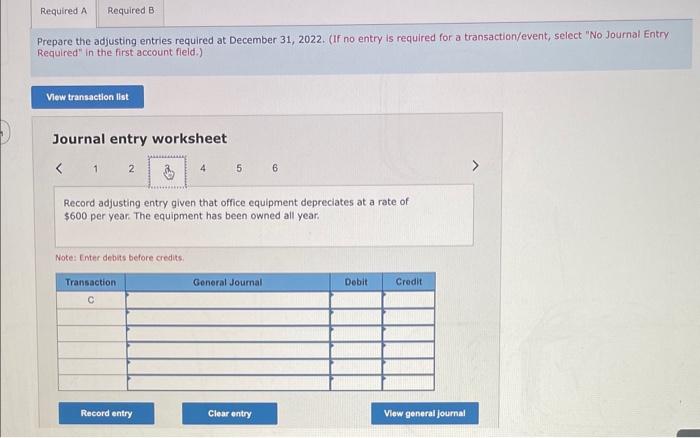

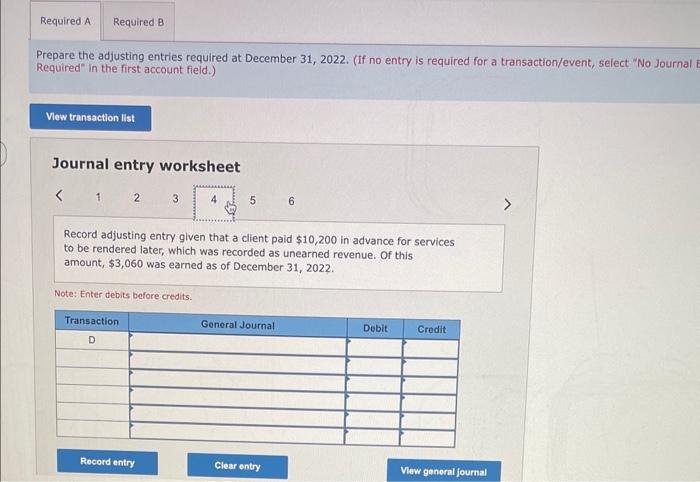

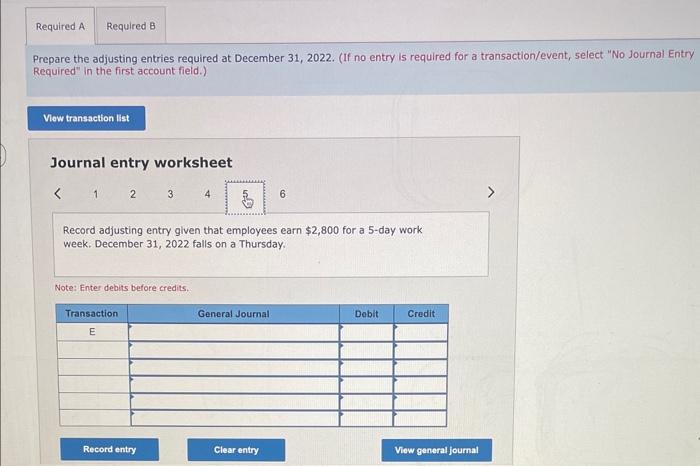

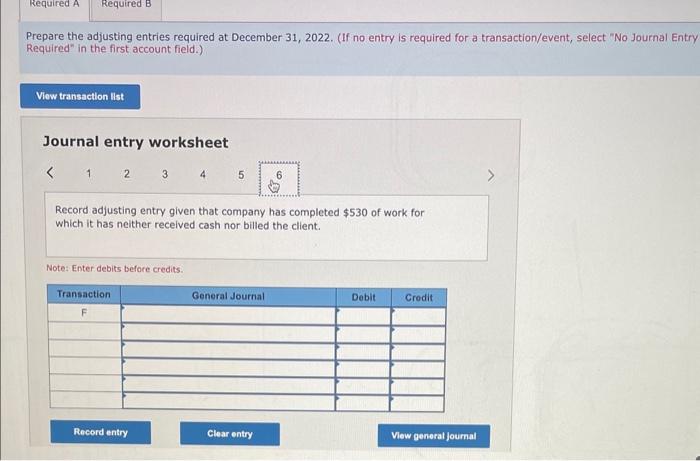

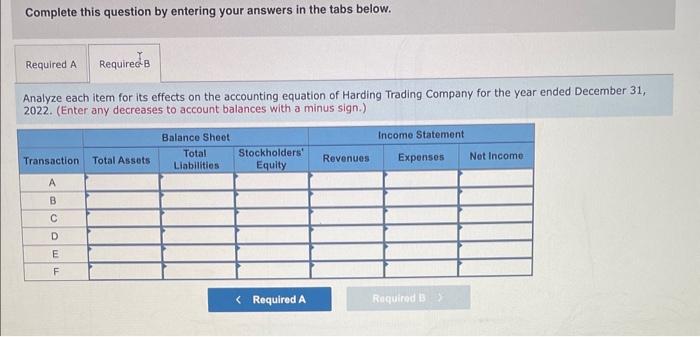

All of the transactions of Harding Trading Company for the year have been journalized and posted. The following information has been gathered for the adjustment process as of December 31, 2022: A. The Supplies account shows a balance of $1,060. A count of supplies revealed $410 on hand. B. The $1,200 premium relating to a one-year insurance policy was paid on December 1,2022. C. The company's equipment, which was purchased last year, depreciates at a rate of $600 per year. D. On September 30,2022 , a customer paid $10,200 in advance for services; as of December 31, 2022, services in the amount of $3,060 had been performed for this customer. E. Employees are paid $2,800 on Fridays for the 5-day workweek, which ends on that Friday. However. December 31,2022 falls on a Thursday. F. The company has completed $530 of work for customers; the customers have not yet been billed and the related revenue has not been recorded. Required: a. Prepare the adjusting entries required at December 31,2022. b. Analyze each item for its effects on the accounting equation of Harding Trading Company for the year ended December 31,2022. Complete this question by entering your answers in the tabs below. Prepare the adjusting entries required at December 31, 2022. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Prepare the adjusting entries required at December 31, 2022. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 234 Record adjusting entry given that the supplies account shows a balance of $1,060. A count of supplies revealed $410 on hand at December 31,2022 . Note: Enter debits before credits. Prepare the adjusting entries required at December 31, 2022. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record adjusting entry given that a one-year insurance policy was purchased for $1,200 on December 1,2022 . It was recorded as Prepaid Insurance at that time. Note: Enter debits before credits. Prepare the adjusting entries required at December 31,2022 . (If no entry is required for a transaction/event, select "No. Journal Entry Required" in the first account fleld.) Journal entry worksheet Record adjusting entry given that office equipment depreciates at a rate of $600 per year. The equipment has been owned all year. Note: Enter debits before credits: Prepare the adjusting entries required at December 31,2022 . (If no entry is required for a transaction/event, select "No Journal Required" in the first account field.) Journal entry worksheet Record adjusting entry given that a client paid $10,200 in advance for services to be rendered later, which was recorded as unearned revenue. Of this amount, $3,060 was earned as of December 31,2022. Note: Enter debits before credits. Prepare the adjusting entries required at December 31,2022 . (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started