Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer on paper , not excel, I've been posting few times so please note I need the answer on paper Jimmy Company purchase a

Please answer on paper , not excel, I've been posting few times so please note I need the answer on paper

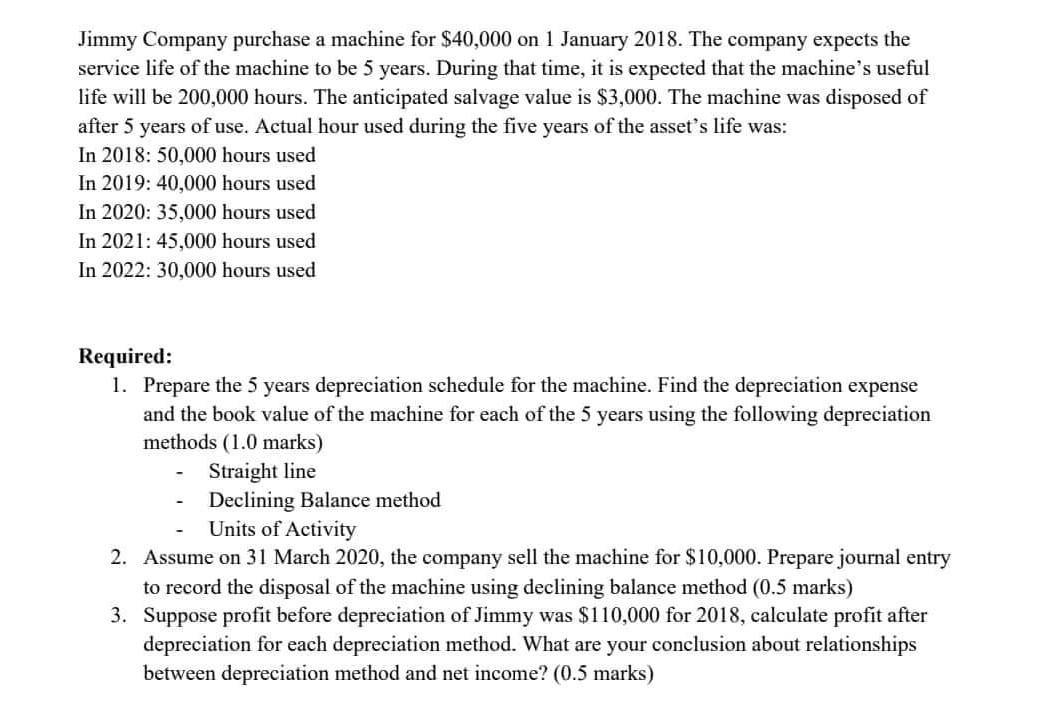

Jimmy Company purchase a machine for $40,000 on 1 January 2018. The company expects the service life of the machine to be 5 years. During that time, it is expected that the machine's useful life will be 200,000 hours. The anticipated salvage value is $3,000. The machine was disposed of after 5 years of use. Actual hour used during the five years of the asset's life was: In 2018: 50,000 hours used In 2019: 40,000 hours used In 2020: 35,000 hours used In 2021: 45,000 hours used In 2022: 30,000 hours used Required: 1. Prepare the 5 years depreciation schedule for the machine. Find the depreciation expense and the book value of the machine for each of the 5 years using the following depreciation methods (1.0 marks) Straight line Declining Balance method Units of Activity 2. Assume on 31 March 2020, the company sell the machine for $10,000. Prepare journal entry to record the disposal of the machine using declining balance method (0.5 marks) 3. Suppose profit before depreciation of Jimmy was $110,000 for 2018, calculate profit after depreciation for each depreciation method. What are your conclusion about relationships between depreciation method and net income? (0.5 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started