Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer only b) and c) Question 3. Derivatives Assume all options are European, and that the underlying asset is a non-dividend paying stock, unless

Please answer only b) and c)

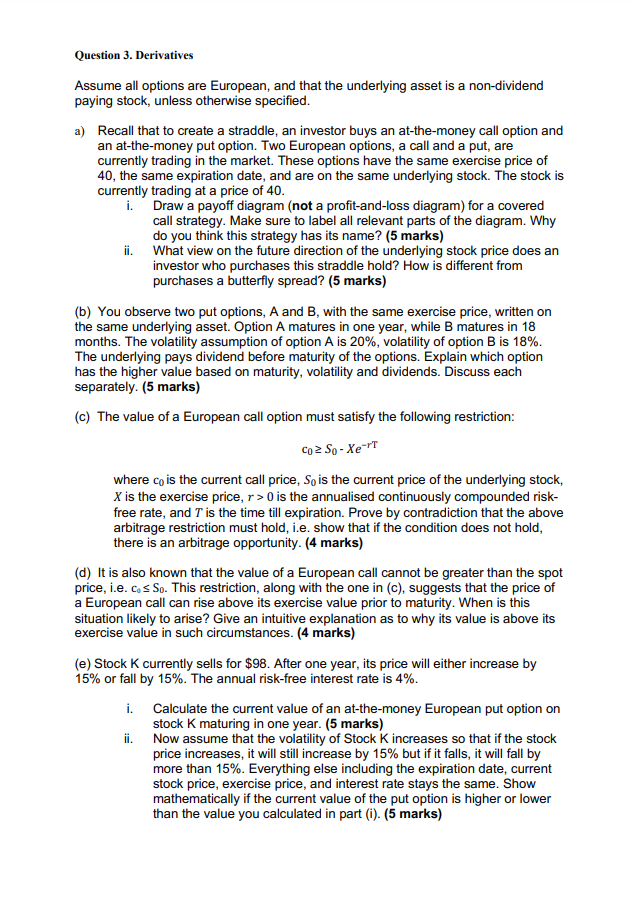

Question 3. Derivatives Assume all options are European, and that the underlying asset is a non-dividend paying stock, unless otherwise specified. a) Recall that to create a straddle, an investor buys an at-the-money call option and an at-the-money put option. Two European options, a call and a put, are currently trading in the market. These options have the same exercise price of 40, the same expiration date, and are on the same underlying stock. The stock is currently trading at a price of 40. i. Draw a payoff diagram (not a profit-and-loss diagram) for a covered call strategy. Make sure to label all relevant parts of the diagram. Why do you think this strategy has its name? (5 marks) ii. What view on the future direction of the underlying stock price does an investor who purchases this straddle hold? How is different from purchases a butterfly spread? (5 marks) (b) You observe two put options, A and B, with the same exercise price, written on the same underlying asset. Option A matures in one year, while B matures in 18 months. The volatility assumption of option A is 20%, volatility of option B is 18%. The underlying pays dividend before maturity of the options. Explain which option has the higher value based on maturity, volatility and dividends. Discuss each separately. (5 marks) (c) The value of a European call option must satisfy the following restriction: Co? So - XerT where co is the current call price, So is the current price of the underlying stock, X is the exercise price, r> 0 is the annualised continuously compounded risk- free rate, and T is the time till expiration. Prove by contradiction that the above arbitrage restriction must hold, i.e. show that if the condition does not hold, there is an arbitrage opportunity. (4 marks) (d) It is also known that the value of a European call cannot be greater than the spot price, i.e. Cos So. This restriction, along with the one in (c), suggests that the price of a European call can rise above its exercise value prior to maturity. When is this situation likely to arise? Give an intuitive explanation as to why its value is above its exercise value in such circumstances. (4 marks) (e) Stock K currently sells for $98. After one year, its price will either increase by 15% or fall by 15%. The annual risk-free interest rate is 4%. i. Calculate the current value of an at-the-money European put option on stock K maturing in one year. (5 marks) ii. Now assume that the volatility of Stock K increases so that if the stock price increases, it will still increase by 15% but if it falls, it will fall by more than 15%. Everything else including the expiration date, current stock price, exercise price, and interest rate stays the same. Show mathematically if the current value of the put option is higher or lower than the value you calculated in part (i). (5 marks) Question 3. Derivatives Assume all options are European, and that the underlying asset is a non-dividend paying stock, unless otherwise specified. a) Recall that to create a straddle, an investor buys an at-the-money call option and an at-the-money put option. Two European options, a call and a put, are currently trading in the market. These options have the same exercise price of 40, the same expiration date, and are on the same underlying stock. The stock is currently trading at a price of 40. i. Draw a payoff diagram (not a profit-and-loss diagram) for a covered call strategy. Make sure to label all relevant parts of the diagram. Why do you think this strategy has its name? (5 marks) ii. What view on the future direction of the underlying stock price does an investor who purchases this straddle hold? How is different from purchases a butterfly spread? (5 marks) (b) You observe two put options, A and B, with the same exercise price, written on the same underlying asset. Option A matures in one year, while B matures in 18 months. The volatility assumption of option A is 20%, volatility of option B is 18%. The underlying pays dividend before maturity of the options. Explain which option has the higher value based on maturity, volatility and dividends. Discuss each separately. (5 marks) (c) The value of a European call option must satisfy the following restriction: Co? So - XerT where co is the current call price, So is the current price of the underlying stock, X is the exercise price, r> 0 is the annualised continuously compounded risk- free rate, and T is the time till expiration. Prove by contradiction that the above arbitrage restriction must hold, i.e. show that if the condition does not hold, there is an arbitrage opportunity. (4 marks) (d) It is also known that the value of a European call cannot be greater than the spot price, i.e. Cos So. This restriction, along with the one in (c), suggests that the price of a European call can rise above its exercise value prior to maturity. When is this situation likely to arise? Give an intuitive explanation as to why its value is above its exercise value in such circumstances. (4 marks) (e) Stock K currently sells for $98. After one year, its price will either increase by 15% or fall by 15%. The annual risk-free interest rate is 4%. i. Calculate the current value of an at-the-money European put option on stock K maturing in one year. (5 marks) ii. Now assume that the volatility of Stock K increases so that if the stock price increases, it will still increase by 15% but if it falls, it will fall by more than 15%. Everything else including the expiration date, current stock price, exercise price, and interest rate stays the same. Show mathematically if the current value of the put option is higher or lower than the value you calculated in part (i)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started