Please answer parts A through F, and make sure numbers arent shortened.

Please answer parts A through F, and make sure numbers arent shortened.

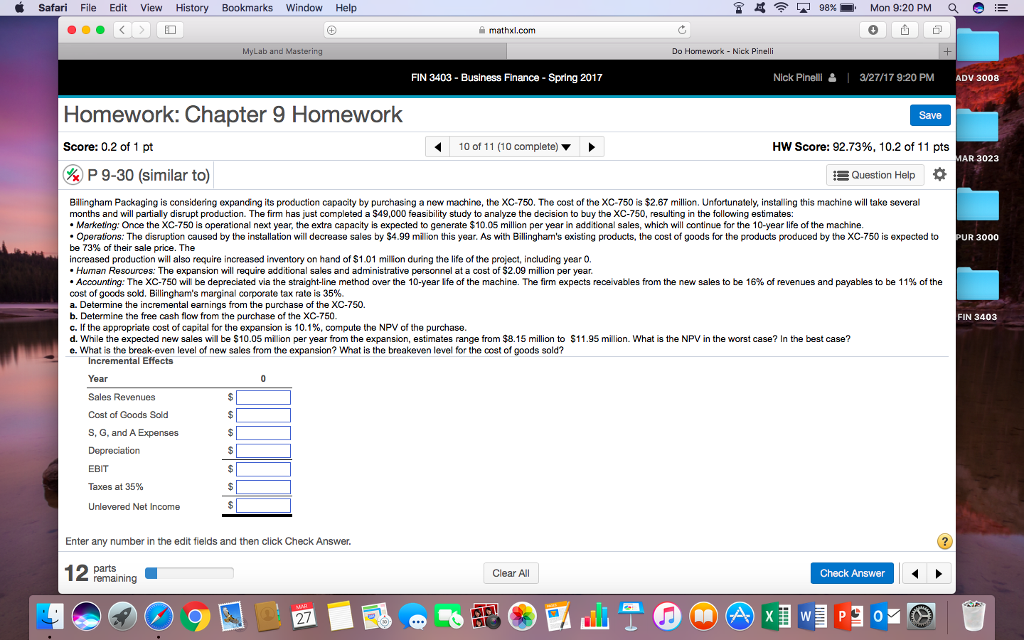

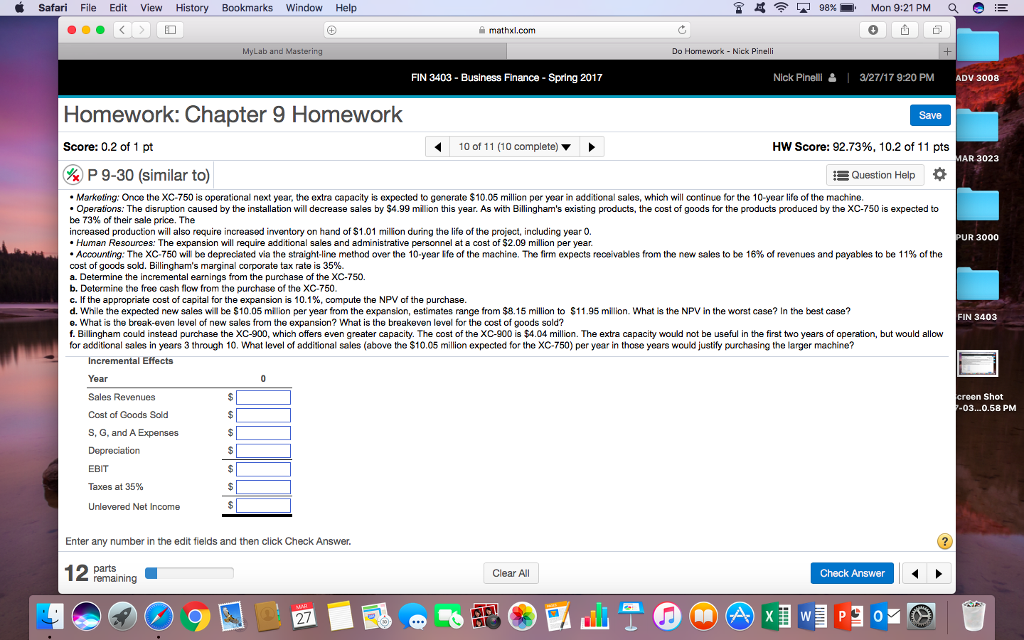

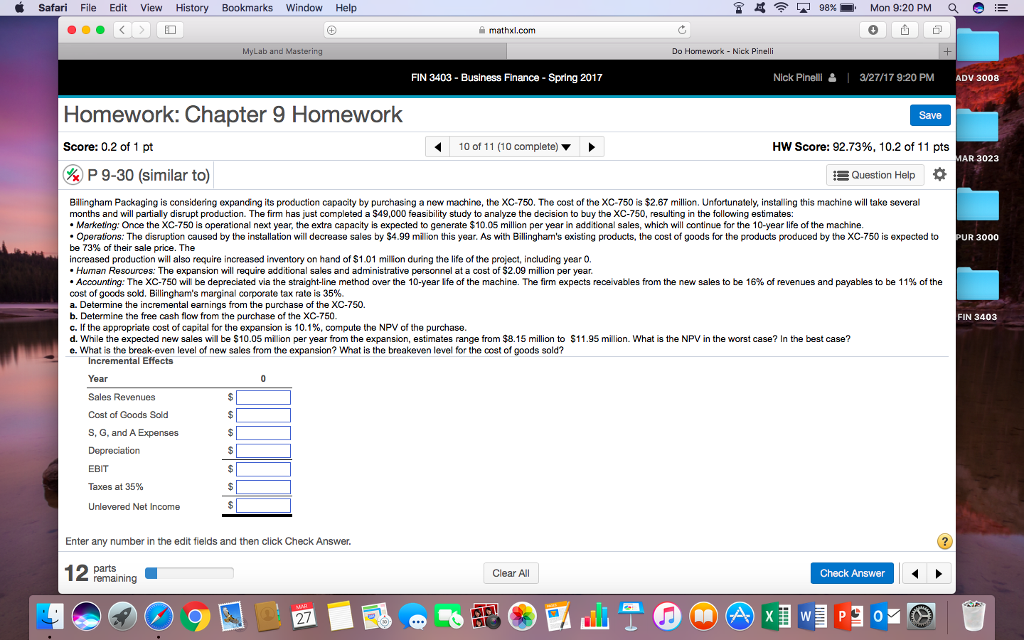

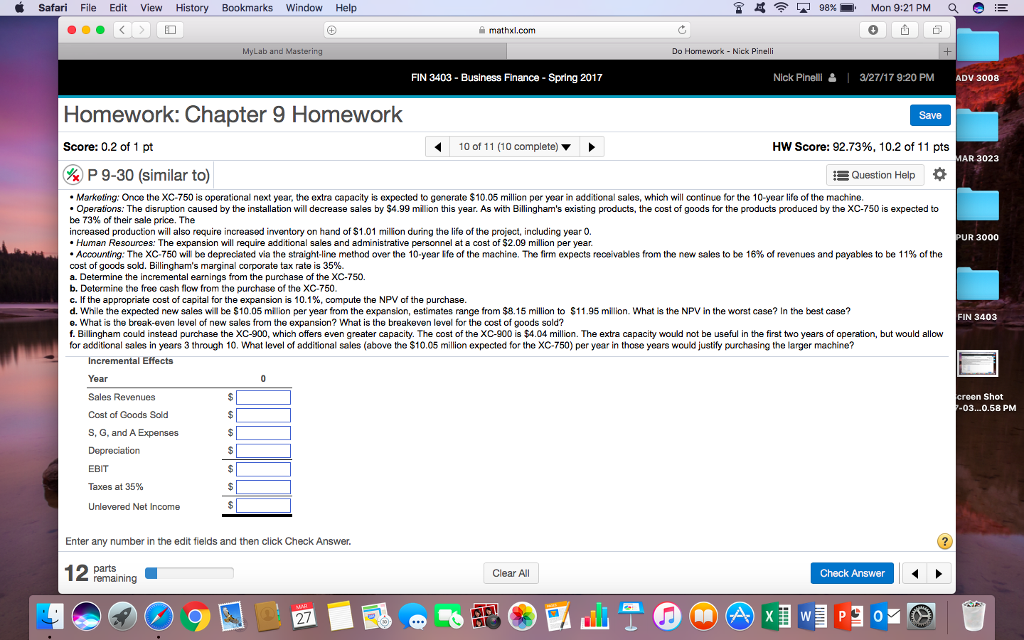

Safari File Edit View History Bookmarks Window Help 98% Mon 9:20 PM a e E mathxl com work Nick FIN 3403 Business Finance Spring 2017 Nick Pinelli 4 3/27/17 920 PM ADV 3008 Homework: Chapter 9 Homework HW Score: 92.73%, 10.2 of 11 pts Score: 0.2 of 1 pt 10 of 11 (10 complete) AR 3023 P 9-30 (similar to) EQuestion Help Billingham Packaging is considering expanding its production capacity by purchasing a new machine, the XC-750. The cost of the XC-750 is $2.67 million. Unfortunately installing this machine will take several months and will partially disrupt production. The firm has just completed a $49,000 feasibility study to analyze the decision to buy the XC-750, resulting in the following estimates: Marketing: Once the XC-750 is operational next year, the extra capacity is expected to generate $10.05 million per year in additional sales, which will continue for the 10-year life of the machine Operations. The disruption caused by the installation will decrease sales by $4.99 milion this year. As with Billingham's existing products, the cost of goods for the products produced by the XC-750 is expected to PUR 3000 be 73% of their sale price. The increased production will also require increased inventory on hand of $1.01 million during the life of the project including year 0 Human Resources: The expansion will require additional sales and administrative personnel at a cost of $2.09 million per year. Accounting: The XC-750 will be depreciated via the straight-line method over the 10-year life of the machine. The firm expects receivables from the new sales to be 16% of revenues and payables to be 11% of the cost of goods sold. Billingham's marginal corporate tax rate is 35%. a. Determine the incremental earnings from the purchase of the XC-750 b. Determine the free cash flow from the purchase of the XC-750 FIN 3403 c. If the appropriate cost of capital for the expansion is 10.1%, compute the NPV of the purchase d. While the expected new sales. will be S10.05 million per year from the expansion, estimates range from $8.15 million to S11.95 million. What is the NPV in the worst case In the best case e. What is the break-even level of new sales from the expansion? What is the breakeven level for the cost of goods sold? ncremental Effects Year Sales Revenues Cost of Goods Sold S, G, and A Expenses Depreciation EBIT Taxes at 35 Unlevered Net Enter any number in the edit fields and then click Check Answer 12 parts remaining Clear All Check Answe

Please answer parts A through F, and make sure numbers arent shortened.

Please answer parts A through F, and make sure numbers arent shortened.