Please answer question 18.7 showing your work and fully with numbers and words explaining, the bullet points are just background information. Thank you.

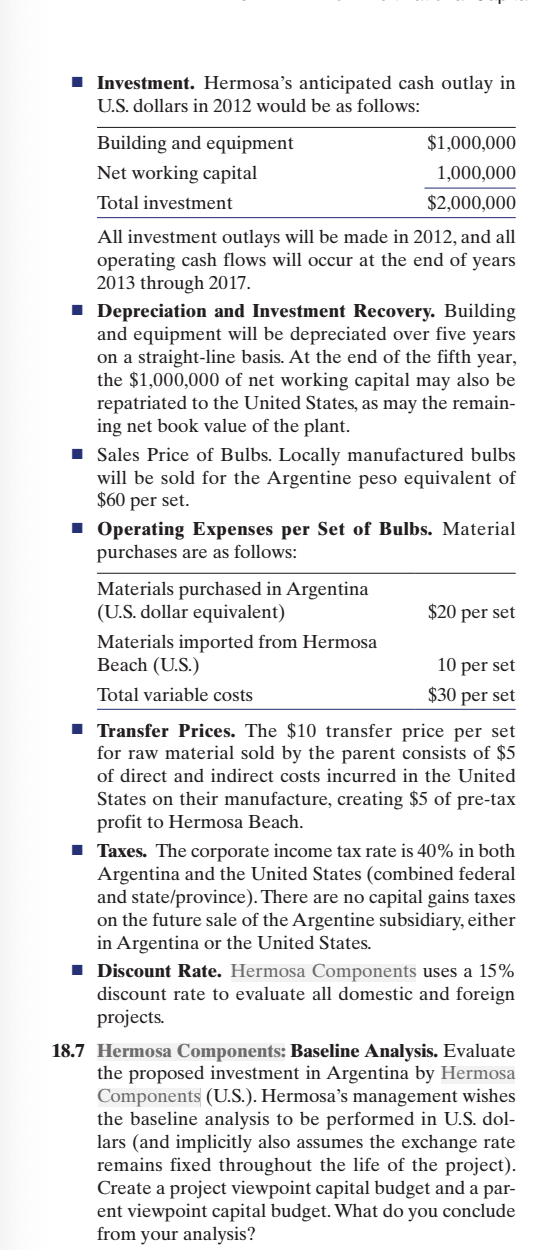

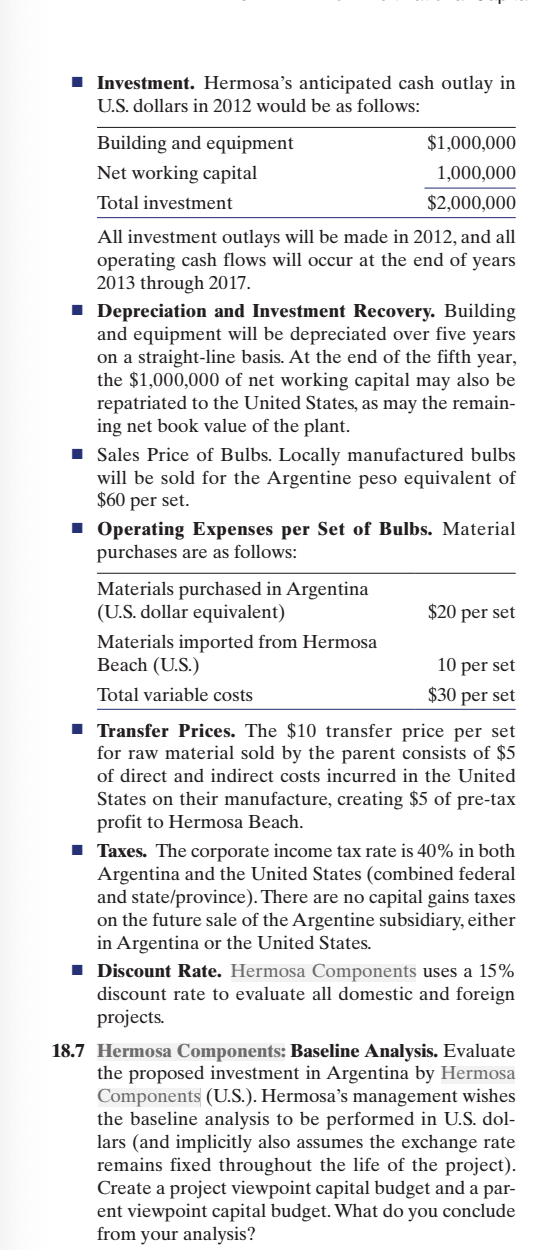

Investment. Hermosa's anticipated cash outlay in U.S. dollars in 2012 would be as follows: Building and equipment Net working capital Total investment $1,000,000 1,000,000 $2,000,000 All investment outlays will be made in 2012, and all operating cash flows will occur at the end of years 2013 through 2017. Depreciation and Investment Recovery. Building and equipment will be depreciated over five years on a straight-line basis. At the end of the fifth year, the $1,000,000 of net working capital may also be repatriated to the United States, as may the remain- ing net book value of the plant. Sales Price of Bulbs. Locally manufactured bulbs will be sold for the Argentine peso equivalent of $60 per set. Operating Expenses per Set of Bulbs. Material purchases are as follows: $20 per set Materials purchased in Argentina (U.S. dollar equivalent) Materials imported from Hermosa Beach (U.S.) Total variable costs 10 per set $30 per set Transfer Prices. The $10 transfer price per set for raw material sold by the parent consists of $5 of direct and indirect costs incurred in the United States on their manufacture, creating $5 of pre-tax profit to Hermosa Beach. Taxes. The corporate income tax rate is 40% in both Argentina and the United States (combined federal and state/province). There are no capital gains taxes on the future sale of the Argentine subsidiary, either in Argentina or the United States. Discount Rate. Hermosa Components uses a 15% discount rate to evaluate all domestic and foreign projects. 18.7 Hermosa Components: Baseline Analysis. Evaluate the proposed investment in Argentina by Hermosa Components (U.S.). Hermosa's management wishes the baseline analysis to be performed in U.S. dol- lars (and implicitly also assumes the exchange rate remains fixed throughout the life of the project). Create a project viewpoint capital budget and a par- ent viewpoint capital budget. What do you conclude from your analysis? Investment. Hermosa's anticipated cash outlay in U.S. dollars in 2012 would be as follows: Building and equipment Net working capital Total investment $1,000,000 1,000,000 $2,000,000 All investment outlays will be made in 2012, and all operating cash flows will occur at the end of years 2013 through 2017. Depreciation and Investment Recovery. Building and equipment will be depreciated over five years on a straight-line basis. At the end of the fifth year, the $1,000,000 of net working capital may also be repatriated to the United States, as may the remain- ing net book value of the plant. Sales Price of Bulbs. Locally manufactured bulbs will be sold for the Argentine peso equivalent of $60 per set. Operating Expenses per Set of Bulbs. Material purchases are as follows: $20 per set Materials purchased in Argentina (U.S. dollar equivalent) Materials imported from Hermosa Beach (U.S.) Total variable costs 10 per set $30 per set Transfer Prices. The $10 transfer price per set for raw material sold by the parent consists of $5 of direct and indirect costs incurred in the United States on their manufacture, creating $5 of pre-tax profit to Hermosa Beach. Taxes. The corporate income tax rate is 40% in both Argentina and the United States (combined federal and state/province). There are no capital gains taxes on the future sale of the Argentine subsidiary, either in Argentina or the United States. Discount Rate. Hermosa Components uses a 15% discount rate to evaluate all domestic and foreign projects. 18.7 Hermosa Components: Baseline Analysis. Evaluate the proposed investment in Argentina by Hermosa Components (U.S.). Hermosa's management wishes the baseline analysis to be performed in U.S. dol- lars (and implicitly also assumes the exchange rate remains fixed throughout the life of the project). Create a project viewpoint capital budget and a par- ent viewpoint capital budget. What do you conclude from your analysis