Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer questions 3, 4, and 5. Thank you! Foster Company wants to buy a special automated machine to replace an existing manual system. The

Please answer questions 3, 4, and 5. Thank you!

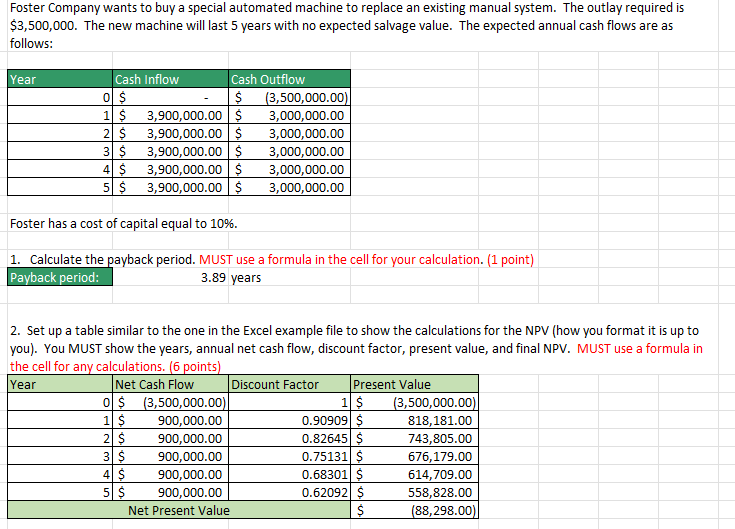

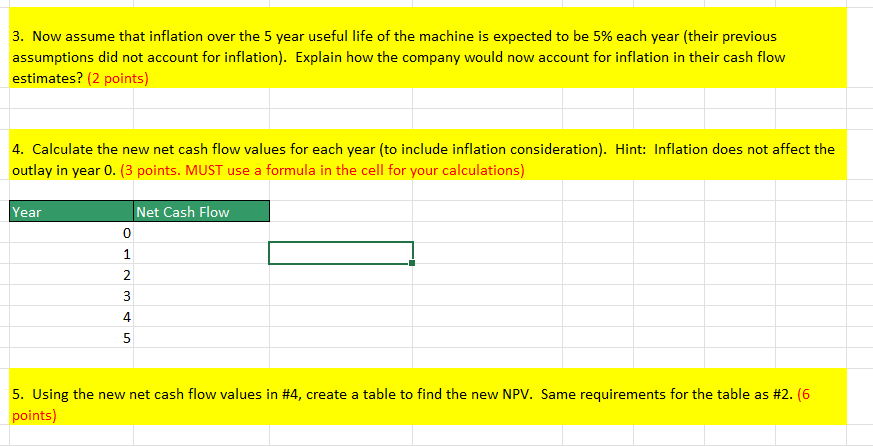

Foster Company wants to buy a special automated machine to replace an existing manual system. The outlay required is $3,500,000. The new machine will last 5 years with no expected salvage value. The expected annual cash flows are as follows: \begin{tabular}{|rrr|lr|} \hline Year & & \multicolumn{2}{|l|}{ Cash Inflow } & \multicolumn{2}{|l|}{ Cash Outflow } \\ \hline 0 & $ & - & $ & (3,500,000.00) \\ \hline 1 & $ & 3,900,000.00 & $ & 3,000,000.00 \\ \hline 2 & $ & 3,900,000.00 & $ & 3,000,000.00 \\ \hline 3 & $ & 3,900,000.00 & $ & 3,000,000.00 \\ \hline 4 & $ & 3,900,000.00 & $ & 3,000,000.00 \\ \hline 5 & $ & 3,900,000.00 & $ & 3,000,000.00 \\ \hline \end{tabular} Foster has a cost of capital equal to 10%. 1. Calculate the payback period. MUST use a formula in the cell for your calculation. (1 point) Payback period: 3.89 years 2. Set up a table similar to the one in the Excel example file to show the calculations for the NPV (how you format it is up to you). You MUST show the years, annual net cash flow, discount factor, present value, and final NPV. MUST use a formula in the cell for any calculations. (6 points) \begin{tabular}{|r|lr|r|lr|} \hline Year & \multicolumn{2}{|l|}{ Net Cash Flow } & \multicolumn{2}{l|}{ Discount Factor } & \multicolumn{2}{l|}{ Present Value } \\ \hline 0 & $ & (3,500,000.00) & 1 & $ & (3,500,000.00) \\ \hline 1 & $ & 900,000.00 & 0.90909 & $ & 818,181.00 \\ \hline 2 & $ & 900,000.00 & 0.82645 & $ & 743,805.00 \\ \hline 3 & $ & 900,000.00 & 0.75131 & $ & 676,179.00 \\ \hline 4 & $ & 900,000.00 & 0.68301 & $ & 614,709.00 \\ \hline 5 & $ & 900,000.00 & 0.62092 & $ & 558,828.00 \\ \hline \multicolumn{3}{|c|}{ Net Present Value } & & $ & (88,298.00) \\ \hline \end{tabular} 3. Now assume that inflation over the 5 year useful life of the machine is expected to be 5% each year (their previous assumptions did not account for inflation). Explain how the company would now account for inflation in their cash flow estimatec? (2 nnintel 4. Calculate the new net cash flow values for each year (to include inflation consideration). Hint: Inflation does not affect the outlay in year 0 . (3 points. MUST use a formula in the cell for your calculations) 5. Using the new net cash flow values in \#4, create a table to find the new NPV. Same requirements for the table as \#2. (6 points)

Foster Company wants to buy a special automated machine to replace an existing manual system. The outlay required is $3,500,000. The new machine will last 5 years with no expected salvage value. The expected annual cash flows are as follows: \begin{tabular}{|rrr|lr|} \hline Year & & \multicolumn{2}{|l|}{ Cash Inflow } & \multicolumn{2}{|l|}{ Cash Outflow } \\ \hline 0 & $ & - & $ & (3,500,000.00) \\ \hline 1 & $ & 3,900,000.00 & $ & 3,000,000.00 \\ \hline 2 & $ & 3,900,000.00 & $ & 3,000,000.00 \\ \hline 3 & $ & 3,900,000.00 & $ & 3,000,000.00 \\ \hline 4 & $ & 3,900,000.00 & $ & 3,000,000.00 \\ \hline 5 & $ & 3,900,000.00 & $ & 3,000,000.00 \\ \hline \end{tabular} Foster has a cost of capital equal to 10%. 1. Calculate the payback period. MUST use a formula in the cell for your calculation. (1 point) Payback period: 3.89 years 2. Set up a table similar to the one in the Excel example file to show the calculations for the NPV (how you format it is up to you). You MUST show the years, annual net cash flow, discount factor, present value, and final NPV. MUST use a formula in the cell for any calculations. (6 points) \begin{tabular}{|r|lr|r|lr|} \hline Year & \multicolumn{2}{|l|}{ Net Cash Flow } & \multicolumn{2}{l|}{ Discount Factor } & \multicolumn{2}{l|}{ Present Value } \\ \hline 0 & $ & (3,500,000.00) & 1 & $ & (3,500,000.00) \\ \hline 1 & $ & 900,000.00 & 0.90909 & $ & 818,181.00 \\ \hline 2 & $ & 900,000.00 & 0.82645 & $ & 743,805.00 \\ \hline 3 & $ & 900,000.00 & 0.75131 & $ & 676,179.00 \\ \hline 4 & $ & 900,000.00 & 0.68301 & $ & 614,709.00 \\ \hline 5 & $ & 900,000.00 & 0.62092 & $ & 558,828.00 \\ \hline \multicolumn{3}{|c|}{ Net Present Value } & & $ & (88,298.00) \\ \hline \end{tabular} 3. Now assume that inflation over the 5 year useful life of the machine is expected to be 5% each year (their previous assumptions did not account for inflation). Explain how the company would now account for inflation in their cash flow estimatec? (2 nnintel 4. Calculate the new net cash flow values for each year (to include inflation consideration). Hint: Inflation does not affect the outlay in year 0 . (3 points. MUST use a formula in the cell for your calculations) 5. Using the new net cash flow values in \#4, create a table to find the new NPV. Same requirements for the table as \#2. (6 points) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started