Answered step by step

Verified Expert Solution

Question

1 Approved Answer

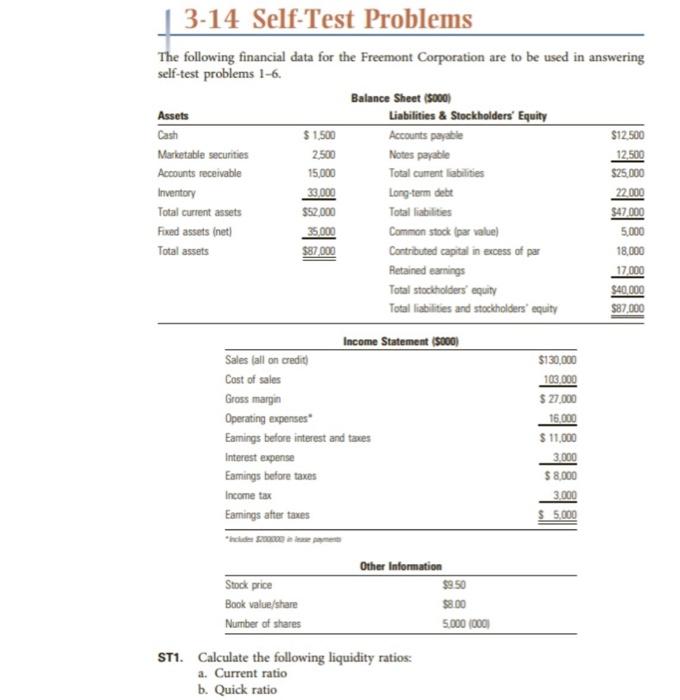

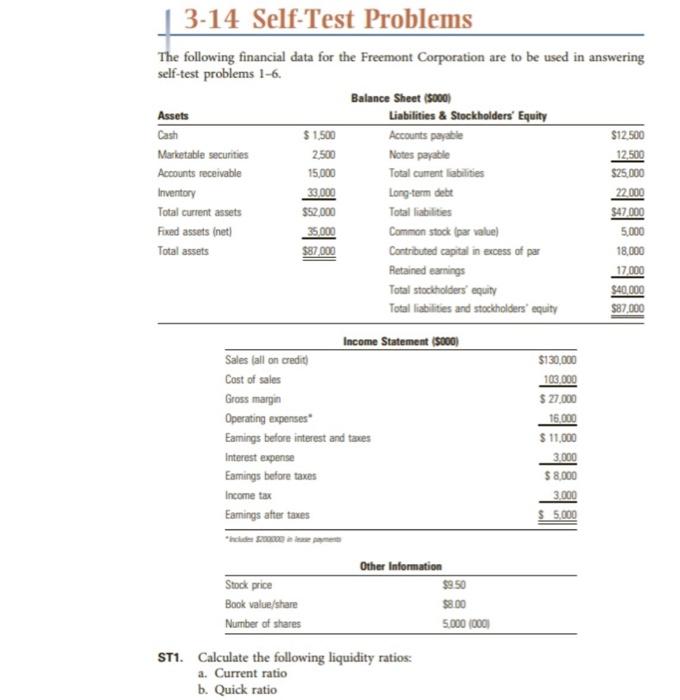

please answer ST1 - ST5 3-14 Self-Test Problems The following financial data for the Freemont Corporation are to be used in answering self-test problems 1-6.

please answer ST1 - ST5

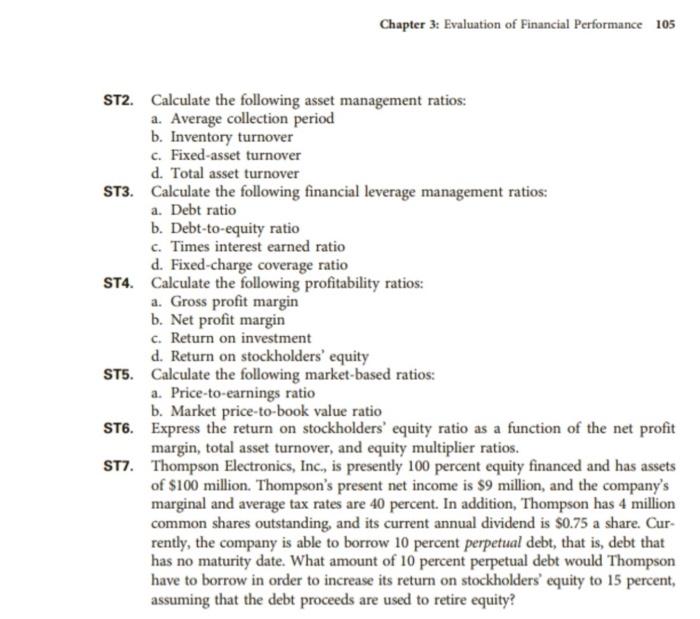

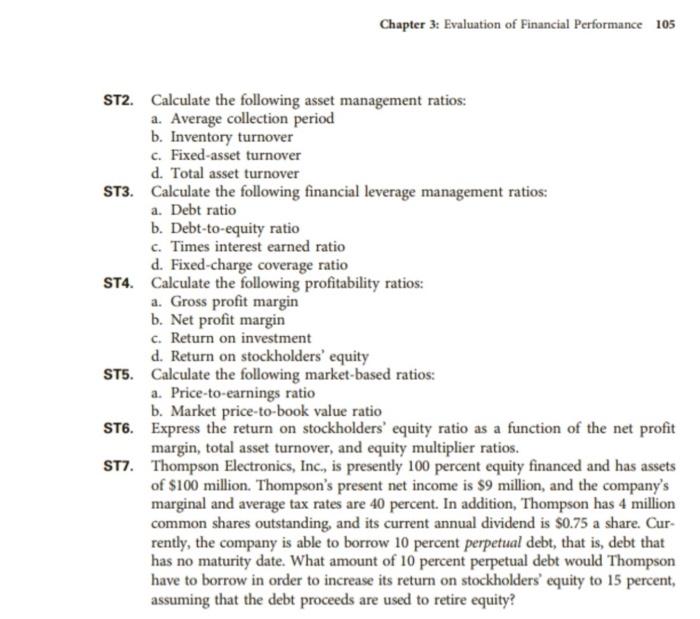

3-14 Self-Test Problems The following financial data for the Freemont Corporation are to be used in answering self-test problems 1-6. ST1. Calculate the following liquidity ratios: a. Current ratio b. Quick ratio ST2. Calculate the following asset management ratios: a. Average collection period b. Inventory turnover c. Fixed-asset turnover d. Total asset turnover ST3. Calculate the following financial leverage management ratios: a. Debt ratio b. Debt-to-equity ratio c. Times interest earned ratio d. Fixed-charge coverage ratio ST4. Calculate the following profitability ratios: a. Gross profit margin b. Net profit margin c. Return on investment d. Return on stockholders' equity ST5. Calculate the following market-based ratios: a. Price-to-earnings ratio b. Market price-to-book value ratio ST6. Express the return on stockholders' equity ratio as a function of the net profit margin, total asset turnover, and equity multiplier ratios. ST7. Thompson Electronics, Inc, is presently 100 percent equity financed and has assets of $100 million. Thompson's present net income is $9 million, and the company's marginal and average tax rates are 40 percent. In addition, Thompson has 4 million common shares outstanding, and its current annual dividend is $0.75 a share. Currently, the company is able to borrow 10 percent perpetual debt, that is, debt that has no maturity date. What amount of 10 percent perpetual debt would Thompson have to borrow in order to increase its return on stockholders' equity to 15 percent, assuming that the debt proceeds are used to retire equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started