Answered step by step

Verified Expert Solution

Question

1 Approved Answer

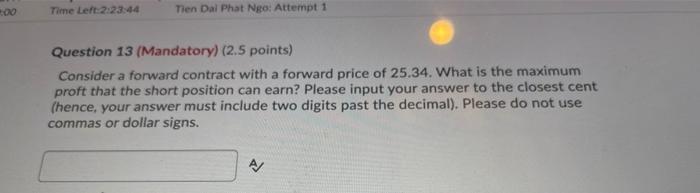

please answer the 2 questions below: Time Left:2:23:44 Tien Dai Phat Nghe Attempt 1 Question 13 (Mandatory) (2.5 points) Consider a forward contract with a

please answer the 2 questions below:

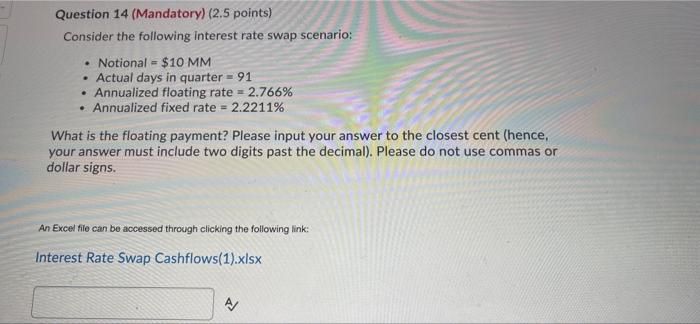

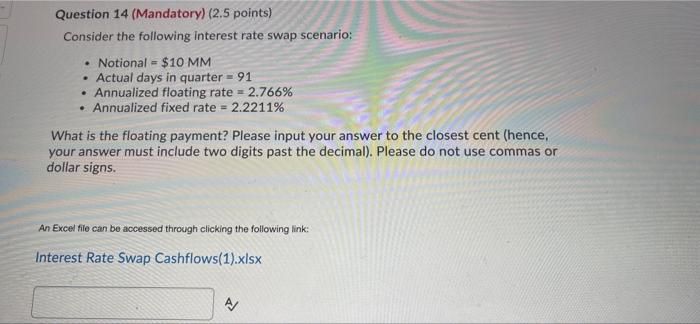

Time Left:2:23:44 Tien Dai Phat Nghe Attempt 1 Question 13 (Mandatory) (2.5 points) Consider a forward contract with a forward price of 25.34. What is the maximum proft that the short position can earn? Please input your answer to the closest cent (hence, your answer must include two digits past the decimal). Please do not use commas or dollar signs. A/ . Question 14 (Mandatory) (2.5 points) Consider the following interest rate swap scenario: Notional = $10 MM Actual days in quarter = 91 Annualized floating rate = 2.766% Annualized fixed rate = 2.2211% What is the floating payment? Please input your answer to the closest cent (hence, your answer must include two digits past the decimal). Please do not use commas or dollar signs. An Excel file can be accessed through clicking the following link: Interest Rate Swap Cashflows(1).xlsx A/

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started