Question

Please answer the following questions: (i) What value could be created by a merger of companies A and B? (ii) If company A pays 1.25

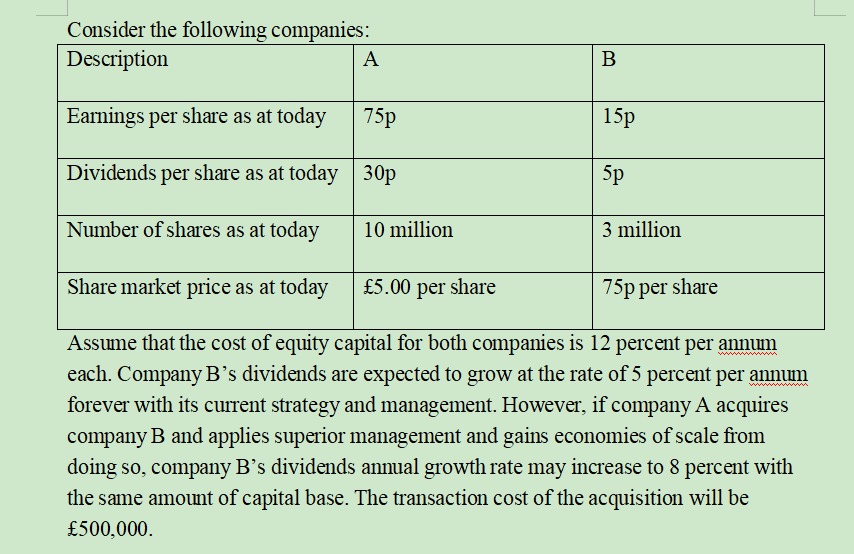

Please answer the following questions: (i) What value could be created by a merger of companies A and B? (ii) If company A pays 1.25 for each share of company B, what value would be created for each group of shareholders? (iii) Instead of paying cash, if company A gives one of its shares for six shares of company B, what value would be created for each group of shareholders? (iv) If none of the benefits expected from the merger of companies A and B is realised, because of problems of integration, what is the loss or gain in value to each group of shareholders (i) under the cash offer and (ii) under the share offer.

Consider the following companies: Description A B Earnings per share as at today 75p 15p Dividends per share as at today 30p 5p Number of shares as at today 10 million 3 million Share market price as at today 5.00 per share 75p per share Assume that the cost of equity capital for both companies is 12 percent per annum each. Company B's dividends are expected to grow at the rate of 5 percent per annum forever with its current strategy and management. However, if company A acquires company B and applies superior management and gains economies of scale from doing so, company Bs dividends annual growth rate may increase to 8 percent with the same amount of capital base. The transaction cost of the acquisition will be 500,000. Consider the following companies: Description A B Earnings per share as at today 75p 15p Dividends per share as at today 30p 5p Number of shares as at today 10 million 3 million Share market price as at today 5.00 per share 75p per share Assume that the cost of equity capital for both companies is 12 percent per annum each. Company B's dividends are expected to grow at the rate of 5 percent per annum forever with its current strategy and management. However, if company A acquires company B and applies superior management and gains economies of scale from doing so, company Bs dividends annual growth rate may increase to 8 percent with the same amount of capital base. The transaction cost of the acquisition will be 500,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started