please answer the following questions. It is U.S Taxation.

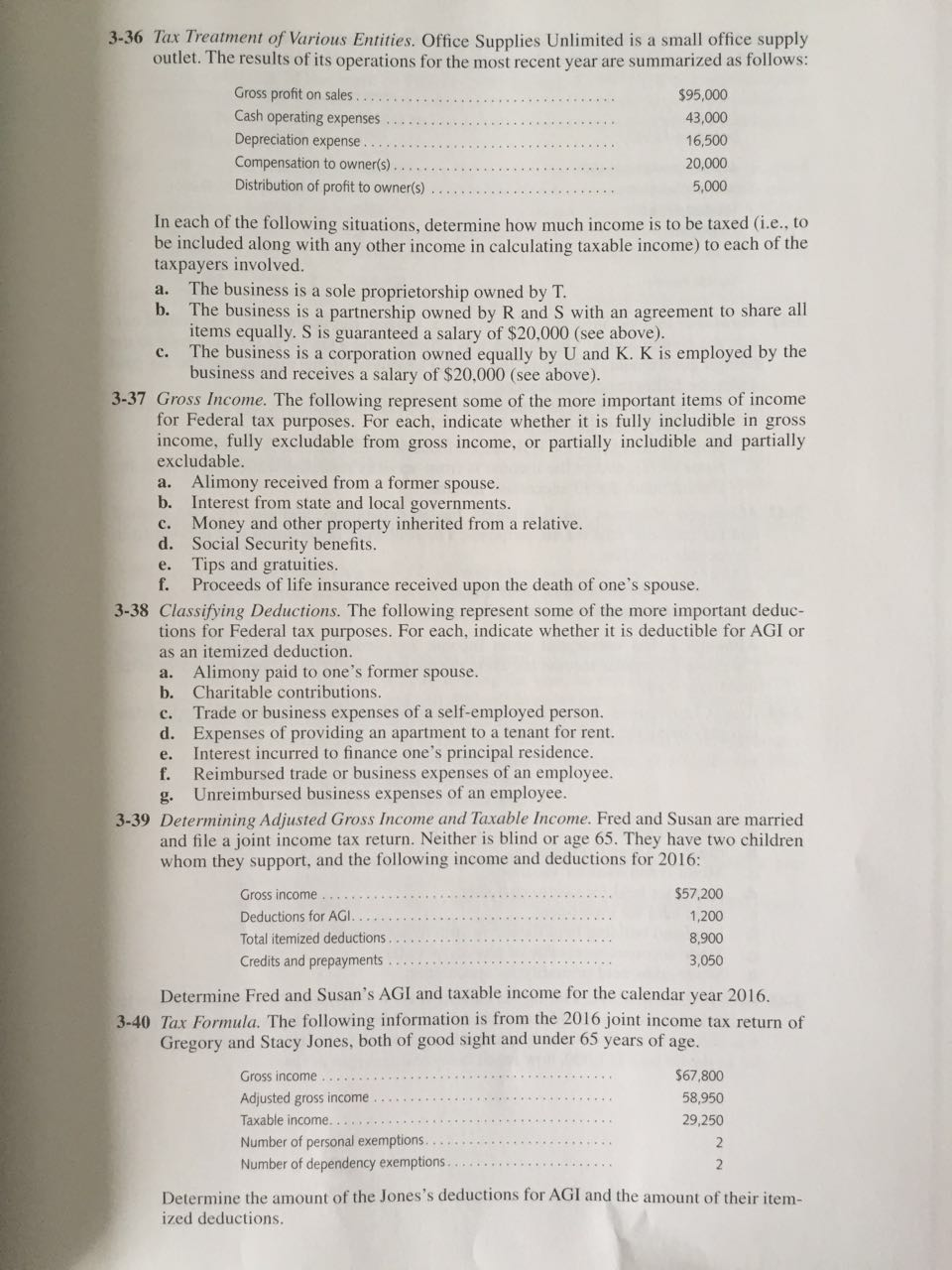

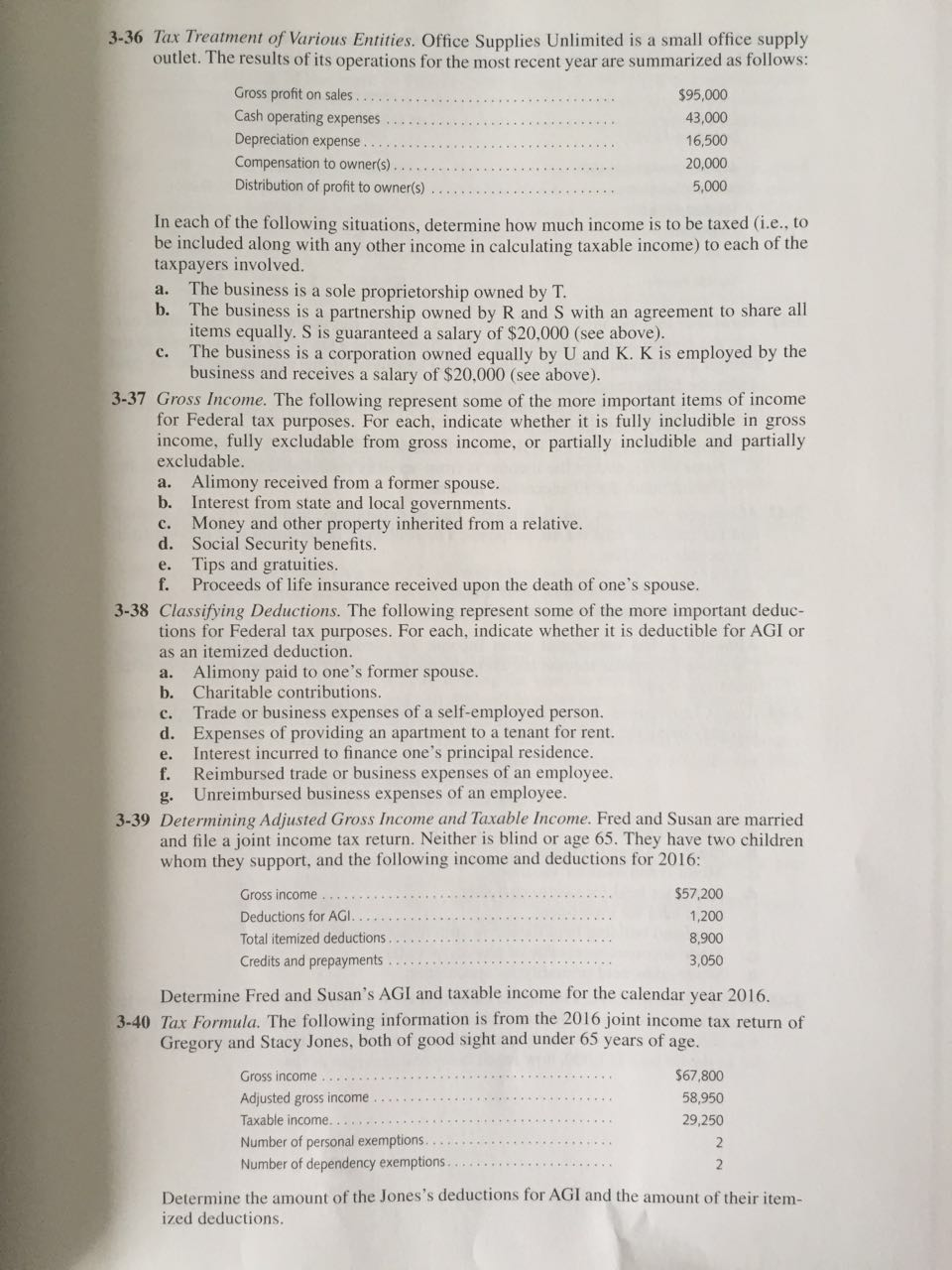

Tax Treatment of Various Entities. Office Supplies Unlimited is a small office supply outlet. The results of its operations for the most recent year are summarized as follows: In each of the following situations, determine how much income is to be taxed (i.e.. to be included along with any other income in calculating taxable income) to each of the taxpayers involved. The business is a sole proprietorship owned by T. The business is a partnership owned by R and S with an agreement to share all items equally. S is guaranteed a salary of $20,000 (see above). The business is a corporation owned equally by U and K. K is employed by the business and receives a salary of $20,000 (see above). Gross Income The following represent some of the more important items of income for Federal tax purposes. For each, indicate whether it is fully includible in gross income, fully excludable from gross income, or partially includible and partially excludable. Alimony received from a former spouse. Interest from state and local governments. Money and other property inherited from a relative. Social Security benefits. Tips and gratuities. Proceeds of life insurance received upon the death of one's spouse. Classifying Deductions. The following represent some of the more important deductions for Federal tax purposes. For each, indicate whether it is deductible for AGI or as an itemized deduction. Alimony paid to one's former spouse. Charitable contributions. Trade or business expenses of a self-employed person. Expenses of providing an apartment to a tenant for rent. Interest incurred to finance one's principal residence. Reimbursed trade or business expenses of an employee. Unreimbursed business expenses of an employee. Determining Adjusted Gross Income and Taxable Income. Fred and Susan are married and file a joint income tax return. Neither is blind or age 65. They have two children whom they support, and the following income and deductions for 2016: Determine Fred and Susan's AGI and taxable income for the calendar year 2016. Tax Formula. The following information is from the 2016 joint income tax return of Gregory and Stacy Jones, both of good sight and under 65 years of age. Determine the amount of the Jones's deductions for AGI and the amount of their itemized deductions