Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Which of the following are tax deductible items to a corporation? 2) interest expenses dividends to common stockholders dividends to preferred stockholders interest

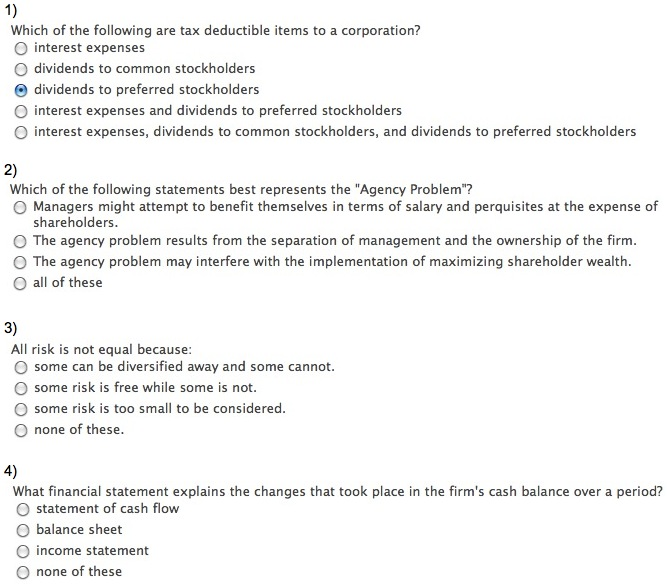

1) Which of the following are tax deductible items to a corporation? 2) interest expenses dividends to common stockholders dividends to preferred stockholders interest expenses and dividends to preferred stockholders interest expenses, dividends to common stockholders, and dividends to preferred stockholders Which of the following statements best represents the "Agency Problem"? 3) Managers might attempt to benefit themselves in terms of salary and perquisites at the expense of shareholders. The agency problem results from the separation of management and the ownership of the firm. The agency problem may interfere with the implementation of maximizing shareholder wealth. O all of these All risk is not equal because: 4) some can be diversified away and some cannot. some risk is free while some is not. some risk is too small to be considered. O none of these. What financial statement explains the changes that took place in the firm's cash balance over a period? statement of cash flow O balance sheet income statement O none of these

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Which of the following are taxdeductible items to a corporation Interest expenses are taxdeductibl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started