Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show your works and answer in Finance way (not in excel) and highlight the answer. thank you 8. (Corporate application) You own a gold

Please show your works and answer in Finance way (not in excel) and highlight the answer. thank you

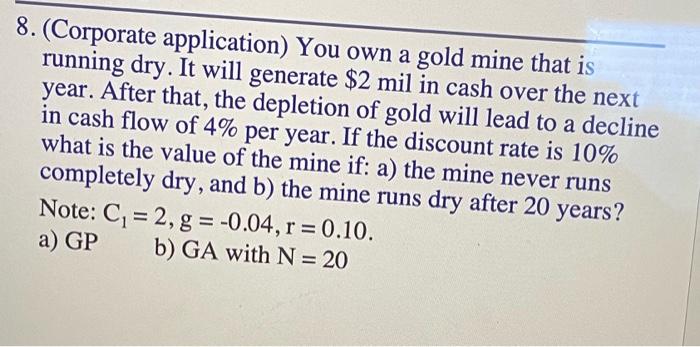

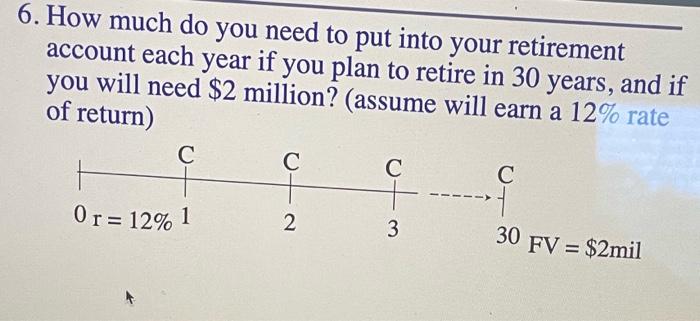

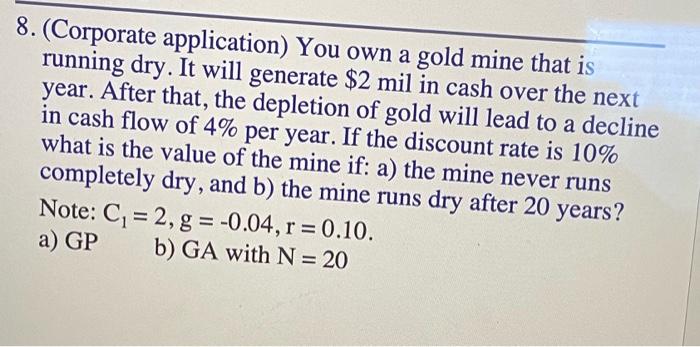

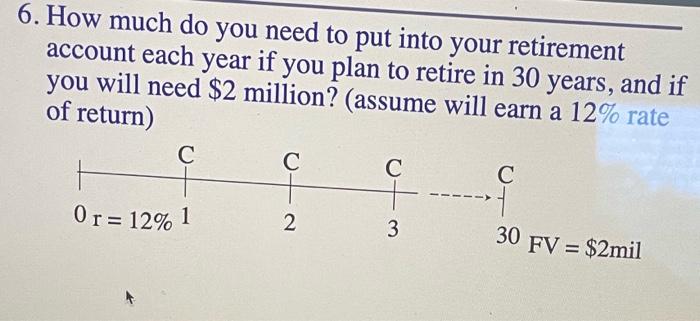

8. (Corporate application) You own a gold mine that is running dry. It will generate $2 mil in cash over the next year. After that, the depletion of gold will lead to a decline in cash flow of 4% per year. If the discount rate is 10% what is the value of the mine if: a) the mine never runs completely dry, and b) the mine runs dry after 20 years? Note: C = 2, g = -0.04, r = 0.10. a) GP b) GA with N = 20 6. How much do you need to put into your retirement account each year if you plan to retire in 30 years, and if you will need $2 million? (assume will earn a 12% rate of return) C C C C 0r = 12% 1 2 3 30 FV = $2mil

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started