Please answer the questions

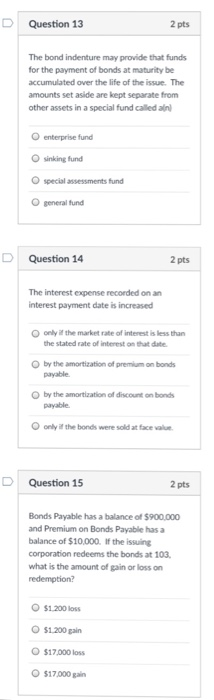

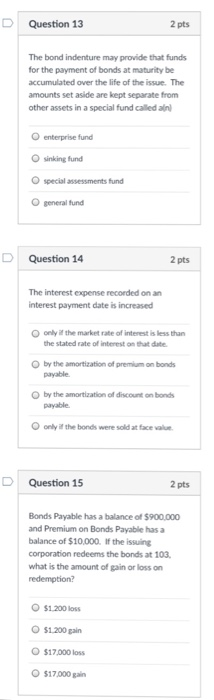

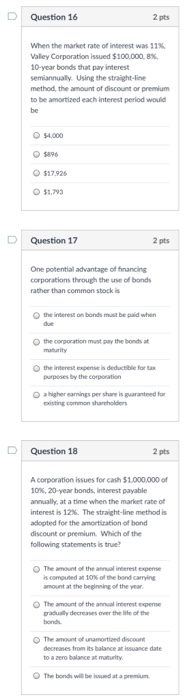

DQuestion 13 2 pts The bond indenture may provide that funds for the payment of bonds at maturity be accumulated over the life of the issue. The amounts set aside are kept separate from other assets in a special fund called aln Oenterprise fund sinking fund O special assessments fund O general fund D Question 14 2 pts The interest expense recorded on an interest payment date is increased only i the market rate of intenest is less than the stated rate of interest on that date O by the amortization of premium on bonds payable O by the amortization of discount on bonds payable 0 only ilf the bonds were sold at face win. D Question 15 2 pts Bonds Payable has a balance of $900,000 and Premium on Bonds Payable has a balance of $10.000. If the issuing corporation redeems the bonds at 103 what is the amount of gain or loss on redemption? $1.200 loss $1.200 gain $17,000 loss O $17,000 gain D Question 16 2 pts When the market rate of interest was 11%, Valley Corporation issued $100.000, 8%, 10-year bonds that pay interest semiannually. Using the straight-line method, the amount of discount or premium to be amortized each interest period would be $4,000 $17.926 $1.293 D Question 17 2 pts One potential advantage of fhnancing corporations through the use of bonds rather than common stock is O the interest on bonds must be paid when the corporation must pay the bonds at maturity the iteest egese ide stie for tax purposes by the corporation O ahigher earnings per share is guaranteed for iting common shareholders DQuestion 18 2 pts A corporation issues for cash $1,000,000 of 10%, 20-year bonds, interest payable annually, at a time when the market rate of interest is 12%. The straight-line method is adopted for the amortization of bond discount or premium. Which of the following statements is true O The amount of the annual interest expense iscompused an 10%ofthe bond carrying amount at the beginning of the year O The amount of the annual interest expense gradually decreases over the life of the O The amount of unamortiaed disco its balance at issuance date to a zero balance at maturity O The bonds will be hsued at a premium