Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer using financial formulas and not in excel disregard the first one. i retook the picture below Lab 6 Questions Name Question 5 -

please answer using financial formulas and not in excel

disregard the first one. i retook the picture below

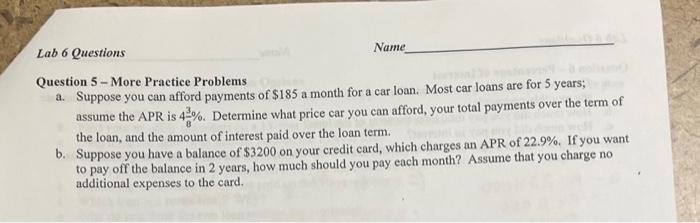

Lab 6 Questions Name Question 5 - More Practice Problems Suppose you can afford payments of S185 a month for a car Joan Most car loans are for 5 years 4.33ume tho APRIs 4%. Determine what price car you can afford, your total payment over the term of the loan, and the amount of interest paid over the loan term. b. Suppose you have a balance of $3200 on your credit card, which charges an APR of 22.9%. If you want to pay off the balance in 2 years, how much should you pay each month? Assume that you charge no additional expenses to the card. Lab 6 Questions Name Question 5 More Practice Problems a. Suppose you can afford payments of $185 a month for a car loan. Most car loans are for 5 years; assume the APR is 4%. Determine what price car you can afford, your total payments over the term of the loan, and the amount of interest paid over the loan term. b. Suppose you have a balance of $3200 on your credit card, which charges an APR of 22.9%. If you want to pay off the balance in 2 years, how much should you pay each month? Assume that you charge no additional expenses to the card Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started