Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please assist in answering all questions below QUESTION 16 Which of the following statements is/are True for the preparation of a partner's capital account and

Please assist in answering all questions below

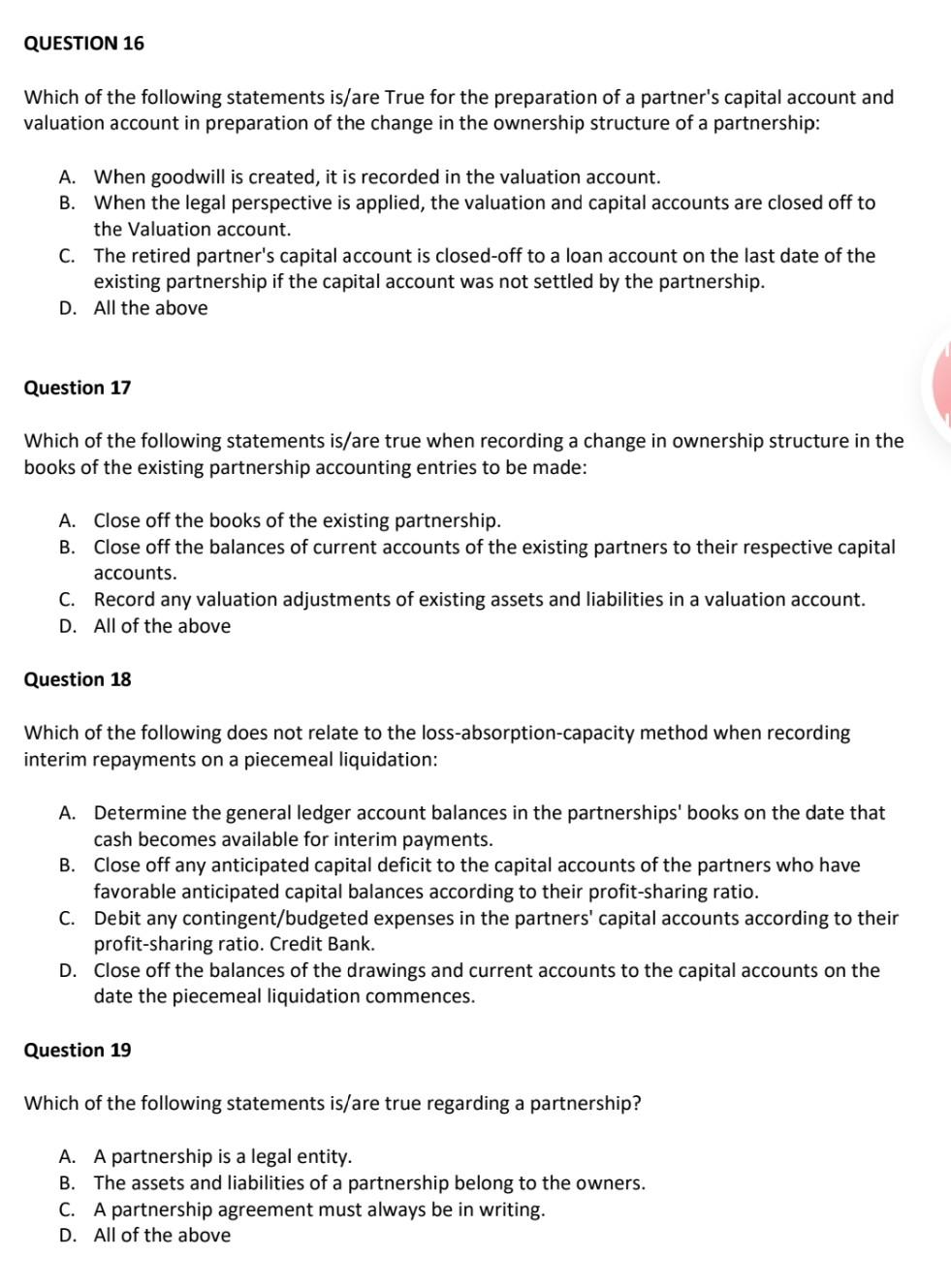

QUESTION 16 Which of the following statements is/are True for the preparation of a partner's capital account and valuation account in preparation of the change in the ownership structure of a partnership: A. When goodwill is created, it is recorded in the valuation account. B. When the legal perspective is applied, the valuation and capital accounts are closed off to the Valuation account. C. The retired partner's capital account is closed-off to a loan account on the last date of the existing partnership if the capital account was not settled by the partnership. D. All the above Question 17 Which of the following statements is/are true when recording a change in ownership structure in the books of the existing partnership accounting entries to be made: A. Close off the books of the existing partnership. B. Close off the balances of current accounts of the existing partners to their respective capital accounts. C. Record any valuation adjustments of existing assets and liabilities in a valuation account. D. All of the above Question 18 Which of the following does not relate to the loss-absorption-capacity method when recording interim repayments on a piecemeal liquidation: A. Determine the general ledger account balances in the partnerships' books on the date that cash becomes available for interim payments. B. Close off any anticipated capital deficit to the capital accounts of the partners who have favorable anticipated capital balances according to their profit-sharing ratio. C. Debit any contingent/budgeted expenses in the partners' capital accounts according to their profit-sharing ratio. Credit Bank. D. Close off the balances of the drawings and current accounts to the capital accounts on the date the piecemeal liquidation commences. Question 19 Which of the following statements is/are true regarding a partnership? A. A partnership is a legal entity. B. The assets and liabilities of a partnership belong to the owners. C. A partnership agreement must always be in writing. D. All of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started