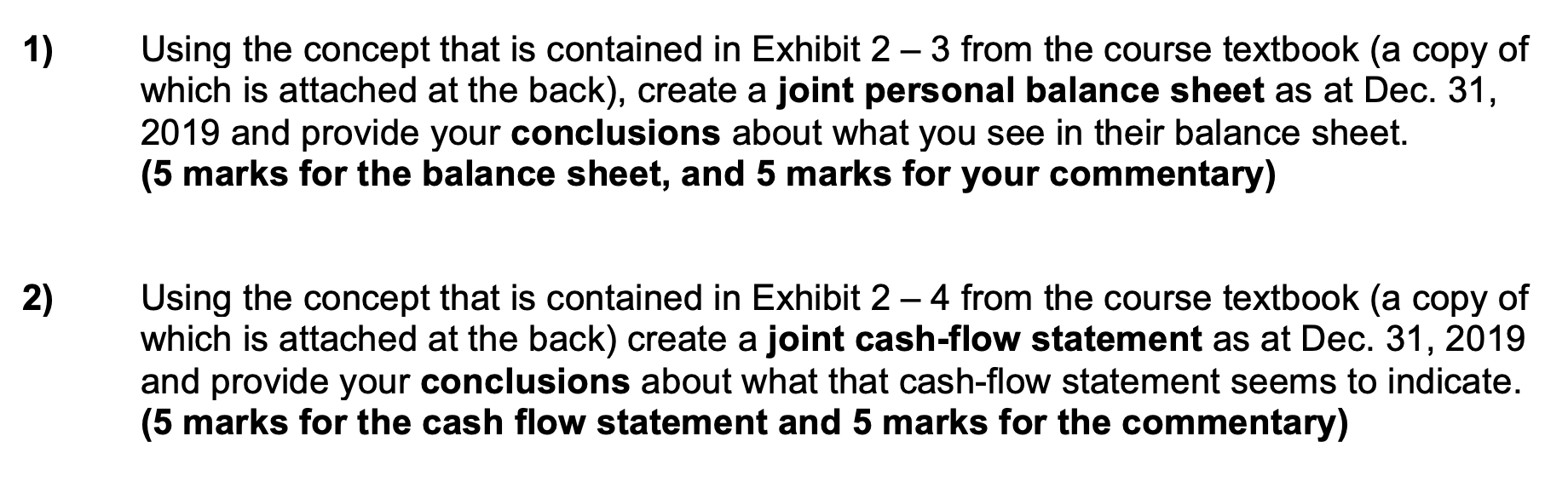

Question

PLEASE ASSIST ME ON CREATING A JOINT CASH-FLOW STATEMENT AND A JOINT PERSONAL BALANCE SHEET FOR THE FOLLOWING. Lois earns $ 80,000 a year (gross),

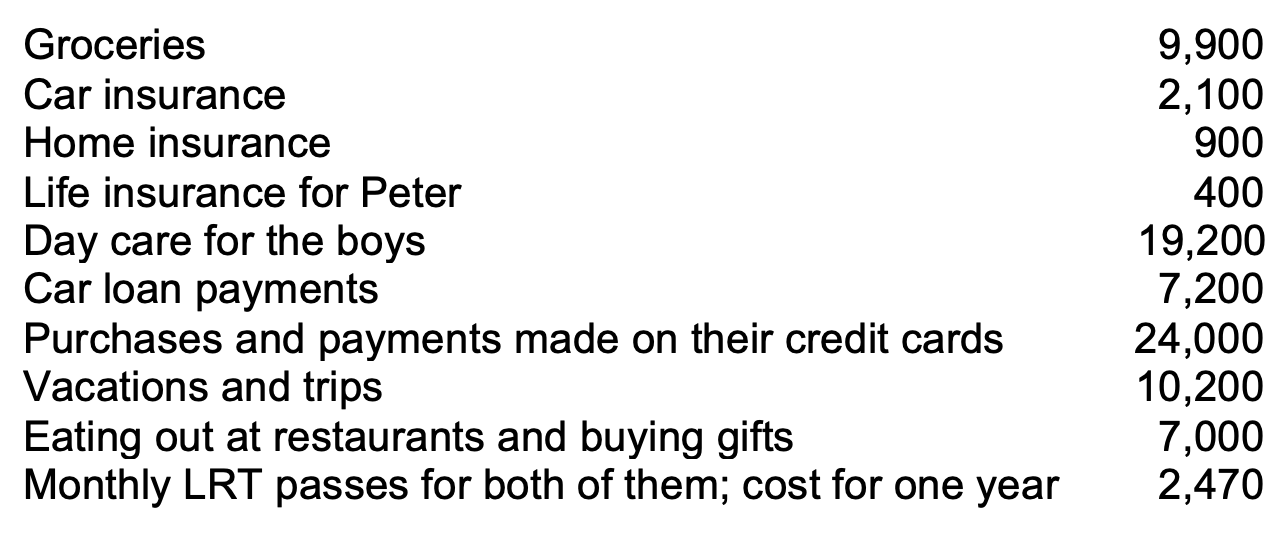

PLEASE ASSIST ME ON CREATING A JOINT CASH-FLOW STATEMENT AND A JOINT PERSONAL BALANCE SHEET FOR THE FOLLOWING.

Lois earns $ 80,000 a year (gross), and her net (take-home) pay is $ 54,000 per year. Her deductions (besides taxes, EI, CPP, and contributions to the company retirement pension plan) include full family health care coverage (medical, drugs, dental, and optical). She also has disability coverage provided by her employers group insurance for 70% of her gross salary, and three times her gross salary in life insurance coverage (straight-term, death benefit only, no cash value until death occurs while employed) under her employers group package. Her annual pay raises for the last 3 years have averaged 5% each year.

Peters gross income is $ 67,000 with a net (take-home) pay of $ 48,000 each year. He does not have group health, medical, or dental coverage from his employer because Loiss employer plan is better than his companys, so he is covered by her work-plan, and therefore, does not have those costs deducted from his pay cheques. Peter does, though, have income tax deducted from his pay, as well as his contributions to his employers retirement pension plan and normal things like EI and CPP, as does Lois with hers.

Peter has group life insurance coverage from his employer that would pay a death benefit of $150,000. He also has disability coverage that would pay 60% of his gross income if he should get injured or disabled. He does have his own term life insurance policy that he has purchased from Canada Life that would pay a death benefit of $150,000. Like his wife, he is in the office from about 8:00 a.m. to about 5:00 p.m. and he gets three weeks of paid annual vacation. His job is also considered to be safe and his annual raises for the last 3 years have averaged just over 6 % each year.

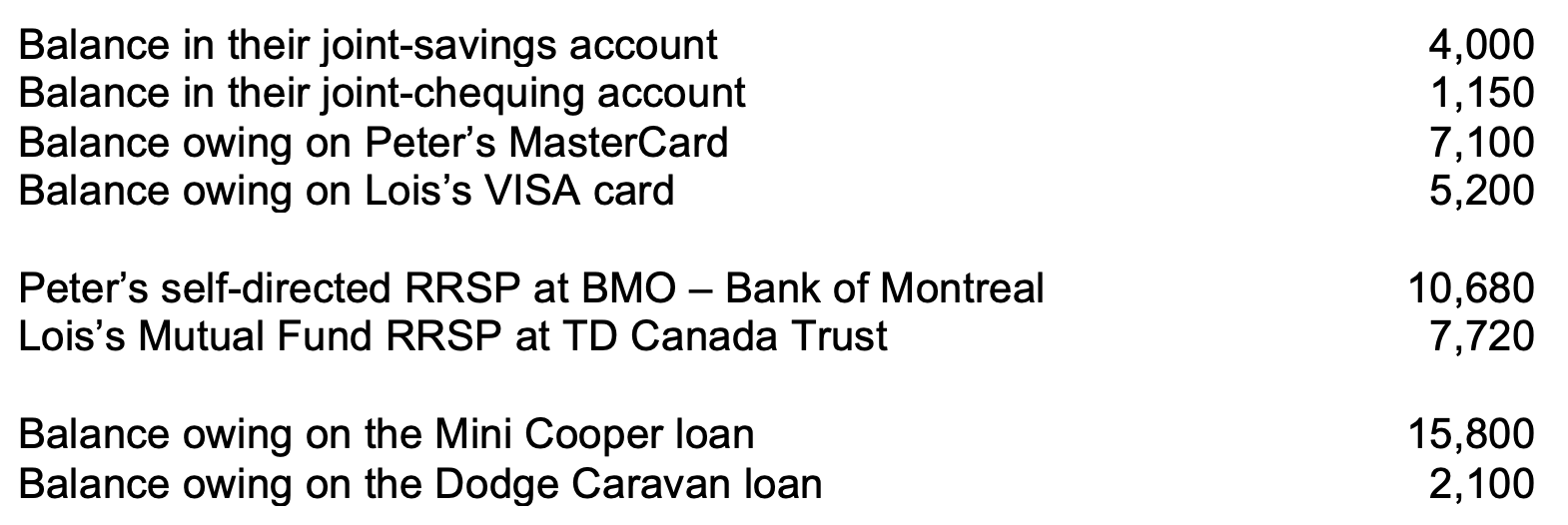

Their home was purchased seven years ago for $400,000 and is currently worth $910,000. Lois and Peter have a mortgage on their home in the amount of $240,000 which has a five-year fixed term with an interest rate of 5.5%, a 20 year amortization, and costs them $1,650 per month in payments. Property taxes are $ 5,700 a year, and last year they spent $ 7,050 on utilities and house maintenance expenses. The couple recently had their home insurance adjusted to raise the amount of replacement-cost coverage of their home contents (furniture, appliances, clothing, etc.) from $100,000 to $125,000. They know, of course, that if they did a personal balance sheet, the current value figure they would use for the contents would be far below what the insurance company would compensate them for in the event of a catastrophe, such as their house burning down. Being conservative, they think that they would estimate the garage sale value of the contents of their home at about $ 50,000 if they did a personal financial statement.

Their vehicles include a 1-year old Mini Cooper-S that cost $35,000 to buy new. It has a current market value of $26,000 and the loan that Lois took out will be paid off four years from now. They also have a four-year old Dodge Grand Caravan, bought new for $31,000 with a market value today of $11,000 and a loan that will be paid off one year from now.

Before their children were born, Lois and Peter were each putting about $2,500 a year into their separate RRSPs. Both Lois and Peter have not put anything into their RRSPs since their children were born. They plan to start putting money into their RRSPs again, when the boys are in school full-time, which will be in two more years.

Right now, Lois RRSP contains balanced mutual funds that hold mainly stocks and bonds, which she thinks are pretty safe. They seem to grow at a rate of about 3% a year, she thinks. Peters RRSP contains shares of ten small oil and gas exploration companies (all listed on the TSX Venture Exchange), most of which are recent start-ups (new companies) and have market values of between $1.50 and $2.25 a share. None of the companies that he owns shares in have paid any dividends, but Peter estimates the total value of the shares he owns has gone up about 10% in the last year.

Lois and Peter plan to work until they are 65 years old, then they would like to retire. If she continues to work with the Calgary Board of Education until retirement, Loiss pension will be paying her about $51,000 a year (gross- before tax). She plans to start receiving her Canada Pension Plan (CPP) and her Old Age Security (OAS) payments from the federal government when she reaches age 65. She has no idea of what her RRSP will be worth by the time she retires but, when she set it up 5 years ago; she hoped that it would be worth at least $300,000 by age 65.

If Peter stays with The City until he retires, his employer pension income is estimated to pay him about $38,000 a year (gross-before tax). Other retirement income will consist of whatever income he can generate from his RRSP and from his CPP and OAS payments, which he plans to begin receiving when he turns 65. Peter is starting to get concerned about how much money he will actually be able to build into his RRSP by the time he reaches age 65 but, like his wife, originally thought he could have about $300,000 in his RRSP by the time he hits age 65.

When they do retire, Lois and Peter would like to spend at least 3 months each winter in either Arizona or Mexico. With this being part of their plan, they believe they will need to have a joint (combined) gross-annual income, at retirement, of at least $125,000 per year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started