Answered step by step

Verified Expert Solution

Question

1 Approved Answer

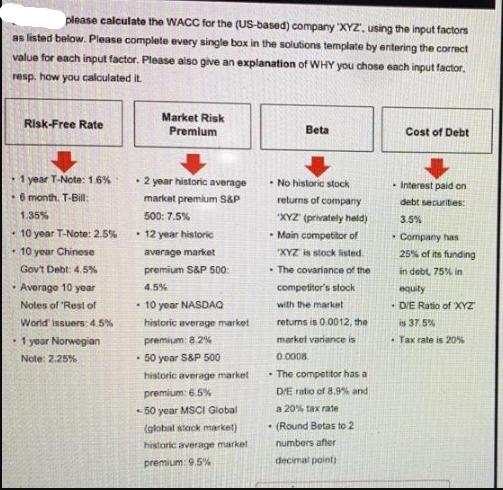

please calculate the WACC for the (US-based) company 'XYZ, using the input factors as listed below. Please complete every single box in the solutions

please calculate the WACC for the (US-based) company 'XYZ", using the input factors as listed below. Please complete every single box in the solutions template by entering the correct value for each input factor. Please also give an explanation of WHY you chose each input factor. resp. how you calculated it. Risk-Free Rate 1 year T-Note: 1.6% 6 month. T-Bill: 1.35% 10 year T-Note: 2.5% . 10 year Chinese Gov't Debt: 4.5% Averago 10 year Notes of 'Rest of World issuers: 4.5% - 1 year Norwegian Note: 2.25% Market Risk Premium - 2 year historic average market premium S&P 500: 7.5% 12 year historic average market premium S&P 500: 4.5% 10 year NASDAQ historic average market premium: 8.2% 50 year S&P 500 historic average market premium: 6.5% 50 year MSCI Global (global stack market) historic average market premium: 9.5% Beta No historic stock returns of company XYZ (privately held) - Main competitor of XYZ is stock listed. The covariance of the competitor's stock with the market returns is 0.0012, the market variance is 0.0008 The competitor has a D/E ratio of 8.9% and a 20% tax rate (Round Betas to 2 numbers after decimal point) Cost of Debt Interest paid on debt securities: 3.5% Company has 25% of its funding in debt 75% in equity - DIE Ratio of XYZ is 37.5% Tax rate is 20%

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Weighted Average Cost of Capital WACC for company XYZ we need to consider the cost of both debt and equity weighted by their respecti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started