Answered step by step

Verified Expert Solution

Question

1 Approved Answer

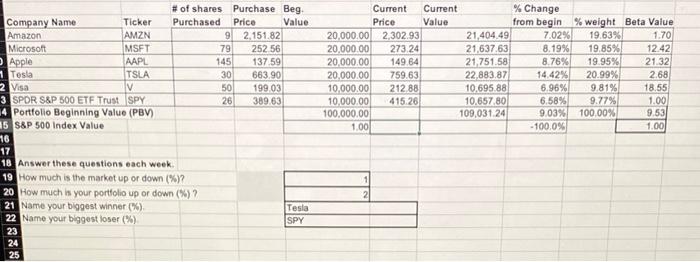

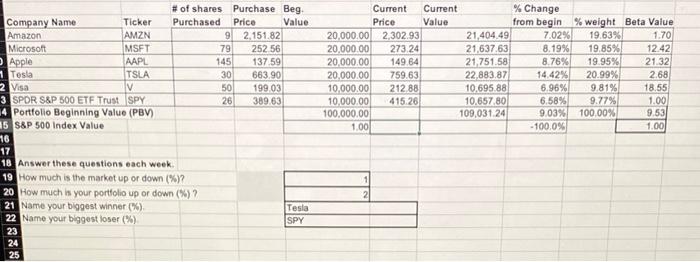

please check if Beta value is correct S&p 500 index value and need to answer those 4 questions 1 2 3 4 Thank you very

please check if Beta value is correct

# of shares Purchased Company Name Amazon Microsoft Apple Ticker AMZN MSFT AAPL 1 Tesla TSLA V 2 Visa 3 SPDR S&P 500 ETF Trust SPY 4 Portfolio Beginning Value (PBV) #5 S&P 500 Index Value 16 17 18 Answer these questions each week. 19 How much is the market up or down (%)? 20 How much is your portfolio up or down (%) ? 21 Name your biggest winner (%). 22 Name your biggest loser (%) 23 24 25 Purchase Beg. Price Value 9 2,151.82 79 145 252.56 137.59 663.90 199.03 389.63 30 50 26 Tesla SPY Current Current Price Value 20,000.00 2,302.93 20,000.00 273.24 20,000.00 149.64 20,000.00 759.63 10,000.00 212.88 10,000.00 415.26 100,000.00 1.00 1 2 21,404.49 21,637.63 21,751.58 22,883.87 10.695.88 10.657.80 109,031.24 % Change from begin % weight Beta Value 7.02% 19.63% 1.70 8.19% 19.85% 12.42 8.76% 19.95% 21.32 14.42% 20.99% 2.68 6.96% 9.81% 18.55 6.58% 9.77% 1.00 9.03% 100.00% -100.0% 9.53 1.00 # of shares Purchased Company Name Amazon Microsoft Apple Ticker AMZN MSFT AAPL 1 Tesla TSLA V 2 Visa 3 SPDR S&P 500 ETF Trust SPY 4 Portfolio Beginning Value (PBV) #5 S&P 500 Index Value 16 17 18 Answer these questions each week. 19 How much is the market up or down (%)? 20 How much is your portfolio up or down (%) ? 21 Name your biggest winner (%). 22 Name your biggest loser (%) 23 24 25 Purchase Beg. Price Value 9 2,151.82 79 145 252.56 137.59 663.90 199.03 389.63 30 50 26 Tesla SPY Current Current Price Value 20,000.00 2,302.93 20,000.00 273.24 20,000.00 149.64 20,000.00 759.63 10,000.00 212.88 10,000.00 415.26 100,000.00 1.00 1 2 21,404.49 21,637.63 21,751.58 22,883.87 10.695.88 10.657.80 109,031.24 % Change from begin % weight Beta Value 7.02% 19.63% 1.70 8.19% 19.85% 12.42 8.76% 19.95% 21.32 14.42% 20.99% 2.68 6.96% 9.81% 18.55 6.58% 9.77% 1.00 9.03% 100.00% -100.0% 9.53 1.00 S&p 500 index value

and need to answer those 4 questions

1

2

3

4

Thank you very much

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started