Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please complete the 2021 federal income tax return for the Garcia family. Be sure to include only required tax forms when completing the tax return.

Please complete the 2021 federal income tax return for the Garcia family. Be sure to include only required tax forms when completing the tax return. Ignore the requirement to attach the form(s) W2 to the front page of the Form 1040. If required information is missing, use reasonable assumptions to fill in the gaps.

PLS HELP ME TO SLOVE THIS PROBLEM. THANK YOU SO MUCH!!!

PLS HELP ME TO SLOVE THIS PROBLEM. THANK YOU SO MUCH!!!

If possible, please show why you got those numbers!!!

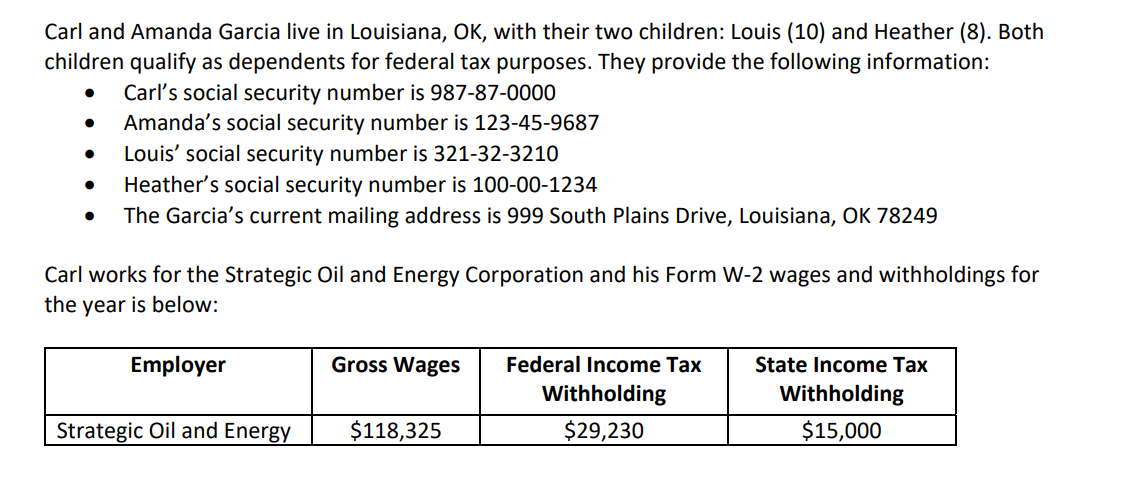

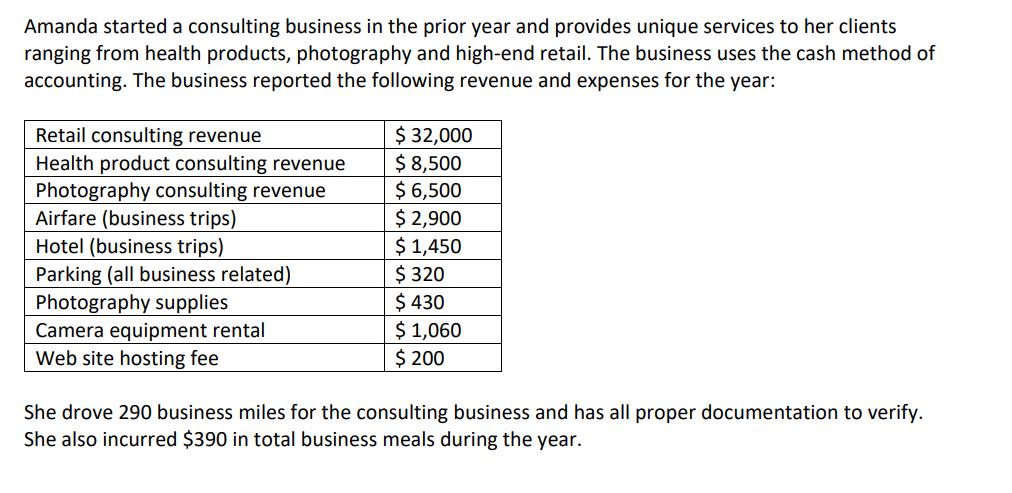

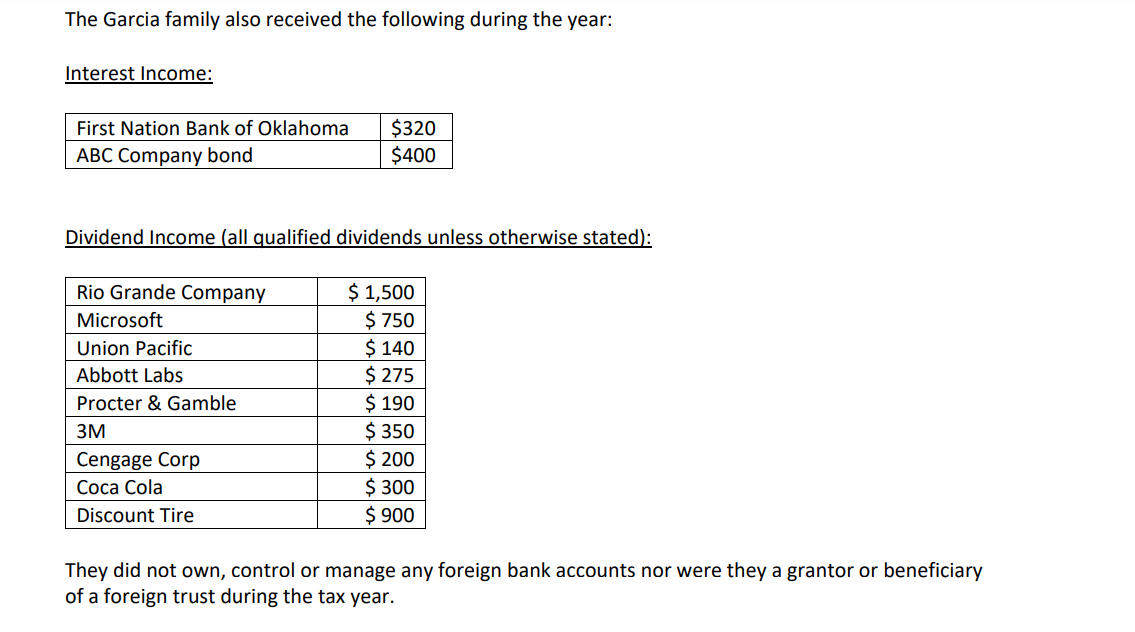

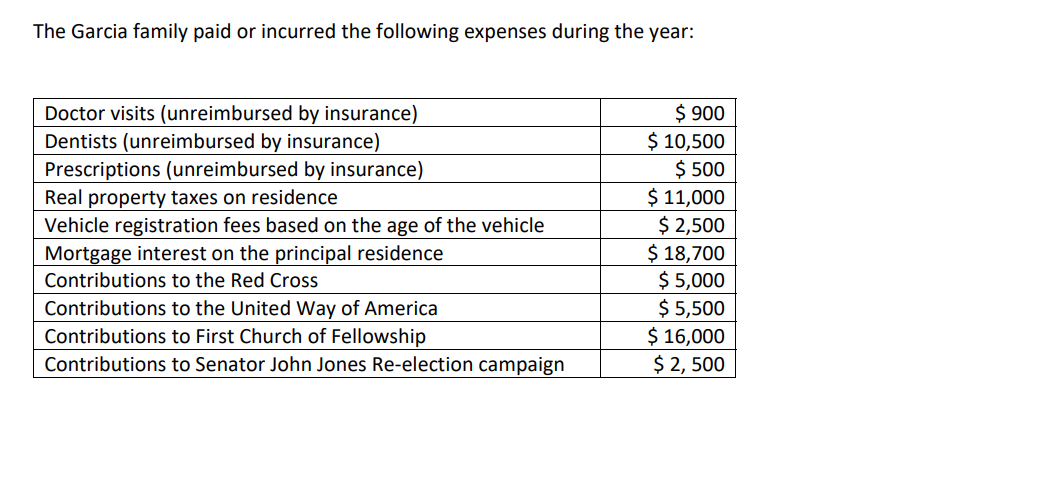

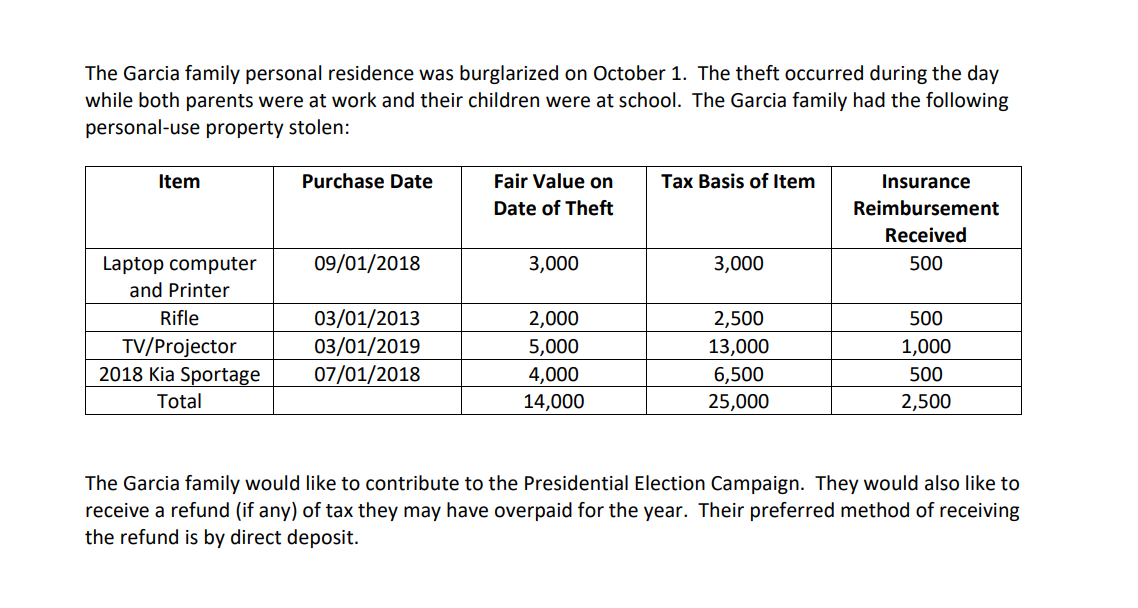

Carl and Amanda Garcia live in Louisiana, OK, with their two children: Louis (10) and Heather (8). Both children qualify as dependents for federal tax purposes. They provide the following information: - Carl's social security number is 987-87-0000 - Amanda's social security number is 123-45-9687 - Louis' social security number is 321-32-3210 - Heather's social security number is 100-00-1234 - The Garcia's current mailing address is 999 South Plains Drive, Louisiana, OK 78249 Carl works for the Strategic Oil and Energy Corporation and his Form W-2 wages and withholdings for the year is below: Amanda started a consulting business in the prior year and provides unique services to her clients ranging from health products, photography and high-end retail. The business uses the cash method of accounting. The business reported the following revenue and expenses for the year: She drove 290 business miles for the consulting business and has all proper documentation to verify. She also incurred $390 in total business meals during the year. The Garcia family also received the following during the year: Interest Income: Dividend Income (all qualified dividends unless otherwise stated): They did not own, control or manage any foreign bank accounts nor were they a grantor or beneficiary of a foreign trust during the tax year. The Garcia family paid or incurred the following expenses during the year: The Garcia family personal residence was burglarized on October 1 . The theft occurred during the day while both parents were at work and their children were at school. The Garcia family had the following personal-use property stolen: The Garcia family would like to contribute to the Presidential Election Campaign. They would also like to receive a refund (if any) of tax they may have overpaid for the year. Their preferred method of receiving the refund is by direct deposit. Carl and Amanda Garcia live in Louisiana, OK, with their two children: Louis (10) and Heather (8). Both children qualify as dependents for federal tax purposes. They provide the following information: - Carl's social security number is 987-87-0000 - Amanda's social security number is 123-45-9687 - Louis' social security number is 321-32-3210 - Heather's social security number is 100-00-1234 - The Garcia's current mailing address is 999 South Plains Drive, Louisiana, OK 78249 Carl works for the Strategic Oil and Energy Corporation and his Form W-2 wages and withholdings for the year is below: Amanda started a consulting business in the prior year and provides unique services to her clients ranging from health products, photography and high-end retail. The business uses the cash method of accounting. The business reported the following revenue and expenses for the year: She drove 290 business miles for the consulting business and has all proper documentation to verify. She also incurred $390 in total business meals during the year. The Garcia family also received the following during the year: Interest Income: Dividend Income (all qualified dividends unless otherwise stated): They did not own, control or manage any foreign bank accounts nor were they a grantor or beneficiary of a foreign trust during the tax year. The Garcia family paid or incurred the following expenses during the year: The Garcia family personal residence was burglarized on October 1 . The theft occurred during the day while both parents were at work and their children were at school. The Garcia family had the following personal-use property stolen: The Garcia family would like to contribute to the Presidential Election Campaign. They would also like to receive a refund (if any) of tax they may have overpaid for the year. Their preferred method of receiving the refund is by direct depositStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started