Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please complete the missing information below and identify any excess or external funds needed. (Growth rate should be rounded to 2 decimal places and all

Please complete the missing information below and identify any excess or external funds needed. (Growth rate should be rounded to 2 decimal places and all other answers to the nearest dollar)

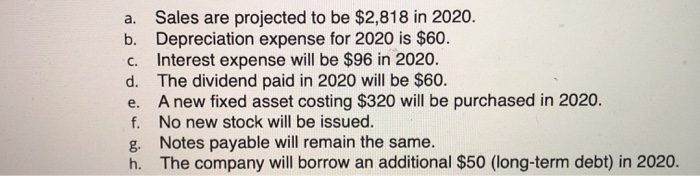

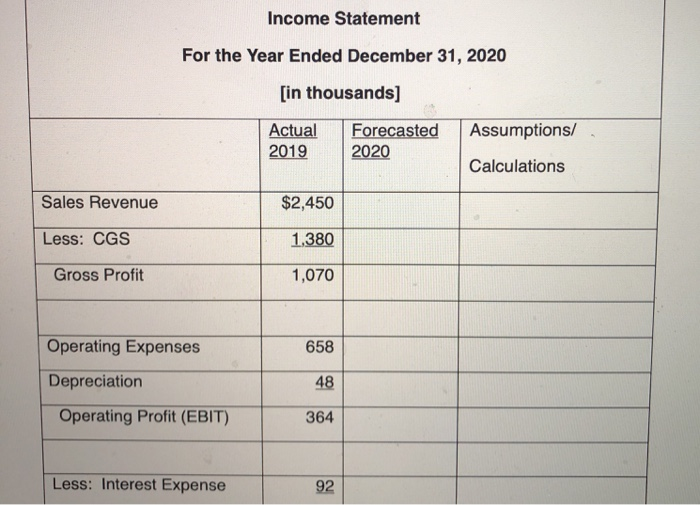

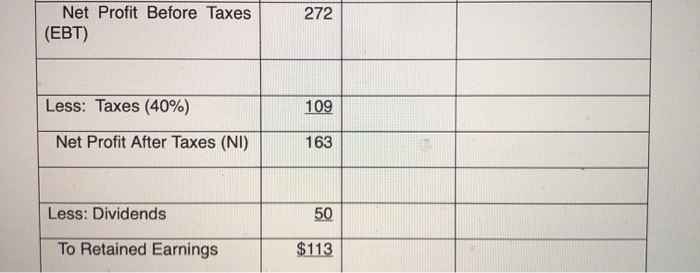

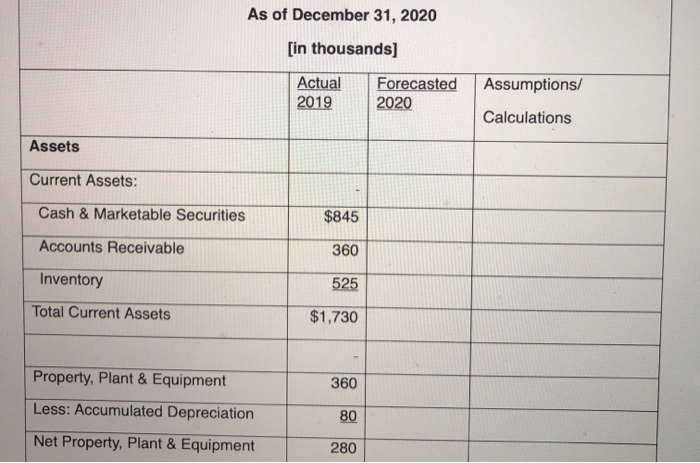

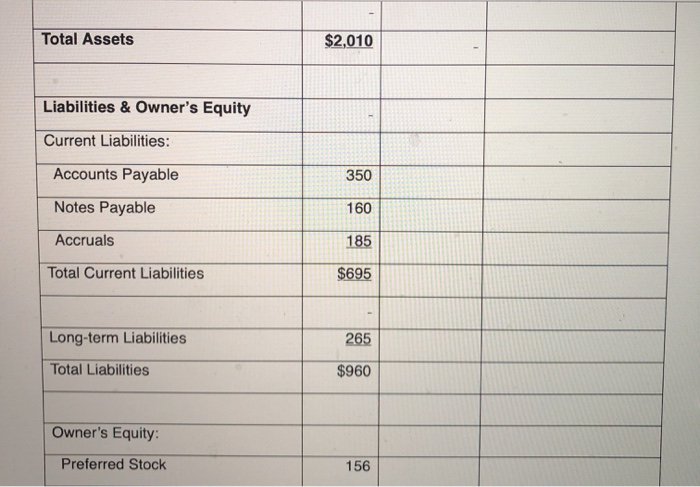

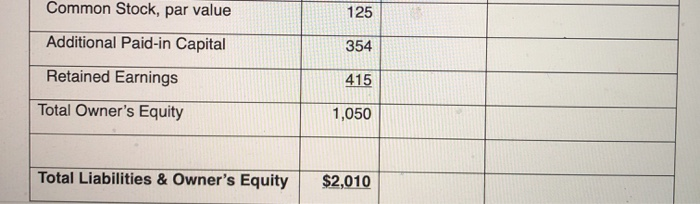

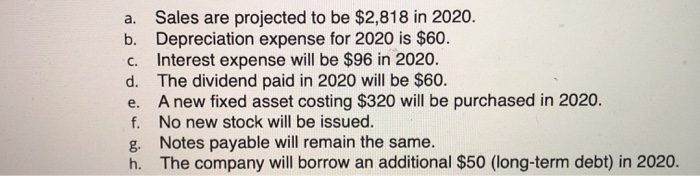

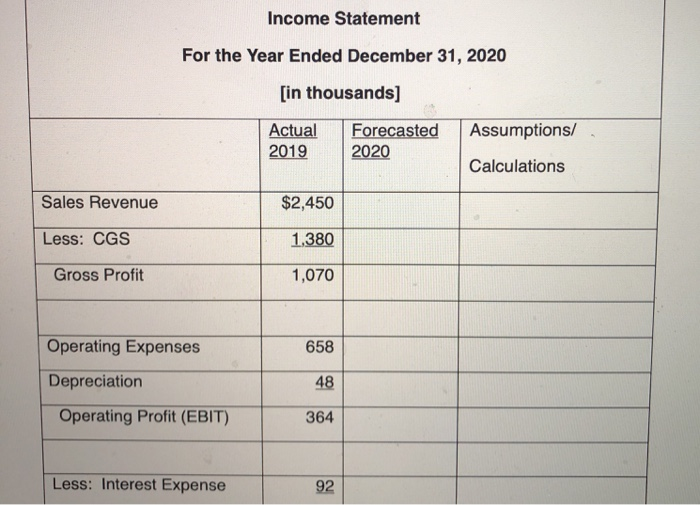

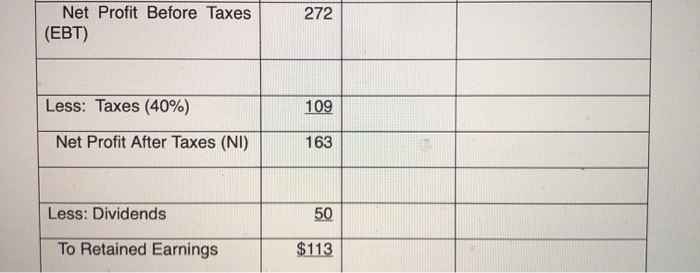

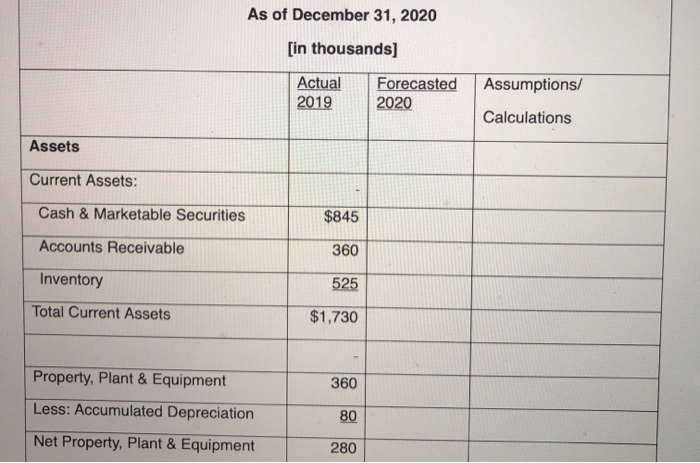

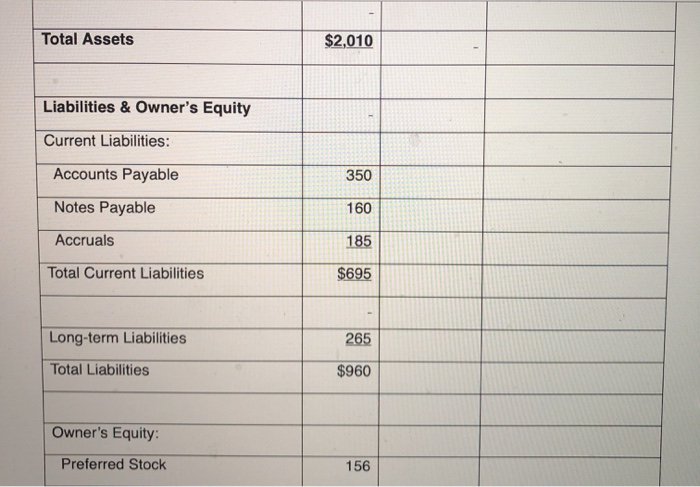

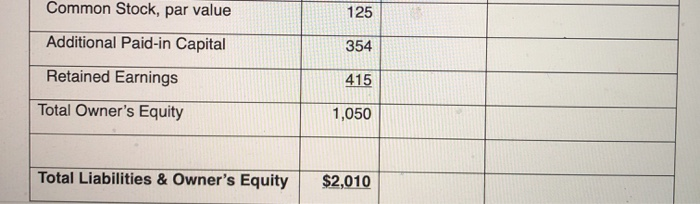

a. C. Sales are projected to be $2,818 in 2020. b. Depreciation expense for 2020 is $60. Interest expense will be $96 in 2020. d. The dividend paid in 2020 will be $60. A new fixed asset costing $320 will be purchased in 2020. f. No new stock will be issued. g. Notes payable will remain the same. h. The company will borrow an additional $50 (long-term debt) in 2020. e. Income Statement For the Year Ended December 31, 2020 [in thousands] Actual 2019 Forecasted 2020 Assumptions/ Calculations Sales Revenue $2,450 Less: CGS 1.380 Gross Profit 1,070 Operating Expenses 658 Depreciation 48 Operating Profit (EBIT) 364 Less: Interest Expense 92 272 Net Profit Before Taxes (EBT) Less: Taxes (40%) 109 Net Profit After Taxes (NI) 163 Less: Dividends 50 To Retained Earnings $113 As of December 31, 2020 [in thousands] Actual 2019 Forecasted 2020 Assumptions/ Calculations Assets Current Assets: Cash & Marketable Securities $845 Accounts Receivable 360 Inventory 525 Total Current Assets $1,730 360 Property, Plant & Equipment Less: Accumulated Depreciation Net Property, Plant & Equipment 80 280 Total Assets $2,010 Liabilities & Owner's Equity Current Liabilities: Accounts Payable 350 Notes Payable 160 Accruals 185 Total Current Liabilities $695 Long-term Liabilities 265 Total Liabilities $960 Owner's Equity Preferred Stock 156 Common Stock, par value 125 Additional Paid-in Capital 354 Retained Earnings 415 Total Owner's Equity 1,050 Total Liabilities & Owner's Equity $2,010

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started