please complete the problem

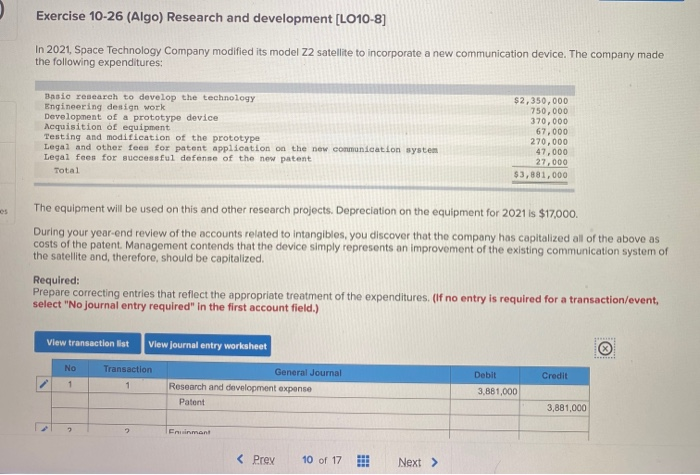

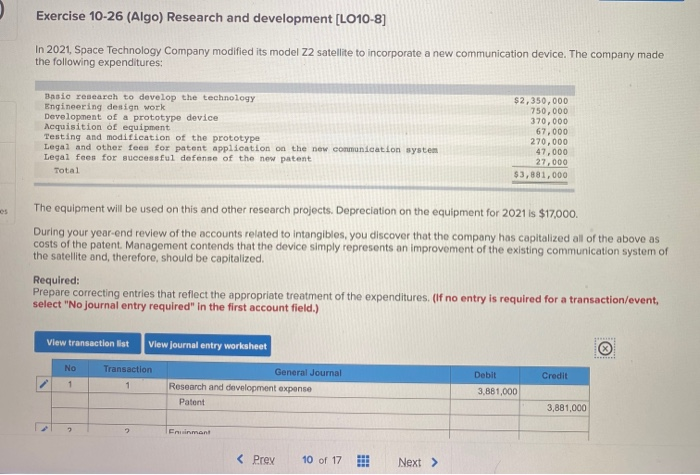

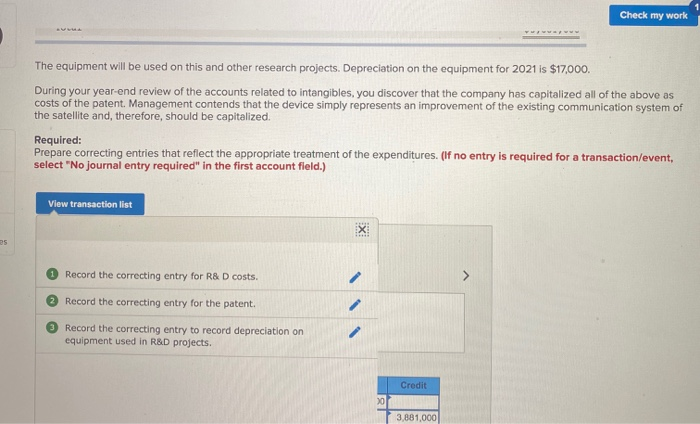

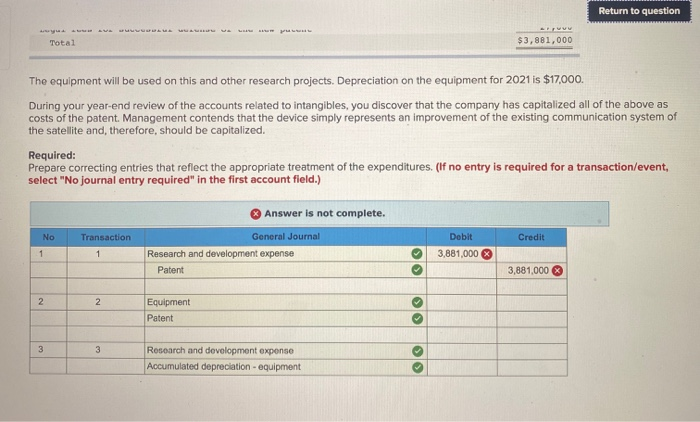

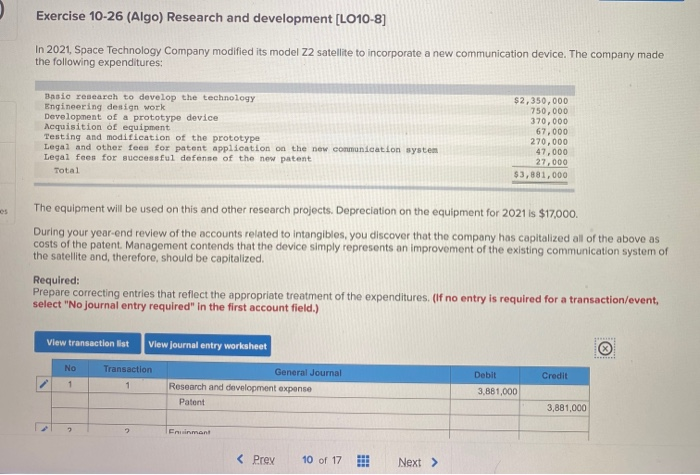

Exercise 10-26 (Algo) Research and development (L010-8] In 2021, Space Technology Company modified its model Z2 satellite to incorporate a new communication device. The company made the following expenditures: Basic research to develop the technology Engineering desien work Development of a prototype device Acquisition of equipment Testing and modification of the prototype Legal and other fees for patent application on the new communication system Legal fees for successful defense of the new patent Total $2,350,000 750,000 370,000 67.000 270.000 47.000 27,000 $3,881,000 The equipment will be used on this and other research projects. Depreciation on the equipment for 2021 is $17,000 During your year-end review of the accounts related to intangibles, you discover that the company has capitalized all of the above as costs of the patent Management contends that the device simply represents an improvement of the existing communication system of the satellite and, therefore, should be capitalized. Required: Prepare correcting entries that reflect the appropriate treatment of the expenditures. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet No Transaction Credit General Journal Research and development expense Patent Debit 3,881,000 3,881,000 Emant Check my work The equipment will be used on this and other research projects. Depreciation on the equipment for 2021 is $17,000. During your year-end review of the accounts related to intangibles, you discover that the company has capitalized all of the above as costs of the patent Management contends that the device simply represents an improvement of the existing communication system of the satellite and, therefore, should be capitalized. Required: Prepare correcting entries that reflect the appropriate treatment of the expenditures. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Record the correcting entry for R&D costs. Record the correcting entry for the patent. Record the correcting entry to record depreciation on equipment used in R&D projects. Credit 3,881,000 Return to question Total $3,881,000 The equipment will be used on this and other research projects. Depreciation on the equipment for 2021 is $17,000. During your year-end review of the accounts related to intangibles, you discover that the company has capitalized all of the above as costs of the patent Management contends that the device simply represents an improvement of the existing communication system of the satellite and, therefore, should be capitalized. Required: Prepare correcting entries that reflect the appropriate treatment of the expenditures. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is not complete. No Transaction Credit General Journal Research and development expense Patent Debit 3,881,000 3,881,000 Equipment Patent Research and development expense Accumulated depreciation - equipment