Answered step by step

Verified Expert Solution

Question

1 Approved Answer

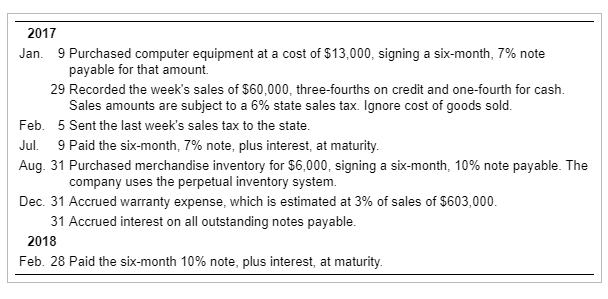

Please complete the whole transaction 2017 Jan. 9 Purchased computer equipment at a cost of $13,000, signing a six-month, 7% note payable for that amount

Please complete the whole transaction

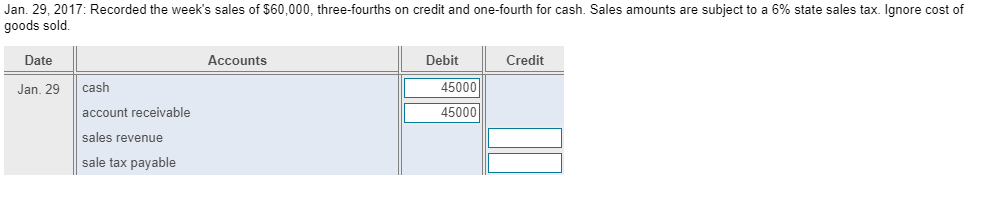

2017 Jan. 9 Purchased computer equipment at a cost of $13,000, signing a six-month, 7% note payable for that amount 29 Recorded the week's sales of $60,000, three-fourths on credit and one-fourth for cash. Sales amounts are subject to a 6% state sales tax. Ignore cost of goods sold. Feb. 5 Sent the last week's sales tax to the state. Jul 9 Paid the six-month, 7% note, plus interest at maturity Aug. 31 Purchased merchandise inventory for $6,000, signing a six-month, 10% note payable. The company uses the perpetual inventory system Dec. 31 Accrued warranty expense, which is estimated at 3% of sales of $603,000 31 Accrued interest on all outstanding notes payable 2018 Feb. 28 Paid the six-month 10% note, plus interest, at maturity Jan. 29, 2017: Recorded the week's sales of $60,000, three-fourths on credit and one-fourth for cash. Sales amounts are subject to a 6% state sales tax. Ignore cost of goods sold. Date Accounts Debit Credit Jan. 29 cash 45000 45000 account receivable sales revenue sale tax payable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started