Question: please do all and i will give a like for sure Use this information to answer questions 28-30. Suppose BearKat Enterprises management team decides to

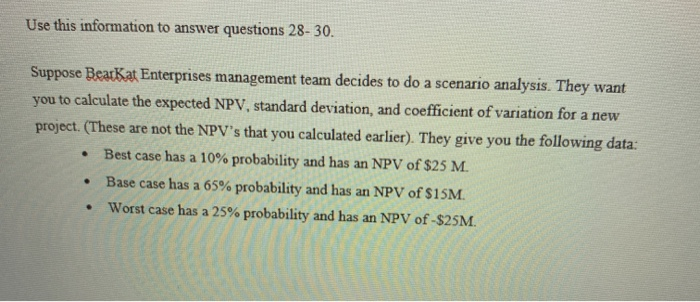

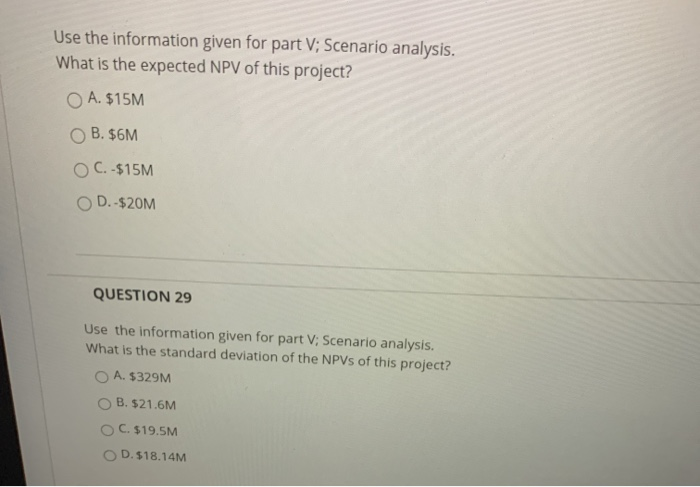

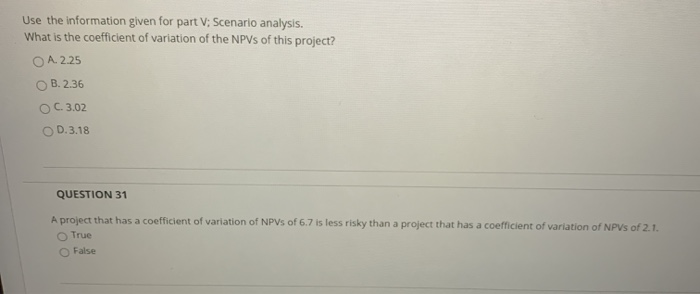

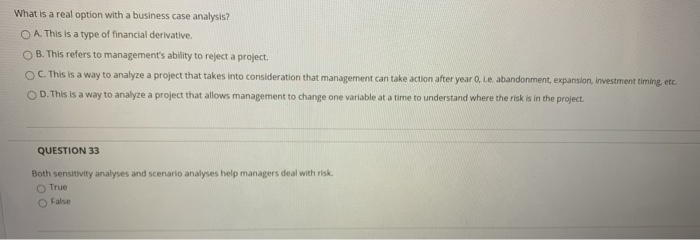

Use this information to answer questions 28-30. Suppose BearKat Enterprises management team decides to do a scenario analysis. They want you to calculate the expected NPV, standard deviation, and coefficient of variation for a new project. These are not the NPV's that you calculated earlier). They give you the following data: Best case has a 10% probability and has an NPV of $25 M. Base case has a 65% probability and has an NPV of $15M. Worst case has a 25% probability and has an NPV of -$25M. Use the information given for part V; Scenario analysis. What is the expected NPV of this project? A. $15M B. $6M O C. -$15M OD. -$20M QUESTION 29 Use the information given for part V; Scenario analysis. What is the standard deviation of the NPVs of this project? A. $329M B. $21.6M C. $19.5M OD. $18.14M Use the information given for part V; Scenario analysis. What is the coefficient of variation of the NPVs of this project? OA. 2.25 B.2.36 OC. 3.02 OD.3.18 QUESTION 31 A project that has a coefficient of variation of NPVs of 6.7 is less risky than a project that has a coefficient of variation of NPVs of 2.1. True False What is a real option with a business case analysis? O A. This is a type of financial derivative. OB. This refers to management's ability to reject a project. C. This is a way to analyze a project that takes into consideration that management can take action after year, Le abandonment, expansion, Investment timing etc. OD. This is a way to analyze a project that allows management to change one variable at a time to understand where the risk is in the project. QUESTION 33 Both sensitivity analyses and scenario analyses help managers deal with risk. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts