Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do both part B and C in 55 minutes please urgently... I'll give you up thumb definitely 1. Consider the following unified monetary model

please do both part B and C in 55 minutes please urgently... I'll give you up thumb definitely

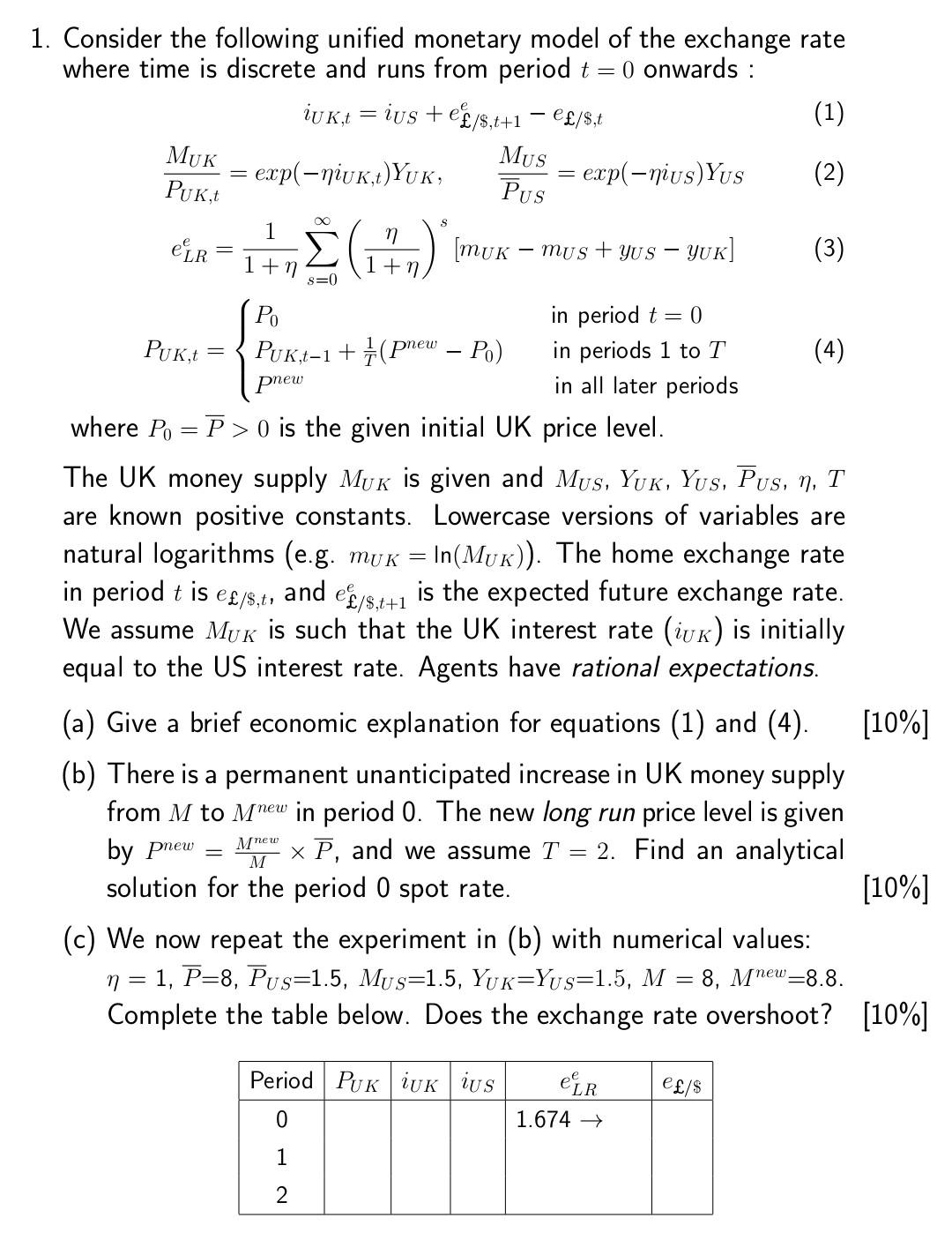

1. Consider the following unified monetary model of the exchange rate where time is discrete and runs from period t = 0 onwards : iuk,tius + e/s,t+1- /s, t = (1) MUK MUS exp(-niuk,t)YUK, exp(-nius) Yus (2) PUK,t PUS S 1 eLR (177) * [Mux - mus + YUS - YUK] (3) 1+ 1+n s=0 Po in period t = 0 PUK,t { PORI- PUK,t-1+ (Pnew - Po) (4) in periods 1 to T in all later periods pnew where P = P >0 is the given initial UK price level. The UK money supply MUK is given and Mus, YUK, Yus, Pus, n, T are known positive constants. Lowercase versions of variables are natural logarithms (e.g. muk = ln(MUK)). The home exchange rate in period t is e/$,t, and e/8,t+1 is the expected future exchange rate. We assume Muk is such that the UK interest rate (iuk) is initially equal to the US interest rate. Agents have rational expectations. (a) Give a brief economic explanation for equations (1) and (4). (b) There is a permanent unanticipated increase in UK money supply from M to Mnew in period 0. The new long run price level is given by pnew x P, and we assume T = 2. Find an analytical solution for the period 0 spot rate. [10%] Mnew = M [10%] (c) We now repeat the experiment in (b) with numerical values: | = 1, P=8, Pus-1.5, Mus=1.5, YUK-YUS-1.5, M 8, Mnew-8.8. Complete the table below. Does the exchange rate overshoot? [10%] Period PUK UK US ELR e/$ 0 1.674 1 2 =Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started