PLEASE DO IN EXCEL AND SHOW SOLUTIONS I WILL RATE. Instructions are posted on the top right thank you!

PLEASE DO IN EXCEL AND SHOW SOLUTIONS I WILL RATE. Instructions are posted on the top right thank you!

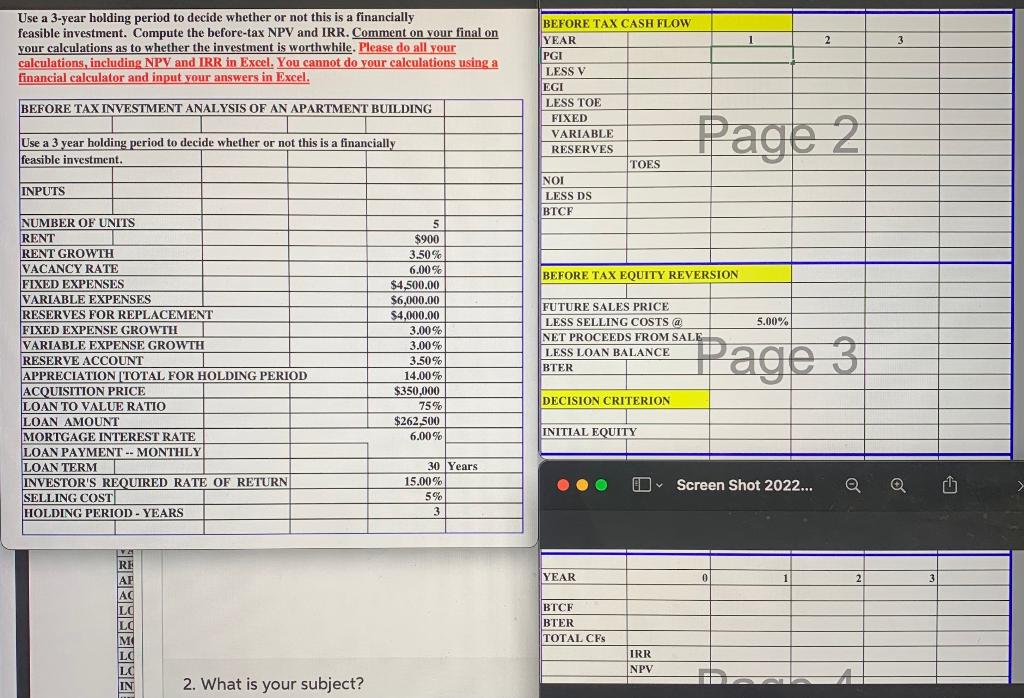

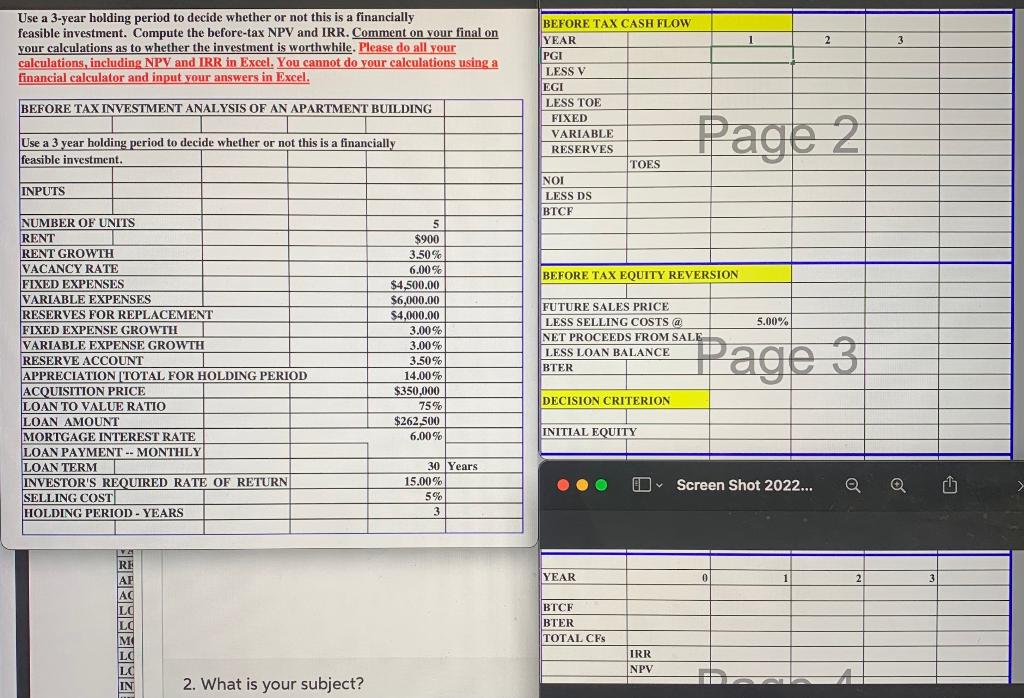

BEFORE TAX CASH FLOW YEAR 2 Use a 3-year holding period to decide whether or not this is a financially feasible investment. Compute the before-tax NPV and IRR. Comment on your final on your calculations as to whether the investment is worthwhile. Please do all your calculations, including NPV and IRR in Excel. You cannot do your calculations using a financial calculator and input your answers in Excel. 3 BEFORE TAX INVESTMENT ANALYSIS OF AN APARTMENT BUILDING PGI LESS V EGI LESS TOE FIXED VARIABLE RESERVES Use a 3 year holding period to decide whether or not this is a financially feasible investment. Page 2 TOES INPUTS NOI LESS DS BTCF BEFORE TAX EQUITY REVERSION 5.00% NUMBER OF UNITS RENT RENT GROWTH VACANCY RATE FIXED EXPENSES VARIABLE EXPENSES RESERVES FOR REPLACEMENT FIXED EXPENSE GROWTH VARIABLE EXPENSE GROWTH RESERVE ACCOUNT APPRECIATION (TOTAL FOR HOLDING PERIOD ACQUISITION PRICE LOAN TO VALUE RATIO LOAN AMOUNT MORTGAGE INTEREST RATE LOAN PAYMENT -- MONTHLY LOAN TERM INVESTOR'S REQUIRED RATE OF RETURN SELLING COST HOLDING PERIOD - YEARS 5 $900 3.50% 6.00% $4,500.00 $6,000.00 $4,000.00 3.00% 3.00% 3.50% 14.00% $350,000 75% $262,500 6.00% FUTURE SALES PRICE LESS SELLING COSTS @ NET PROCEEDS FROM SALE LESS LOAN BALANCE BTER Page 3 3 DECISION CRITERION INITIAL EQUITY 30 Years 15.00% 5% 3 O Screen Shot 2022... YEAR 0 1 2 3 RE AC LG BTCF BTER TOTAL CFS M IRR NPV IN 2. What is your subject? BEFORE TAX CASH FLOW YEAR 2 Use a 3-year holding period to decide whether or not this is a financially feasible investment. Compute the before-tax NPV and IRR. Comment on your final on your calculations as to whether the investment is worthwhile. Please do all your calculations, including NPV and IRR in Excel. You cannot do your calculations using a financial calculator and input your answers in Excel. 3 BEFORE TAX INVESTMENT ANALYSIS OF AN APARTMENT BUILDING PGI LESS V EGI LESS TOE FIXED VARIABLE RESERVES Use a 3 year holding period to decide whether or not this is a financially feasible investment. Page 2 TOES INPUTS NOI LESS DS BTCF BEFORE TAX EQUITY REVERSION 5.00% NUMBER OF UNITS RENT RENT GROWTH VACANCY RATE FIXED EXPENSES VARIABLE EXPENSES RESERVES FOR REPLACEMENT FIXED EXPENSE GROWTH VARIABLE EXPENSE GROWTH RESERVE ACCOUNT APPRECIATION (TOTAL FOR HOLDING PERIOD ACQUISITION PRICE LOAN TO VALUE RATIO LOAN AMOUNT MORTGAGE INTEREST RATE LOAN PAYMENT -- MONTHLY LOAN TERM INVESTOR'S REQUIRED RATE OF RETURN SELLING COST HOLDING PERIOD - YEARS 5 $900 3.50% 6.00% $4,500.00 $6,000.00 $4,000.00 3.00% 3.00% 3.50% 14.00% $350,000 75% $262,500 6.00% FUTURE SALES PRICE LESS SELLING COSTS @ NET PROCEEDS FROM SALE LESS LOAN BALANCE BTER Page 3 3 DECISION CRITERION INITIAL EQUITY 30 Years 15.00% 5% 3 O Screen Shot 2022... YEAR 0 1 2 3 RE AC LG BTCF BTER TOTAL CFS M IRR NPV IN 2. What is your subject

PLEASE DO IN EXCEL AND SHOW SOLUTIONS I WILL RATE. Instructions are posted on the top right thank you!

PLEASE DO IN EXCEL AND SHOW SOLUTIONS I WILL RATE. Instructions are posted on the top right thank you!