Please do not use excel. show formula and full work. Thank you

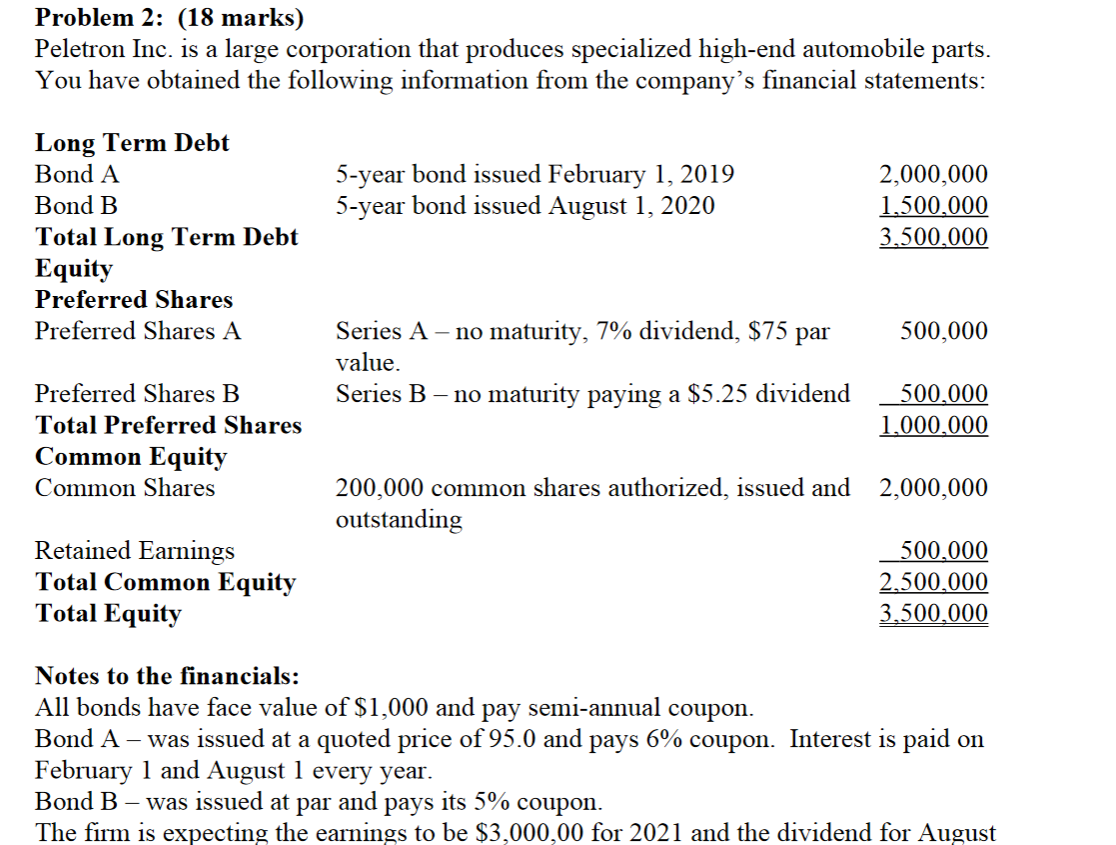

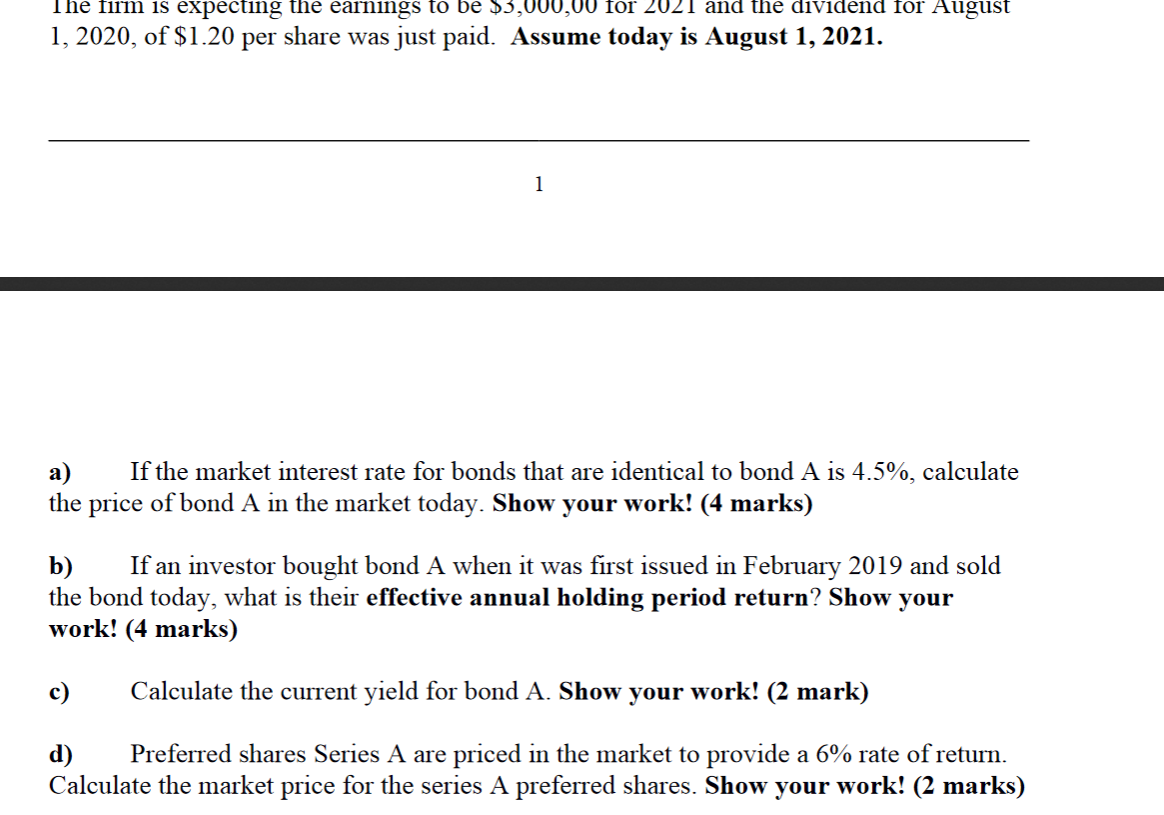

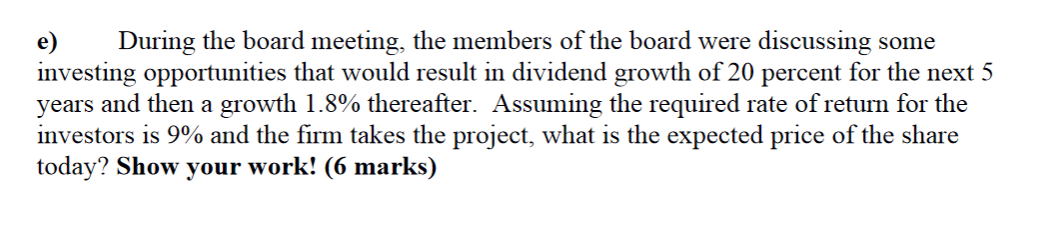

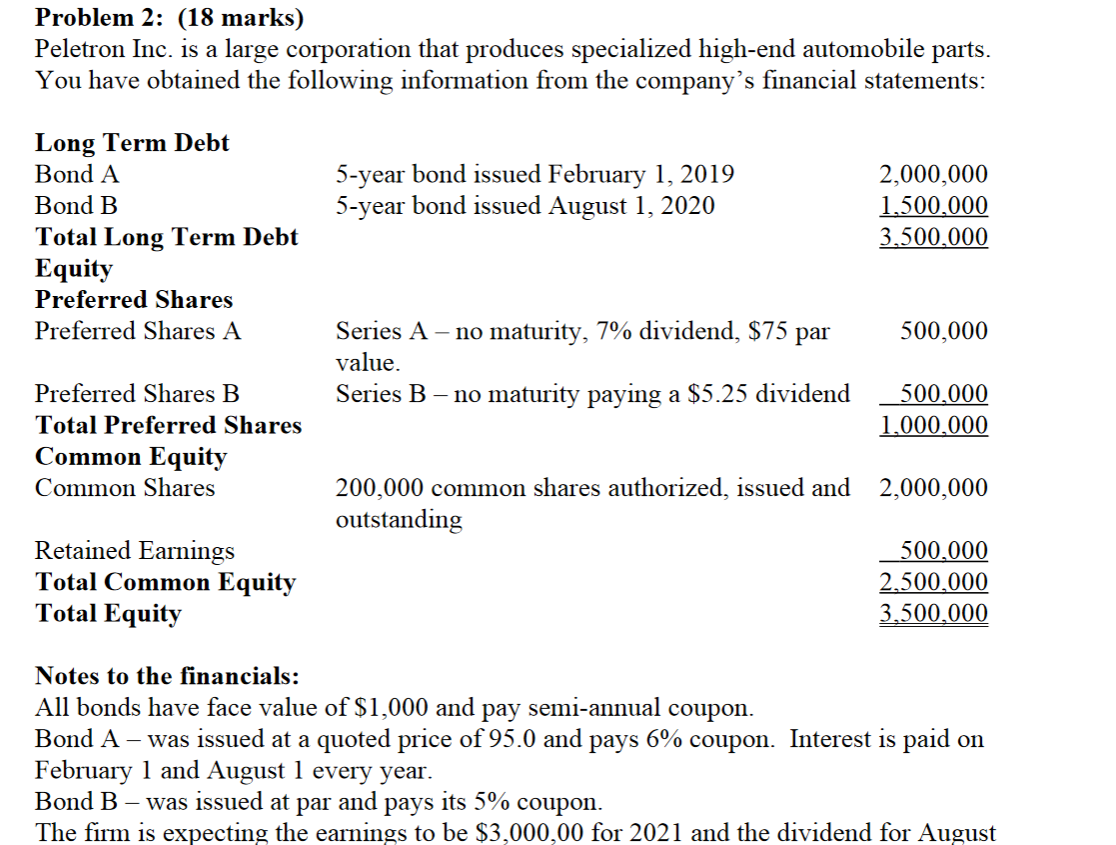

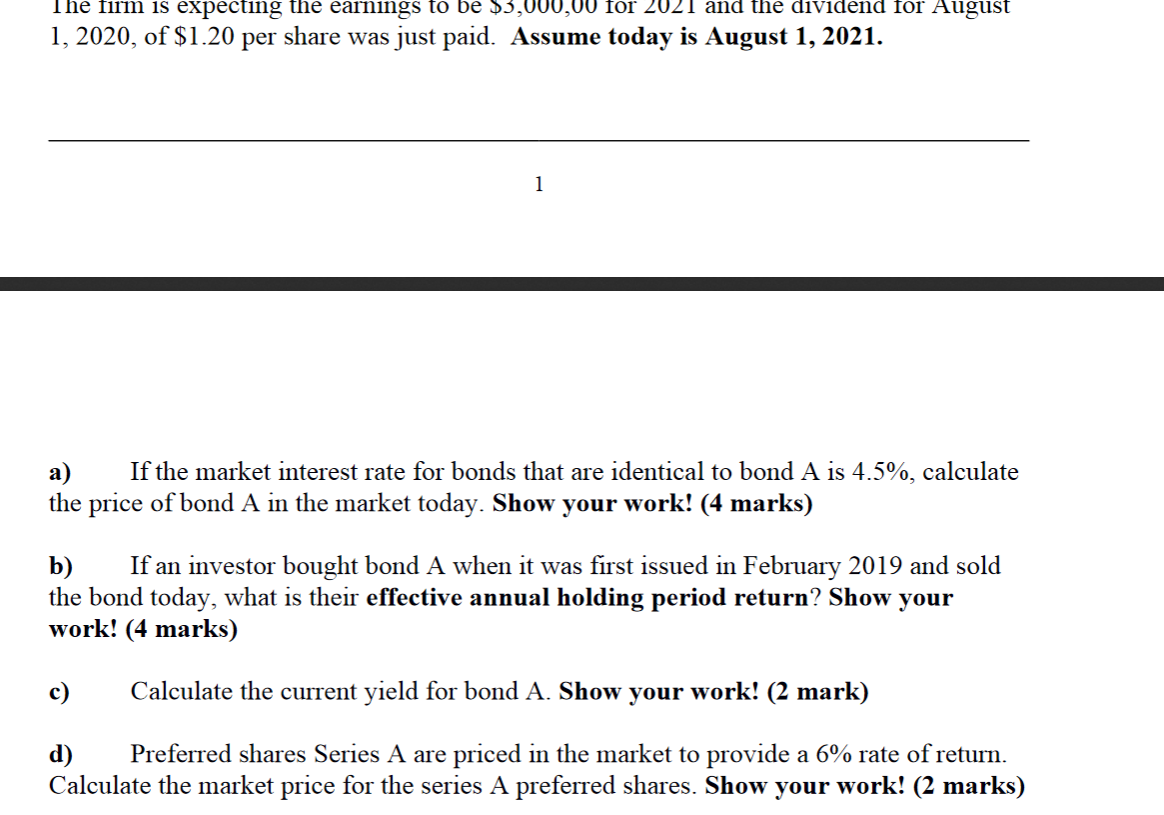

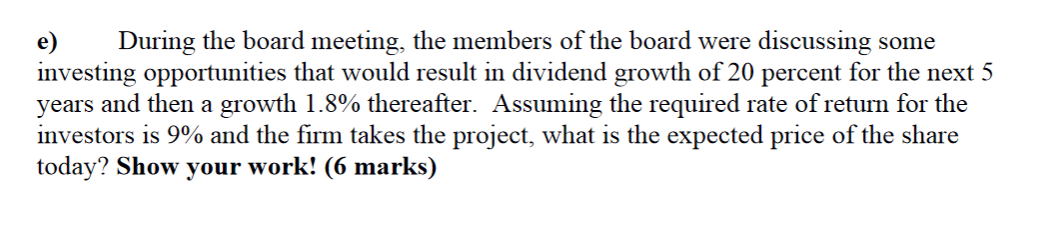

Problem 2: (18 marks) Peletron Inc. is a large corporation that produces specialized high-end automobile parts. You have obtained the following information from the company's financial statements: 5-year bond issued February 1, 2019 5-year bond issued August 1, 2020 Long Term Debt Bond A Bond B Total Long Term Debt Equity Preferred Shares Preferred Shares A 2,000,000 1,500,000 3,500,000 500,000 Series A - no maturity, 7% dividend, $75 par value. Series B - no maturity paying a $5.25 dividend 500,000 1,000,000 Preferred Shares B Total Preferred Shares Common Equity Common Shares Retained Earnings Total Common Equity Total Equity 200,000 common shares authorized, issued and 2,000,000 outstanding 500,000 2,500,000 3,500,000 Notes to the financials: All bonds have face value of $1,000 and pay semi-annual coupon. Bond A - was issued at a quoted price of 95.0 and pays 6% coupon. Interest is paid on February 1 and August 1 every year. Bond B - was issued at par and pays its 5% coupon. The firm is expecting the earnings to be $3,000,00 for 2021 and the dividend for August The firm is expecting the earnings to be $3,000,00 for 2021 and the dividend for August 1, 2020, of $1.20 per share was just paid. Assume today is August 1, 2021. 1 a) If the market interest rate for bonds that are identical to bond A is 4.5%, calculate the price of bond A in the market today. Show your work! (4 marks) b) If an investor bought bond A when it was first issued in February 2019 and sold the bond today, what is their effective annual holding period return? Show your work! (4 marks) c) Calculate the current yield for bond A. Show your work! (2 mark) d) Preferred shares Series A are priced in the market to provide a 6% rate of return. Calculate the market price for the series A preferred shares. Show your work! (2 marks) e) During the board meeting, the members of the board were discussing some investing opportunities that would result in dividend growth of 20 percent for the next 5 years and then a growth 1.8% thereafter. Assuming the required rate of return for the investors is 9% and the firm takes the project, what is the expected price of the share today? Show your work! (6 marks)