Question

Please Do Steps 5-9 (use excel if needbe, do not handwrite) www.sec.gov www.ralphlauren.com 10k Reports - http://quicktake.morningstar.com/stocknet/secdocuments.aspx?symbol=rl You can rely on the following answers, Please

Please Do Steps 5-9 (use excel if needbe, do not handwrite)

www.sec.gov

www.ralphlauren.com

10k Reports - http://quicktake.morningstar.com/stocknet/secdocuments.aspx?symbol=rl

You can rely on the following answers, Please Answer In A Similar Form.

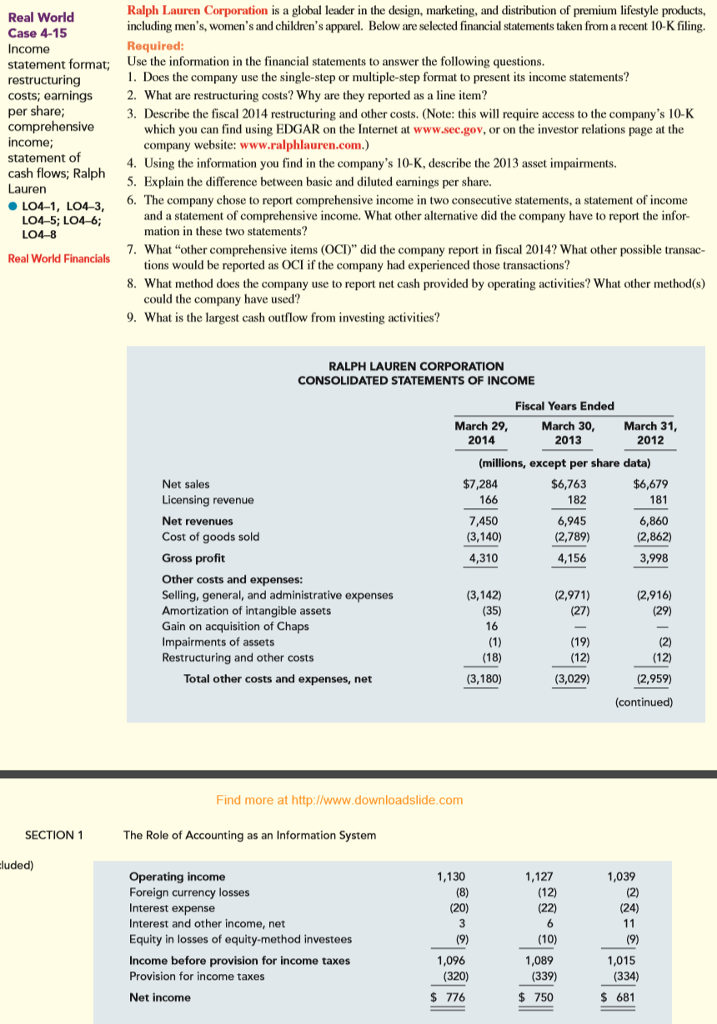

Ans 1 : Company is using Multiple step Income Statements .It is relevant as company is segregating separately, its operating Income and expenses which is not a case under single step income statement. Furthermore only under Multiple Step Income Statements there is separate disclosure for gross profit. So it is relevant that Company is using Multiple step Income Statements.

Ans 2: Restructuring Cost are like onetime expenses which company incurred on discontinuance of any business or manufacturing plant or lay off employees. This type of cost are not recurring in nature and are incurred for betterment of business in Future. As it is separate kind of expenses which not generally happens in business and are also non recurring in nature so disclosed separately. And also under GAAP it is required to disclosed such expenditure separately and foot notes should be provided, so stockholders are aware of such steps taken by company.

Ans 3: Restructing Cost was incurred on account of discontinuance of Rugby brand retail operations. As the business analysis made by company stated that the brand growth is too slow and if its resources are reallocated company can earn more returns.

And also there was a discontinuance of the majority of the products sold under the American Living brand created for and exclusively sold to JCPenney, effective for the fall 2012 wholesale selling season. The discontinuance of these American Living product lines did not have a material impact on their consolidated or segment results.

During the year company incurred 18 million expenses on account of such restructuring.

Ans 4: Asset Impairments occurs when the fair value of asset or the expected benefit derive from the asset reduces below the carrying value of asset. If such situation arises company should impair its asset up to the higher of fair value or value in use and such impairment loss should be recognised as an expenses.

During the year company incurred 1 million losses due to impairment of its asset.

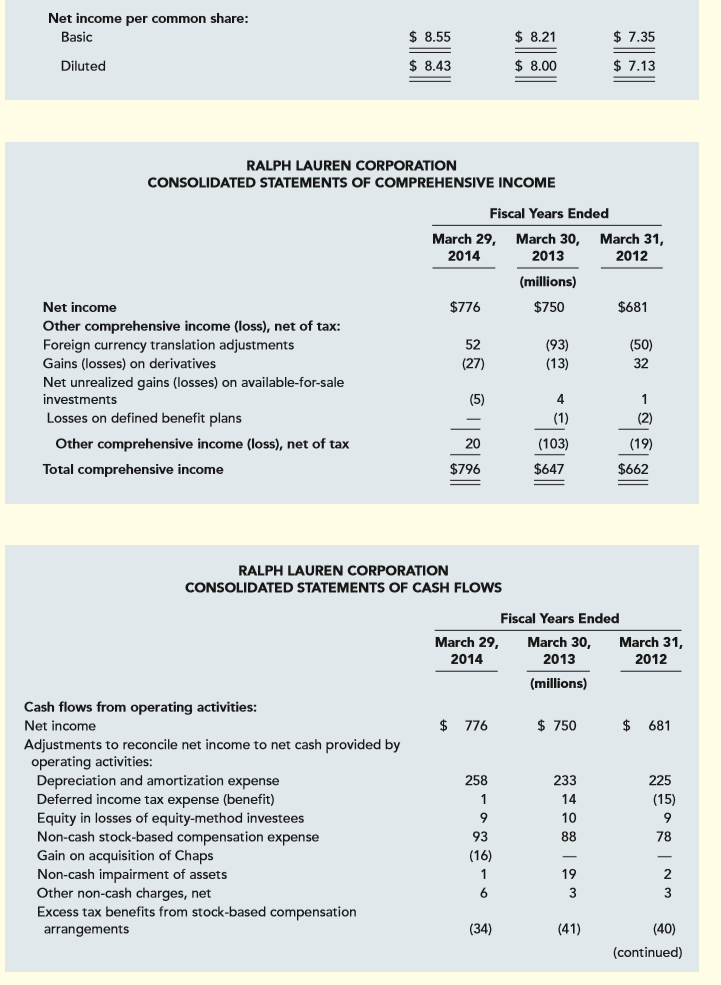

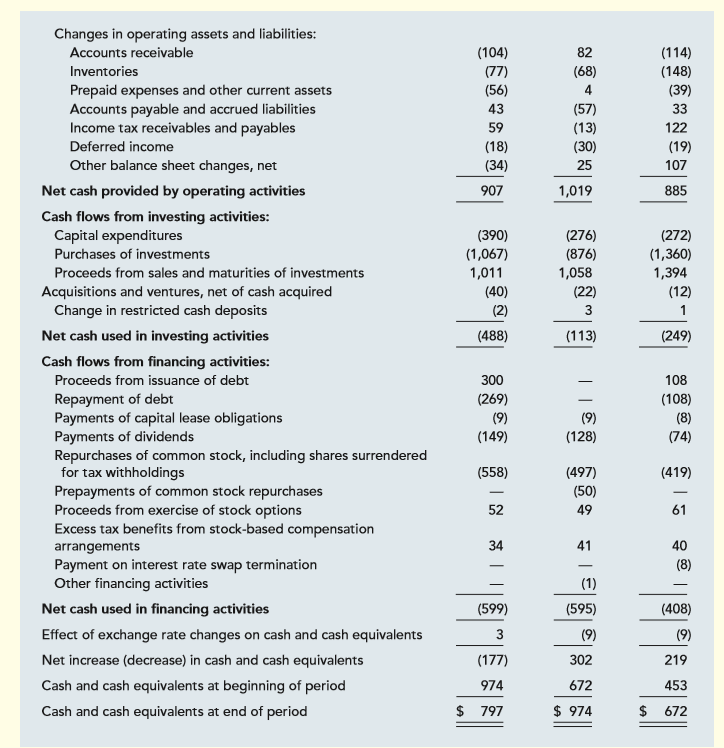

ph Lauren Corporation is a global leader in the design, marketing, and distribution of premium lifestyle products, Real World including men's, women's and children's apparel. Below are selected financial statements taken from arecent 10-K filing. Case 4-15 Required Income statement format Use the information in the financial statements to answer the following questions. l. Does the company use the single-step or multip format to present its income statements? le-step restructuring costs, earnings 2. What are restructuring costs? Why are they reported as a line item? per share 3. Describe the fi 2014 restructuring and other costs. (Note: this w the company's 10-K Sca require access comprehensive which you can find using EDGAR on the Internet at www.sec.gov,or on the investor relations page at the ncome company website: www auren com statement of 4. Using the information you find 0-K, describe the 2013 asset impairments. he company's cash flows; Ralph 5. Explain the difference between basic and diluted earnings per share. Lauren 6. The company chose to report comprehensive income in two consecutive statements, a statement of income LO4-1, LO4-3, and a statement of comprehensive income. What other alternative did the company have to report the infor LO4-5; LO4-6; mation in these two statements? LO4-8 7. What "other comprehensive items (OCD" did the company report in fiscal 2014? What other possible transac- Real World Financials tions would be reported as OCI ifthe company had experienced those transactions? 8. What method does the company use to report net cash provided by operating activities? What other method(s) could the company have used? 9. What is the largest cash outflow from investing activities? RALPH LAUREN CORPORATION CONSOLIDATED STATEMENTS OF INCOME Fiscal Years Ended March 29, March 30 March 31 2014 2013 2012 (millions, except per share data) $6,679 Net sales $7,284 $6,763 Licensing revenue 166 182 18 7,450 6,945 6,860 Net revenues Cost of goods sold 3,140 2,789 (2,862) Gross profit 4,310 4,156 3,998 Other costs and expenses Selling, general, and administrative expenses 3,142) (2,971 (2,916 Amortization of intangible assets 35) (29 Gain on acquisition of Chaps 16 Impairments of assets 19 Restructuring and other costs 12 12) Total other costs and expenses, net 3,180 3,029 (2,959 continued) Find more at http://www.downloadslide.com SECTION 1 The Role of Accounting as an Information System uded operating income 130 1,127 1,039 Foreign currency los Interest expense (24) nterest and other income, net 11 Equity in losses of equity-method investees 10) Income before provision for income taxes 1,089 1,015 Provision for income ta 339) 334 776 750 681 Net incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started