Question

Please don't do it in Excel Suppose that Mrs Qureshi can invest all her savings in shares of Ihser plc, or all her savings in

Please don't do it in Excel

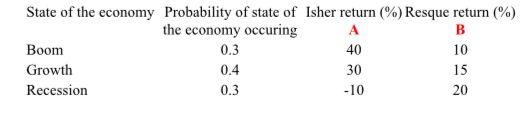

Suppose that Mrs Qureshi can invest all her savings in shares of Ihser plc, or all her savings in Resque plc. Alternatively she could diversify her investment between these two. There are three possible states of the economy, boom, growth or recession, and the returns on Ihser and Resque depend on which state will occur. Required: a) Calculate the expected return, variance and standard deviation for each share. b) Calculate the expected return for the following diversifying allocations of Mrs Qureshis savings: (i) 50% in Ihser, 50% in Resque; (ii) 10% in Ihser, 90% in Resque.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started