Answered step by step

Verified Expert Solution

Question

1 Approved Answer

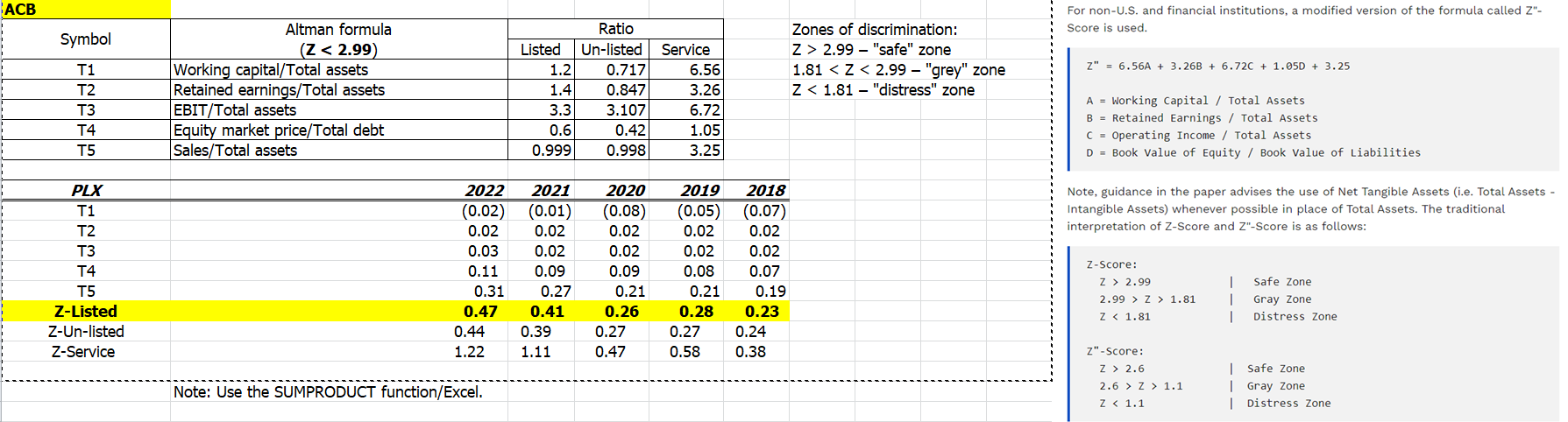

PLEASE EVALUATE/ comment/ analyze THIS FINANCIAL RISK OF ACB BANK IN VIETNAM AND then give conclusion for this table as well. URGENT, PLEASE HELP, THANK

PLEASE EVALUATE/ comment/ analyze THIS FINANCIAL RISK OF ACB BANK IN VIETNAM AND then give conclusion for this table as well.

URGENT, PLEASE HELP, THANK YOU

For non-U.S. and financial institutions, a modified version of the formula called Z"- Score is used. Z=6.56A+3.26B+6.72C+1.05D+3.25 A= Working Capital / Total Assets B= Retained Earnings / Total Assets C= Operating Income / Total Assets D= Book Value of Equity / Book Value of Liabilities Note, guidance in the paper advises the use of Net Tangible Assets (i.e. Total Assets Intangible Assets) whenever possible in place of Total Assets. The traditional interpretation of Z-Score and Z"-Score is as follows: Z-score:z>2.992.99>z>1.81z2.62.6>z>1.1SafeZoneGrayZoneDistressZoneSafeZoneGrayZoneDistressZoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started