Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please fill in the answer on above sheet figure in blue cell. QUESTION 4 Wharf and Alexander are father and son. Together they operate a

Please fill in the answer on above sheet figure in blue cell.

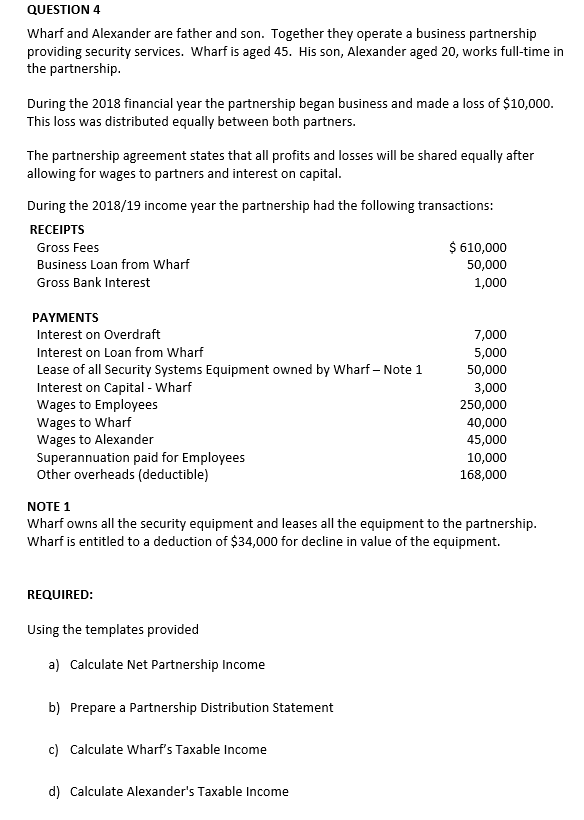

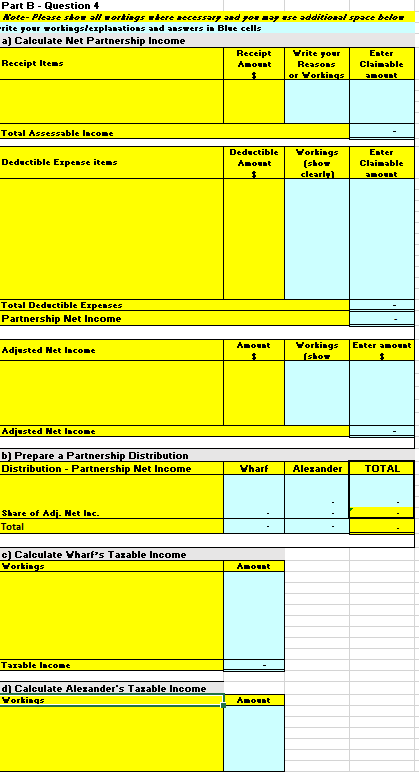

QUESTION 4 Wharf and Alexander are father and son. Together they operate a business partnership providing security services. Wharf is aged 45. His son, Alexander aged 20, works full-time in the partnership During the 2018 financial year the partnership began business and made a loss of $10,000. This loss was distributed equally between both partners. The partnership agreement states that all profits and losses will be shared equally after allowing for wages to partners and interest on capital. During the 2018/19 income year the partnership had the following transactions: RECEIPTS Gross Fees $ 610,000 Business Loan from Wharf 50,000 Gross Bank Interest 1,000 PAYMENTS Interest on Overdraft Interest on Loan from Wharf Lease of all Security Systems Equipment owned by Wharf - Note 1 Interest on Capital - Wharf Wages to Employees Wages to Wharf Wages to Alexander Superannuation paid for Employees Other overheads (deductible) 7,000 5,000 50,000 3,000 250,000 40,000 45,000 10,000 168,000 NOTE 1 Wharf owns all the security equipment and leases all the equipment to the partnership. Wharf is entitled to a deduction of $34,000 for decline in value of the equipment. REQUIRED: Using the templates provided a) Calculate Net Partnership Income b) Prepare a Partnership Distribution Statement c) Calculate Wharf's Taxable income d) Calculate Alexander's Taxable income Part B - Question 4 Hote- Please stor rortings rdere necessary and yor y ese addition/ space belor rite your Forkingslesplanations and ansters in Blue cells a) Calculate Net Partnership Income Receipt Vrite your Ester Receipt Items Amount Reasons Claimable or Yorking about Total Assessable lacone Deductible Expense items Deductible Azont Yorkings (shor clearl Eater Clainable about Total Deductible Expenses Partnership Net Income daont Adjusted Het lacout Eater amount Yorkings shoz Adjusted Net Income b) Prepare a Partnership Distribution Distribution - Partnership Net Income Vharf Alexander TOTAL Share of Adj. Het lac. Total c) Calculate Yharf's Tazable Income Yorkings About Tarable lacone d Calculate Alexander's Tazable Income Yorkings daontStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started