Answered step by step

Verified Expert Solution

Question

1 Approved Answer

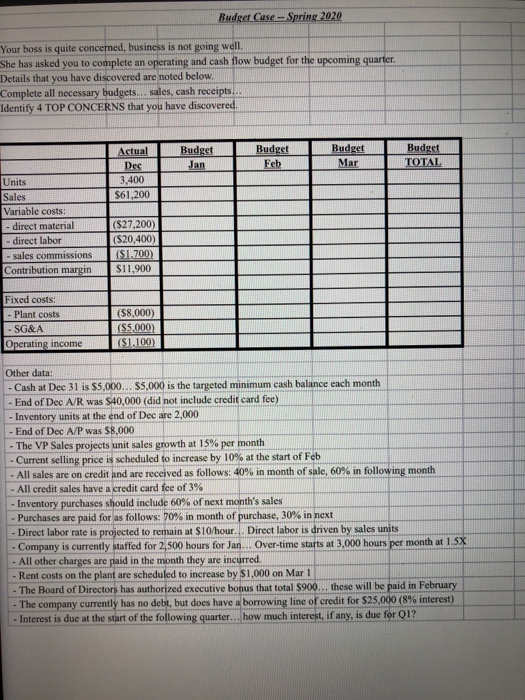

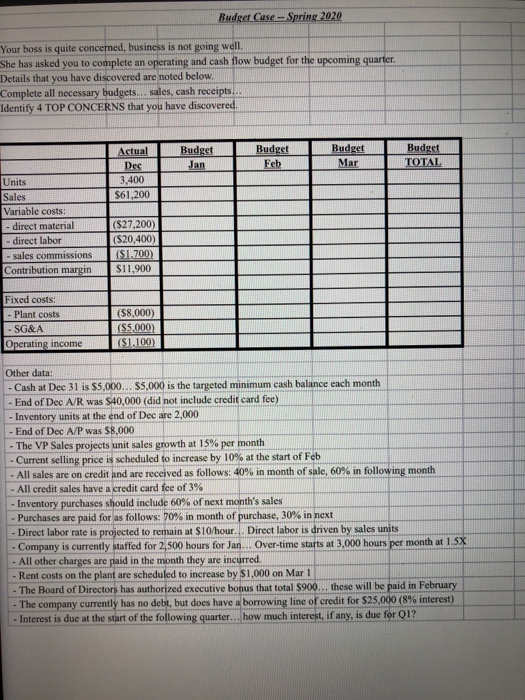

Please gelp mw figure this out! thank you. Budget Case - Spring 2020 Your boss is quite concerned, business is not going well. She has

Please gelp mw figure this out! thank you. Budget Case - Spring 2020 Your boss is quite concerned, business is not going well. She has asked you to complete an operating and cash flow budget for the upcoming quarter. Details that you have discovered are noted below. Complete all necessary budgets... sales, cash receipts... Identify 4 TOP CONCERNS that you have discovered. Budget Jan Budget Feb Budget Mar Budget TOTAL Actual Des 3,400 $61,200 Units Sales Variable costs: - direct material - direct labor - sales commissions Contribution margin ($27.200) ($20,400) (51.700 $11.900 Fixed costs: - Plant costs - SG&A Operating income ($8,000) $5,000 (51.100) Other data: - Cash at Dec 31 is $5,000... 55,000 is the targeted minimum cash balance each month - End of Dee A/R was $40,000 (did not include credit card fee) - Inventory units at the end of Dec are 2,000 - End of Dee A/P was $8,000 - The VP Sales projects unit sales growth at 15% per month - Current selling price is scheduled to increase by 10% at the start of Feb - All sales are on credit and are received as follows: 40% in month of sale, 60% in following month - All credit sales have a credit card fee of 3% - Inventory purchases should include 60% of next month's sales Purchases are paid for as follows: 70% in month of purchase. 30% in next - Direct labor rate is projected to remain at $10/hour. Direct labor is driven by sales units - Company is currently staffed for 2,500 hours for Jan... Over-time starts at 3,000 hours per month at 1.5X - All other charges are paid in the month they are incurred. - Rent costs on the plant are scheduled to increase by $1,000 on Mar The Board of Directors has authorized executive bonus that total $900... these will be paid in February - The company currently has no debt, but does have a borrowing line of credit for $25,000 (8% interest) - Interest is due at the start of the following quarter... how much interest, if any, is due for Q1? Budget Case - Spring 2020 Your boss is quite concerned, business is not going well. She has asked you to complete an operating and cash flow budget for the upcoming quarter. Details that you have discovered are noted below. Complete all necessary budgets... sales, cash receipts... Identify 4 TOP CONCERNS that you have discovered. Budget Jan Budget Feb Budget Mar Budget TOTAL Actual Des 3,400 $61,200 Units Sales Variable costs: - direct material - direct labor - sales commissions Contribution margin ($27.200) ($20,400) (51.700 $11.900 Fixed costs: - Plant costs - SG&A Operating income ($8,000) $5,000 (51.100) Other data: - Cash at Dec 31 is $5,000... 55,000 is the targeted minimum cash balance each month - End of Dee A/R was $40,000 (did not include credit card fee) - Inventory units at the end of Dec are 2,000 - End of Dee A/P was $8,000 - The VP Sales projects unit sales growth at 15% per month - Current selling price is scheduled to increase by 10% at the start of Feb - All sales are on credit and are received as follows: 40% in month of sale, 60% in following month - All credit sales have a credit card fee of 3% - Inventory purchases should include 60% of next month's sales Purchases are paid for as follows: 70% in month of purchase. 30% in next - Direct labor rate is projected to remain at $10/hour. Direct labor is driven by sales units - Company is currently staffed for 2,500 hours for Jan... Over-time starts at 3,000 hours per month at 1.5X - All other charges are paid in the month they are incurred. - Rent costs on the plant are scheduled to increase by $1,000 on Mar The Board of Directors has authorized executive bonus that total $900... these will be paid in February - The company currently has no debt, but does have a borrowing line of credit for $25,000 (8% interest) - Interest is due at the start of the following quarter... how much interest, if any, is due for Q1

Please gelp mw figure this out! thank you. Budget Case - Spring 2020 Your boss is quite concerned, business is not going well. She has asked you to complete an operating and cash flow budget for the upcoming quarter. Details that you have discovered are noted below. Complete all necessary budgets... sales, cash receipts... Identify 4 TOP CONCERNS that you have discovered. Budget Jan Budget Feb Budget Mar Budget TOTAL Actual Des 3,400 $61,200 Units Sales Variable costs: - direct material - direct labor - sales commissions Contribution margin ($27.200) ($20,400) (51.700 $11.900 Fixed costs: - Plant costs - SG&A Operating income ($8,000) $5,000 (51.100) Other data: - Cash at Dec 31 is $5,000... 55,000 is the targeted minimum cash balance each month - End of Dee A/R was $40,000 (did not include credit card fee) - Inventory units at the end of Dec are 2,000 - End of Dee A/P was $8,000 - The VP Sales projects unit sales growth at 15% per month - Current selling price is scheduled to increase by 10% at the start of Feb - All sales are on credit and are received as follows: 40% in month of sale, 60% in following month - All credit sales have a credit card fee of 3% - Inventory purchases should include 60% of next month's sales Purchases are paid for as follows: 70% in month of purchase. 30% in next - Direct labor rate is projected to remain at $10/hour. Direct labor is driven by sales units - Company is currently staffed for 2,500 hours for Jan... Over-time starts at 3,000 hours per month at 1.5X - All other charges are paid in the month they are incurred. - Rent costs on the plant are scheduled to increase by $1,000 on Mar The Board of Directors has authorized executive bonus that total $900... these will be paid in February - The company currently has no debt, but does have a borrowing line of credit for $25,000 (8% interest) - Interest is due at the start of the following quarter... how much interest, if any, is due for Q1? Budget Case - Spring 2020 Your boss is quite concerned, business is not going well. She has asked you to complete an operating and cash flow budget for the upcoming quarter. Details that you have discovered are noted below. Complete all necessary budgets... sales, cash receipts... Identify 4 TOP CONCERNS that you have discovered. Budget Jan Budget Feb Budget Mar Budget TOTAL Actual Des 3,400 $61,200 Units Sales Variable costs: - direct material - direct labor - sales commissions Contribution margin ($27.200) ($20,400) (51.700 $11.900 Fixed costs: - Plant costs - SG&A Operating income ($8,000) $5,000 (51.100) Other data: - Cash at Dec 31 is $5,000... 55,000 is the targeted minimum cash balance each month - End of Dee A/R was $40,000 (did not include credit card fee) - Inventory units at the end of Dec are 2,000 - End of Dee A/P was $8,000 - The VP Sales projects unit sales growth at 15% per month - Current selling price is scheduled to increase by 10% at the start of Feb - All sales are on credit and are received as follows: 40% in month of sale, 60% in following month - All credit sales have a credit card fee of 3% - Inventory purchases should include 60% of next month's sales Purchases are paid for as follows: 70% in month of purchase. 30% in next - Direct labor rate is projected to remain at $10/hour. Direct labor is driven by sales units - Company is currently staffed for 2,500 hours for Jan... Over-time starts at 3,000 hours per month at 1.5X - All other charges are paid in the month they are incurred. - Rent costs on the plant are scheduled to increase by $1,000 on Mar The Board of Directors has authorized executive bonus that total $900... these will be paid in February - The company currently has no debt, but does have a borrowing line of credit for $25,000 (8% interest) - Interest is due at the start of the following quarter... how much interest, if any, is due for Q1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started