Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please give a solution for this problem; in excel with formulas Accretion/Dilution Exercise Instructions Determine the maximum premium Coca-Cola could pay for Canada Dry before

please give a solution for this problem; in excel with formulas

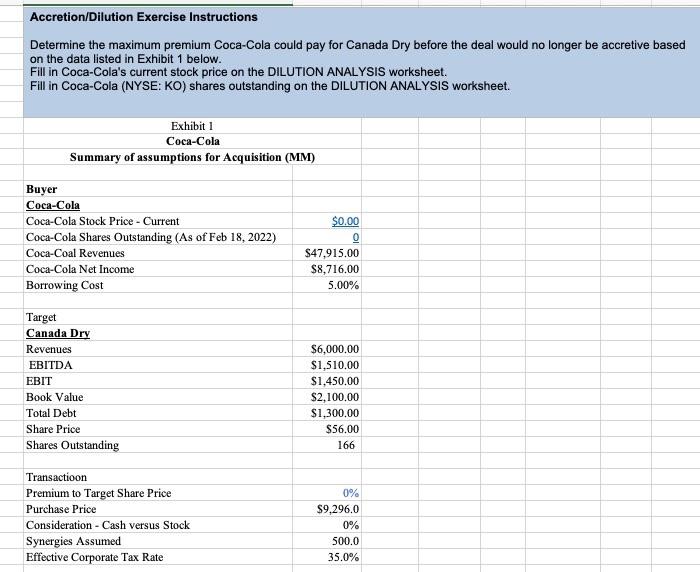

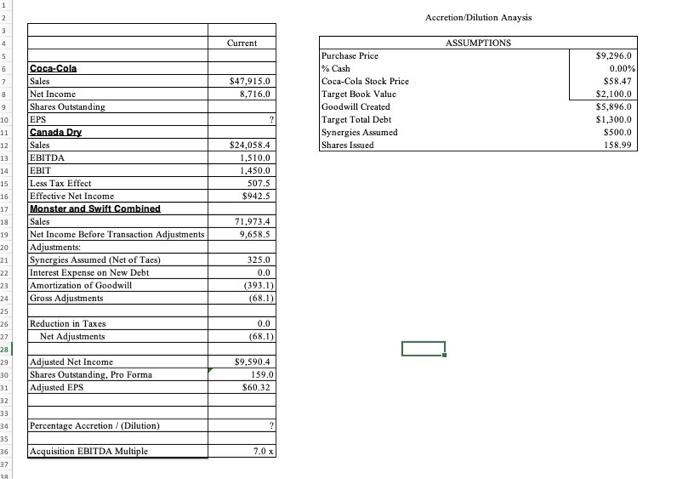

Accretion/Dilution Exercise Instructions Determine the maximum premium Coca-Cola could pay for Canada Dry before the deal would no longer be accretive based on the data listed in Exhibit 1 below. Fill in Coca-Cola's current stock price on the DILUTION ANALYSIS worksheet. Fill in Coca-Cola (NYSE: KO) shares outstanding on the DILUTION ANALYSIS worksheet. Exhibit 1 Coca-Cola Summary of assumptions for Acquisition (MM) Buyer Coca-Cola Coca-Cola Stock Price - Current Coca-Cola Shares Outstanding (As of Feb 18, 2022) Coca-Coal Revenues Coca-Cola Net Income Borrowing Cost $0.00 O $47,915.00 $8,716.00 5.00% Target Canada Dry Revenues EBITDA EBIT Book Value Total Debt Share Price Shares Outstanding $6,000,00 $1,510.00 $1,450.00 $2,100,00 $1,300.00 $56.00 166 0% Transactioon Premium to Target Share Price Purchase Price Consideration - Cash versus Stock Synergies Assumed Effective Corporate Tax Rate $9,296,0 0% 500.0 35.0% 1 2 Accretion/Dilution Anaysis Current ASSUMPTIONS 5 6 7 $47,915.0 8.716.0 Purchase Price % Cash Coca-Cola Stock Price Target Book Valuc Goodwill Created Target Total Debt Synergies Assumed Shares Issued $9,296.0 0.00% SS8,47 $2,100.0 $5,896,0 $1,300.0 $500.0 158.99 ? Coca-Cola Sales Net Income Shares Outstanding EPS Canada Dry Sales EBITDA EBIT Less Tax Effect Effective Net Income Monster and Swift Combined Sales Net Income Before Transaction Adjustments Adjustments: Synergies Assumed (Net of Taes) Interest Expense on New Debt Amortization of Goodwill Gross Adjustments 3 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 $24,058.4 1.510.0 1,450.0 507.5 $942.5 71,973.4 9,658.5 325.0 0.0 (393.1) (68.1) Reduction in Taxes Net Adjustments 0.0 (68.1) 27 281 29 30 $9.590.4 Adjusted Net Income Shares Outstanding. Pro Forma Adjusted EPS 159.0 $60.32 Percentage Accretion/ (Dilution) ? 12 33 34 35 36 37 Acquisition EBITDA Multiple 7.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started