Please give each step of the detailed answer process, thank you!

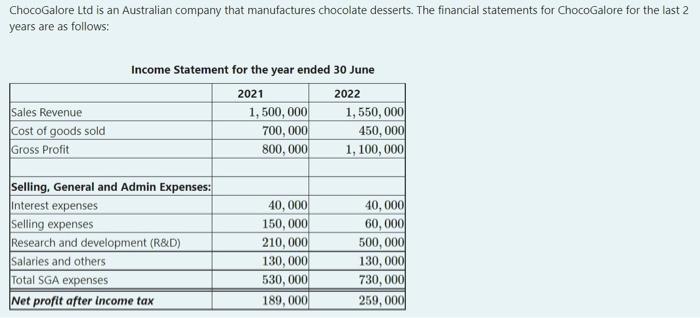

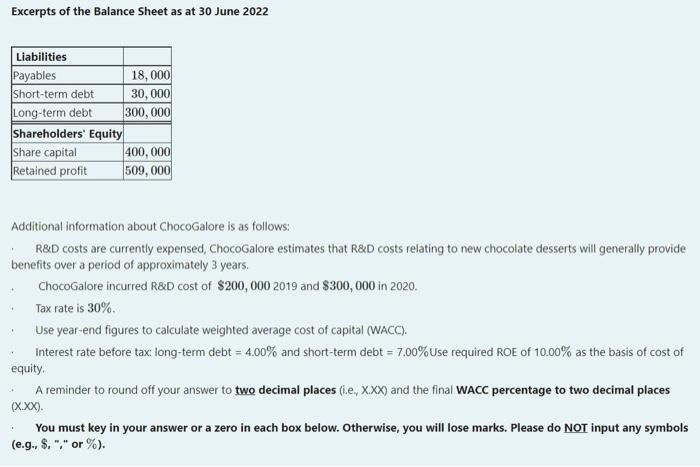

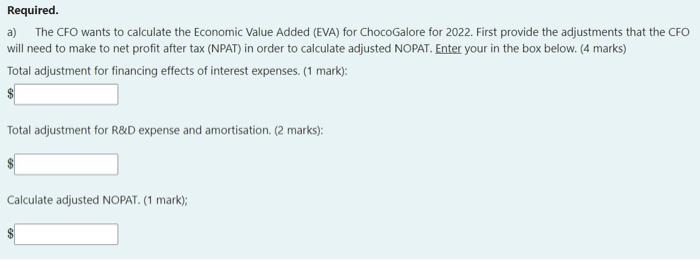

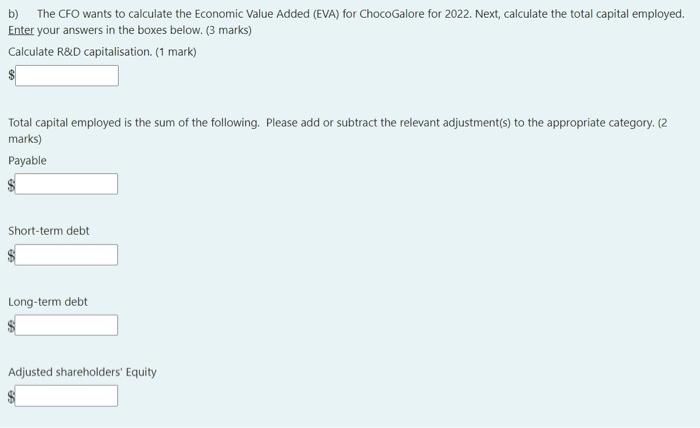

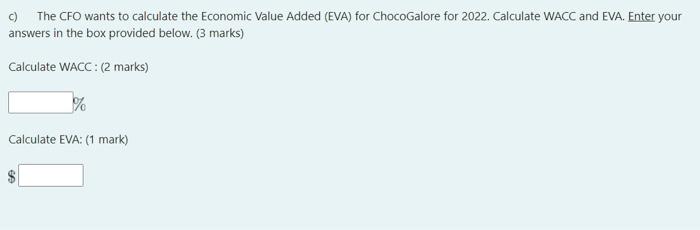

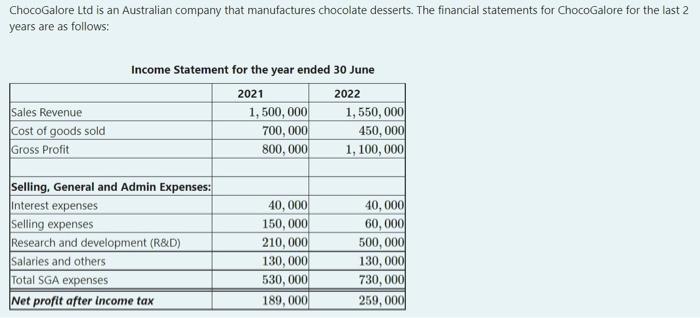

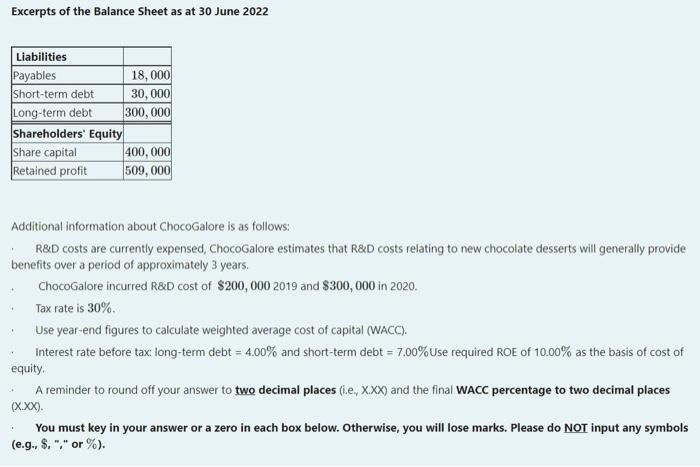

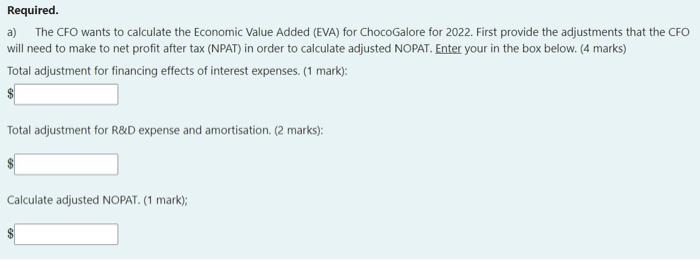

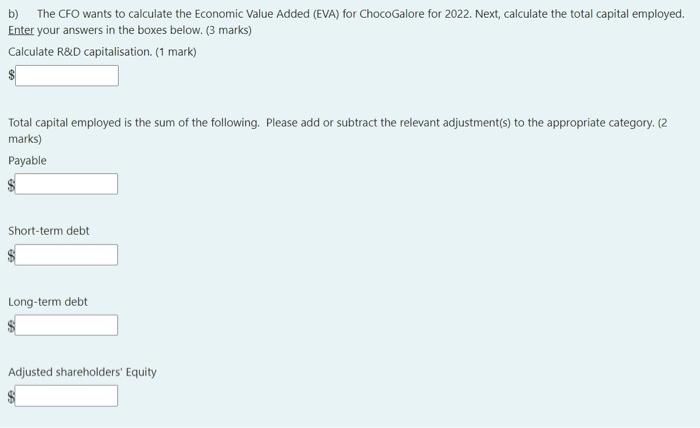

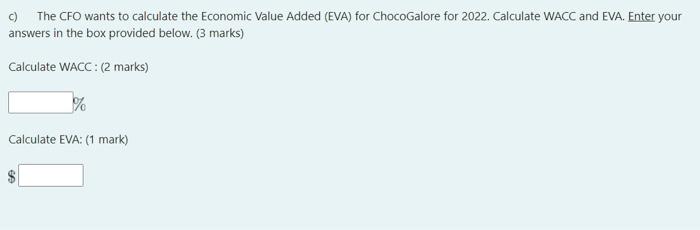

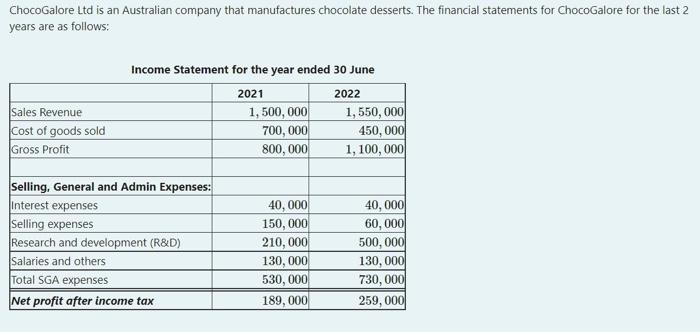

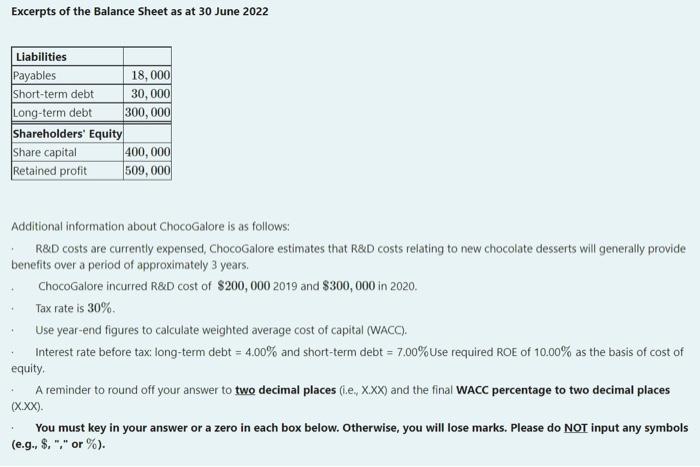

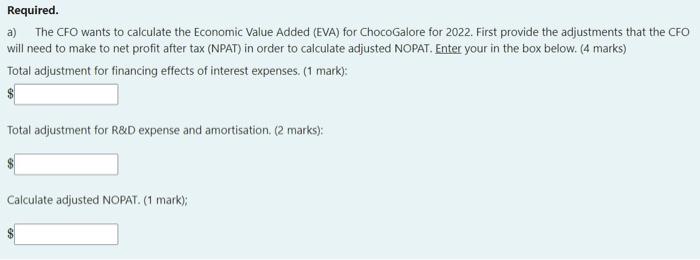

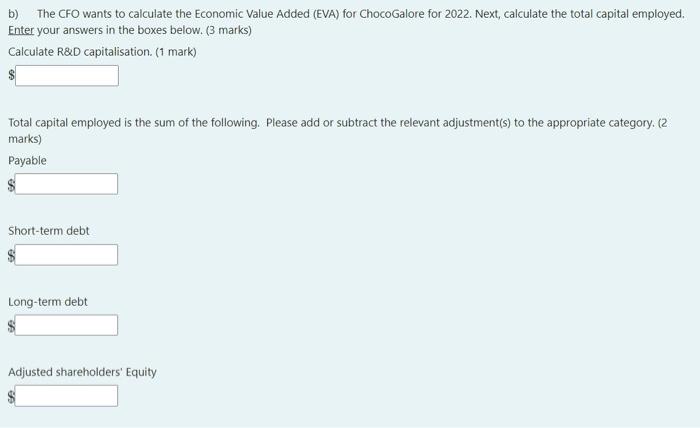

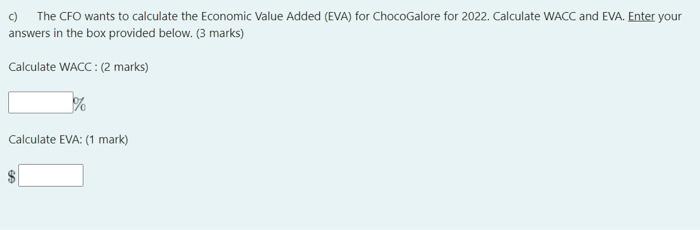

ChocoGalore Ltd is an Australian company that manufactures chocolate desserts. The financial statements for ChocoGalore for the last 2 years are as follows: Income Statement for the year ended 30 June Excerpts of the Balance Sheet as at 30 June 2022 Additional information about ChocoGalore is as follows: R&D costs are currently expensed, ChocoGalore estimates that R\&D costs relating to new chocolate desserts will generally provide benefits over a period of approximately 3 years. ChocoGalore incurred R\&D cost of $200,0002019 and $300,000 in 2020. Tax rate is 30%. Use year-end figures to calculate weighted average cost of capital (WACC). Interest rate before tax: long-term debt =4.00% and short-term debt =7.00% Use required ROE of 10.00% as the basis of cost of equity, A reminder to round off your answer to two decimal places (i.e. X.XX ) and the final WACC percentage to two decimal places (X.XX). You must key in your answer or a zero in each box below. Otherwise, you will lose marks. Please do NOT input any symbols (e.g., $,"," or %. a) The CFO wants to calculate the Economic Value Added (EVA) for ChocoGalore for 2022 . First provide the adjustments that the CFO will need to make to net profit after tax (NPAT) in order to calculate adjusted NOPAT. Enter your in the box below. (4 marks) Total adjustment for financing effects of interest expenses. ( 1 mark): Total adjustment for R&D expense and amortisation. ( 2 marks): 4 Calculate adjusted NOPAT. (1 mark); b) The CFO wants to calculate the Economic Value Added (EVA) for ChocoGalore for 2022. Next, calculate the total capital employed. Enter your answers in the boxes below. ( 3 marks) Calculate R\&D capitalisation. ( 1 mark) Total capital employed is the sum of the following. Please add or subtract the relevant adjustment(s) to the appropriate category. (2 marks) Payable Short-term debt Long-term debt Adjusted shareholders' Equity c) The CFO wants to calculate the Economic Value Added (EVA) for ChocoGalore for 2022 . Calculate WACC and EVA. Enter your answers in the box provided below. (3 marks) Calculate WACC: (2 marks) % Calculate EVA: (1 mark) ChocoGalore Ltd is an Australian company that manufactures chocolate desserts. The financial statements for ChocoGalore for the last 2 years are as follows: Income Statement for the year ended 30 June Excerpts of the Balance Sheet as at 30 June 2022 Additional information about ChocoGalore is as follows: R&D costs are currently expensed, ChocoGalore estimates that R\&D costs relating to new chocolate desserts will generally provide benefits over a period of approximately 3 years. ChocoGalore incurred R\&D cost of $200,0002019 and $300,000 in 2020. Tax rate is 30%. Use year-end figures to calculate weighted average cost of capital (WACC). Interest rate before tax: long-term debt =4.00% and short-term debt =7.00% Use required ROE of 10.00% as the basis of cost of equity, A reminder to round off your answer to two decimal places (i.e. X.XX ) and the final WACC percentage to two decimal places (X.XX). You must key in your answer or a zero in each box below. Otherwise, you will lose marks. Please do NOT input any symbols (e.g., $,"," or %. a) The CFO wants to calculate the Economic Value Added (EVA) for ChocoGalore for 2022 . First provide the adjustments that the CFO will need to make to net profit after tax (NPAT) in order to calculate adjusted NOPAT. Enter your in the box below. (4 marks) Total adjustment for financing effects of interest expenses. ( 1 mark): Total adjustment for R&D expense and amortisation. ( 2 marks): 4 Calculate adjusted NOPAT. (1 mark); b) The CFO wants to calculate the Economic Value Added (EVA) for ChocoGalore for 2022. Next, calculate the total capital employed. Enter your answers in the boxes below. ( 3 marks) Calculate R\&D capitalisation. ( 1 mark) Total capital employed is the sum of the following. Please add or subtract the relevant adjustment(s) to the appropriate category. (2 marks) Payable Short-term debt Long-term debt Adjusted shareholders' Equity c) The CFO wants to calculate the Economic Value Added (EVA) for ChocoGalore for 2022 . Calculate WACC and EVA. Enter your answers in the box provided below. (3 marks) Calculate WACC: (2 marks) % Calculate EVA: (1 mark)