Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Help!!!! 1. Which of the following is true regarding the difference between a company's sustainable growth rate (SGR) and its internal growth rate (IGR)?

Please Help!!!!

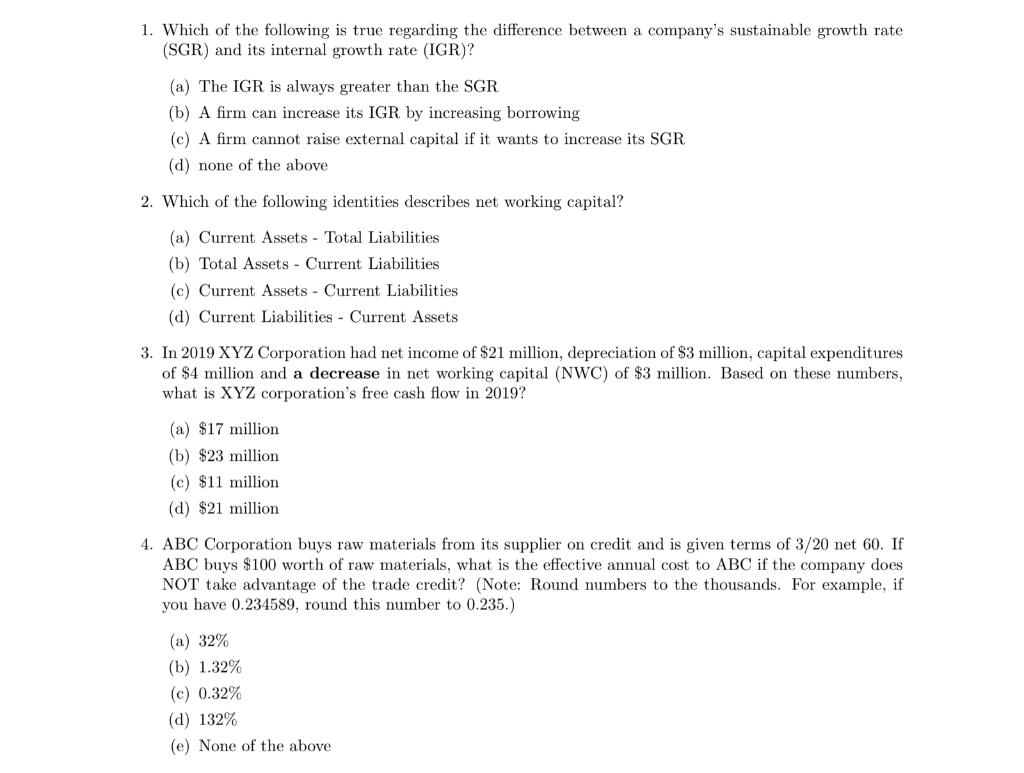

1. Which of the following is true regarding the difference between a company's sustainable growth rate (SGR) and its internal growth rate (IGR)? (a) The IGR is always greater than the SGR (b) A firm can increase its IGR by increasing borrowing (c) A firm cannot raise external capital if it wants to increase its SGR (d) none of the above 2. Which of the following identities describes net working capital? (a) Current Assets - Total Liabilities (b) Total Assets - Current Liabilities (c) Current Assets - Current Liabilities (d) Current Liabilities - Current Assets 3. In 2019 XYZ Corporation had net income of $21 million, depreciation of $3 million, capital expenditures of $4 million and a decrease in net working capital (NWC) of $3 million. Based on these numbers, what is XYZ corporation's free cash flow in 2019? (a) $17 million (b) $23 million (c) $11 million (d) $21 million 4. ABC Corporation buys raw materials from its supplier on credit and is given terms of 3/20 net 60. If ABC buys $100 worth of raw materials, what is the effective annual cost to ABC if the company does NOT take advantage of the trade credit? (Note: Round numbers to the thousands. For example, if you have 0.234589, round this number to 0.235.) (a) 32% (b) 1.32% (c) 0.32% (d) 132% (e) None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started