Answered step by step

Verified Expert Solution

Question

1 Approved Answer

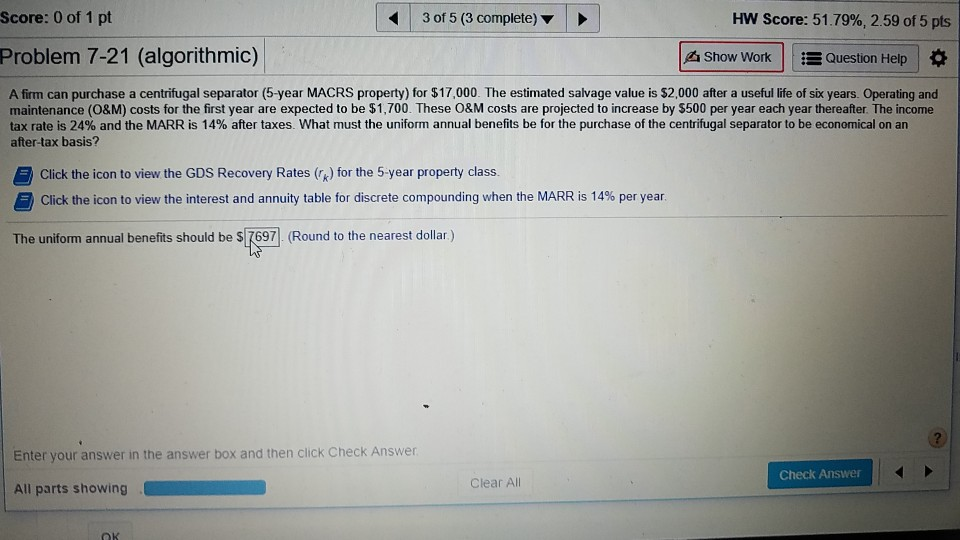

please help 3 of 5 (3 complete) Score: 0 of 1 pt HW Score: 51.79%, 2.59 of 5 pts Problem 7-21 (algorithmic) a Show WorkQuestion

please help

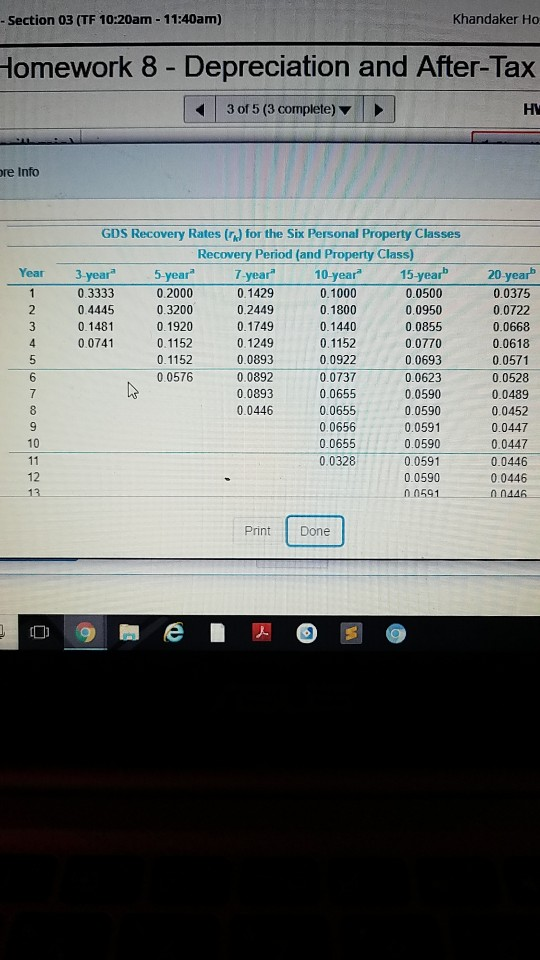

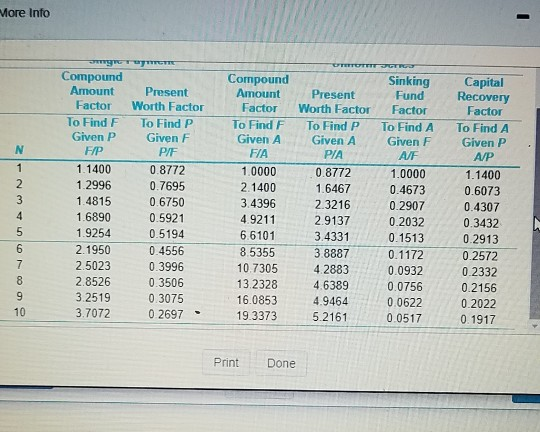

3 of 5 (3 complete) Score: 0 of 1 pt HW Score: 51.79%, 2.59 of 5 pts Problem 7-21 (algorithmic) a Show WorkQuestion Help A firm can purchase a centrifugal separator (5-year MACRS property) for $17,000. The estimated salvage value is $2,000 after a useful life of six years. Operating and maintenance (O&M) costs for the first year are expected to be $1,700. These 0&M costs are projected to increase by $500 per year each year thereafter. The income tax rate is 24% and the MARR is 14% after taxes. What must e un o an a benefits or he purchase of the cem a se a aorto ba econo al n after-tax basis? Click the icon to view the GDS Recovery Rates (k) for the 5-year property class. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 14% per year The uniform annual benefits should be S 7697 (Round to the nearest dollar.) Enter your answer in the answer box and then click Check Answer Check Answer Clear All All parts showing Khandaker Ho Section 03 (TF 10:20am 11:40am) Homework 8 - Depreciation and After-Tax 3 of 5 (3 complete) HV re Info GDS Recovery Rates () for the Six Personal Property Classes Recovery Period (and Property Class) Year 3 year 5-year7year 10.year 15-year 20 year 0.0375 0.0722 0.0668 0.0618 0.0571 0.0528 0 0 0 0.0489 0.0452 0.0447 0.0447 0.0446 0.0446 0.2000 2 0.4445 0.3200 0.3333 0.1000 0.1800 0.1429 0.2449 0.0950 3 0.1481 0.1920 0.1749 0.1440 0.0855 0.0770 0.0693 4 0.07410.1152 0.1152 0.1249 0.0893 0.1152 0.0922 6 0.0893 0.0446 0.0655 0.0655 0.0656 0.0655 0.03280.0591 0.0590 0.0590 0.0591 0.0590 9 10 12 0.0590 591 Print Done yrAP - 03723-226 07031 27 -7 35 531 poa-Fi ve A 3 16432-2 2 221 a ec Fa-, i '1 0 0 0 0|0 0 0 0 0 03723 2627 06905-19765 21-10000 FO G -10000-00000 t ct P A 27671|7 3 9 41 6133-88866 Fa nd na 77 4 2 1 3 88 88 3 4 Fi ve P 8 6 3 9 482692 es th Pr ort-01 Gi- 0 1 2 2 3-3 4 4 4 5 ntr-FA -0 0 6 1 150257 0091053383 en A-0 4 3 2 137203 5833 F014965 4680369 25014|6 6 6 57 79529-5 9 079 76791-5 9 506 8765543332| th H i P- OG 0 0 0 0 0-0 0 0 0 0 06504-0 369 0550- 49882-9 FiF-1 2 4 6 915827 11-22233 N-1 2 3 4 5-6 7 8 9 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started