Please Help

Please Help

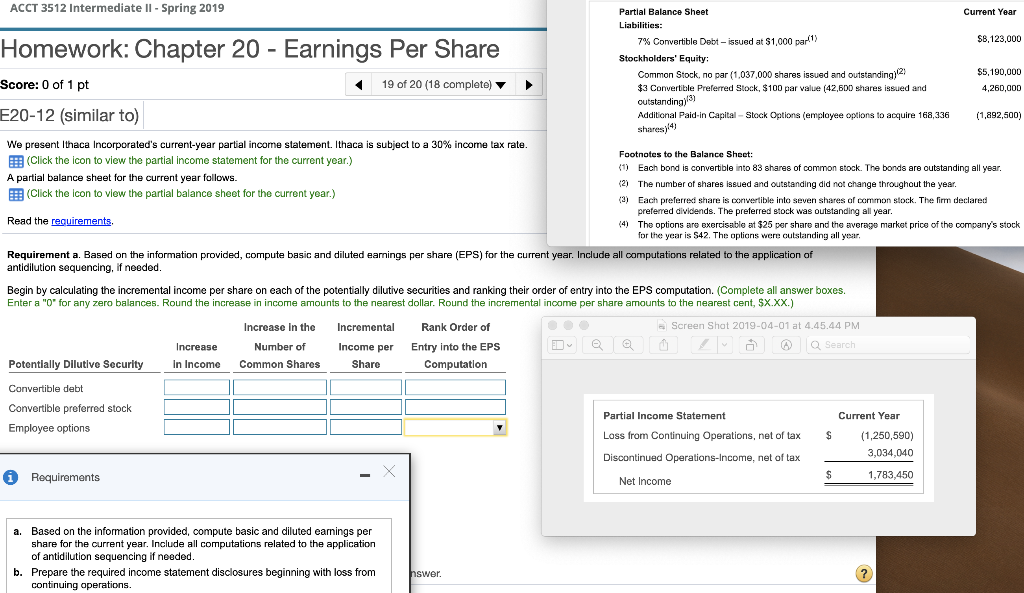

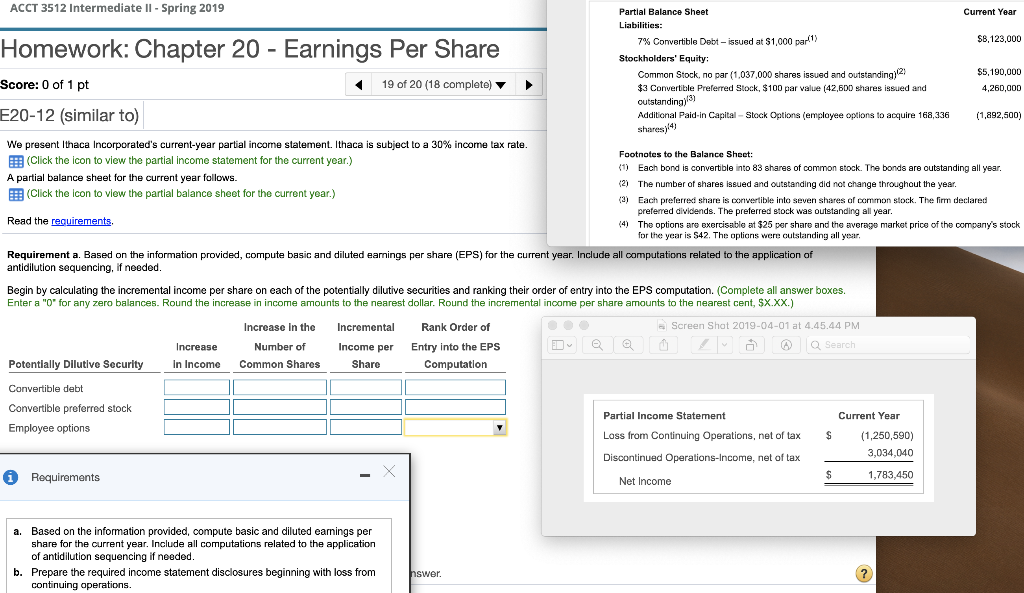

ACCT 3512 Intermediate II Spring 2019 Partial Balance Sheet Liabilitics: Current Year 7% Convertible Debt-issued at $1,000 pari1) $8,123,000 Homework: Chapter 20 - Earnings Per Share Stockholders' Equity: Common Stock, no par1.037,000 shares issued and outstanding)2 $5,190,000 Score: 0 of 1 pt 19 of 20 (18 complete) $3 Converible Preferred Stock, $100 par value (42,6DD shares issued and 4,260,00D 13) E20-12 (similar to) Additional Paid-in Capital- Stock Options (employee options to acquire 168,336 ,892,500) shares We present Ithaca Incorporated's current-year partial income statement. Ithaca is subject to a 30% income tax rate. EEB (Click the icon to view the partial income statement for the current year.) A partial balance sheet for the current year follows. EEE (Click the icon to view the partial balance sheet for the current year.) Read the requirements. Footnotes to the Balance Sheet: Each bond is convertble into 83 shares of common stock. The bonds are outstanding all year The number of shares issued and outstanding did not change throughout the year. Each preferred share is convertible inlo seven shares af common stock. The firn declared preferred dividends. The preterred stock was outstanding all year. 4) The options are exercisable at 325 per share and the average market price of the company's stock for the year is 542. The oplians we cutstanding all year Requirement a. Based on the information provided, compute basic and diluted earnings per share (EPS) for the current year. Include all computations related to the application of antidilution sequencing, if needed Begin by calculating the incremental income per share on each of the potentially dilutive securities and ranking their order of entry into the EPS computation. (Complete all answer boxes Enter a "O" for any zero balances. Round the increase in income amounts to the nearest dollar. Round the incremental inoome per share amounts to the nearest cent, SX.XX.) Screen Shat 2019-04-01 at 4.45.44 PM Increase In the Number of Common Shares Incremental Income per Sharc Rank Order of Entry into the EPS Computation Increase GQSearch Potentially Dilutive Security Convertible debt Convertible preferred stock Employee options In Income Partial Income Statement Loss from Continuing Operations, net of taxS1,250,590) Discontinued Operations-Income, net of tax Current Year 3,034,040 1 Requirements 1,783,450 Net Income a. Based on the information provided, compute basic and diluted eamings per share for the current year. Include all computations related to the application of antidilution sequencing if needed Prepare the required income statement disclosures beginning with loss from b. swer ACCT 3512 Intermediate II Spring 2019 Partial Balance Sheet Liabilitics: Current Year 7% Convertible Debt-issued at $1,000 pari1) $8,123,000 Homework: Chapter 20 - Earnings Per Share Stockholders' Equity: Common Stock, no par1.037,000 shares issued and outstanding)2 $5,190,000 Score: 0 of 1 pt 19 of 20 (18 complete) $3 Converible Preferred Stock, $100 par value (42,6DD shares issued and 4,260,00D 13) E20-12 (similar to) Additional Paid-in Capital- Stock Options (employee options to acquire 168,336 ,892,500) shares We present Ithaca Incorporated's current-year partial income statement. Ithaca is subject to a 30% income tax rate. EEB (Click the icon to view the partial income statement for the current year.) A partial balance sheet for the current year follows. EEE (Click the icon to view the partial balance sheet for the current year.) Read the requirements. Footnotes to the Balance Sheet: Each bond is convertble into 83 shares of common stock. The bonds are outstanding all year The number of shares issued and outstanding did not change throughout the year. Each preferred share is convertible inlo seven shares af common stock. The firn declared preferred dividends. The preterred stock was outstanding all year. 4) The options are exercisable at 325 per share and the average market price of the company's stock for the year is 542. The oplians we cutstanding all year Requirement a. Based on the information provided, compute basic and diluted earnings per share (EPS) for the current year. Include all computations related to the application of antidilution sequencing, if needed Begin by calculating the incremental income per share on each of the potentially dilutive securities and ranking their order of entry into the EPS computation. (Complete all answer boxes Enter a "O" for any zero balances. Round the increase in income amounts to the nearest dollar. Round the incremental inoome per share amounts to the nearest cent, SX.XX.) Screen Shat 2019-04-01 at 4.45.44 PM Increase In the Number of Common Shares Incremental Income per Sharc Rank Order of Entry into the EPS Computation Increase GQSearch Potentially Dilutive Security Convertible debt Convertible preferred stock Employee options In Income Partial Income Statement Loss from Continuing Operations, net of taxS1,250,590) Discontinued Operations-Income, net of tax Current Year 3,034,040 1 Requirements 1,783,450 Net Income a. Based on the information provided, compute basic and diluted eamings per share for the current year. Include all computations related to the application of antidilution sequencing if needed Prepare the required income statement disclosures beginning with loss from b. swer

Please Help

Please Help