Answered step by step

Verified Expert Solution

Question

1 Approved Answer

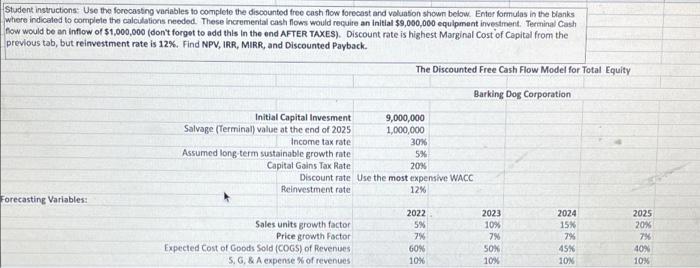

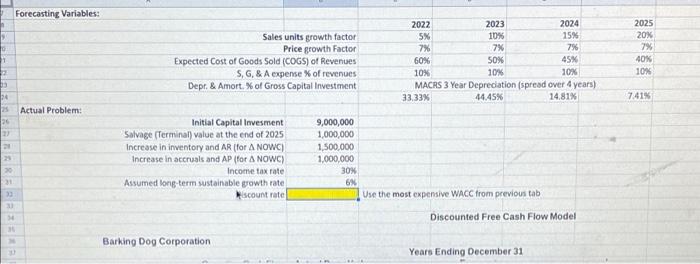

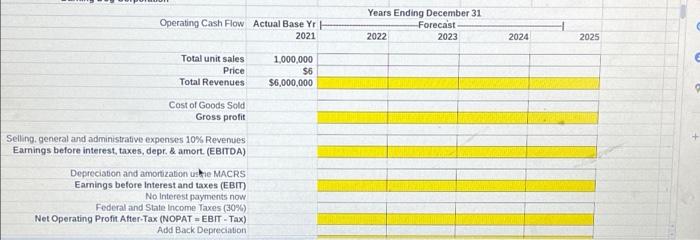

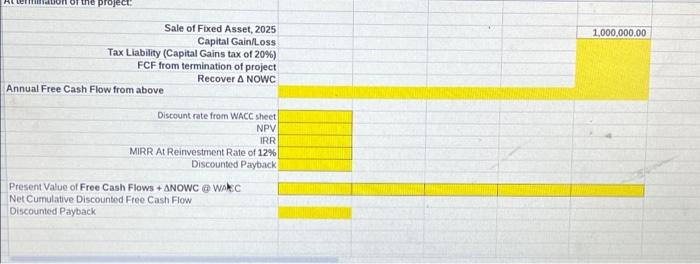

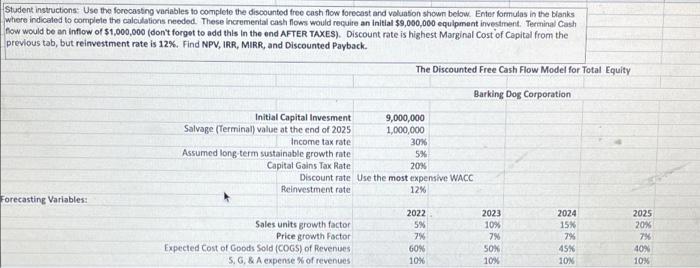

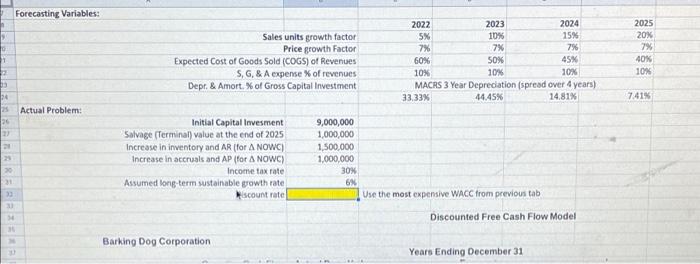

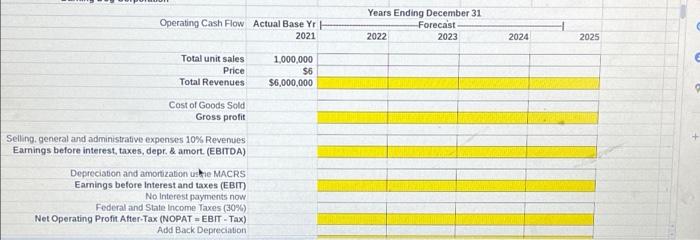

please help and write out formulas! Student instructions: Use the forecasting variables to complete the discounted free cash flow forecast and Valuation shown below. Enter

please help and write out formulas!

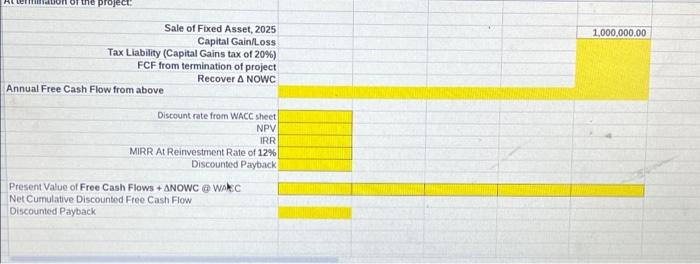

Student instructions: Use the forecasting variables to complete the discounted free cash flow forecast and Valuation shown below. Enter formules in the blanks where indicated to complete the calculations needed. These incremental cash flows would require an initial $9,000,000 equipment investment. Terminal Cash flow would be an inflow of $1,000,000 (don't forget to add this in the end AFTER TAXES). Discount rate is highest Marginal Cost of Capital from the previous tab, but reinvestment rate is 12%. Find NPV, IRR, MIRR, and Discounted Payback The Discounted Free Cash Flow Model for Total Equity Barking Dog Corporation Initial Capital Invesment 9,000,000 Salvage (Terminal) value at the end of 2025 1,000,000 Income tax rate 30% Assumed long term sustainable growth rate 5% Capital Gains Tax Rate 20% Discount rate Use the most expensive WACC Reinvestment rate 12% Forecasting Variables: 2025 20% Sales units growth factor Price growth Factor Expected Cost of Goods Sold (COGS) of Revenues 5.G. & A expense of revenues 2022 5% 7% GON 10% 2023 10% 7% SOX 10% 2024 15% 7% 45% 10% 7% 40% 10% Forecasting Variables: Sales units growth factor Price growth Factor Expected Cost of Goods Sold (COGS) of Revenues S, G, & A expense of revenues Dept. & Amort. % of Gross Capital Investment 2022 2023 2024 5% 10% 15% 2% 7% 7% 60% 45% 10% 10% 10% MACRS 3 Year Depreciation (spread over 4 years) 33.33% 44.45% 14,81% 2025 20% 7% 40% 10% SOX 14 7.41% Actual Problem: 26 TREBAZE Initial Capital Invesment Salvage (Terminal) value at the end of 2025 Increase in inventory and AR (for ANOWC) Increase in accruals and AP (For A NOWC) Income tax rate Assumed long-term sustainable prowth rate scount rate 9,000,000 1,000,000 1,500,000 1,000,000 30% 6 30 Use the most expensive WACC from previous tab Discounted Free Cash Flow Model Barking Dog Corporation Years Ending December 31 Operating Cash Flow Actual Base Y 2021 Years Ending December 31 -Forecast 2022 2023 2024 2025 Total unit sales Price Total Revenues 1,000,000 $6 $6,000,000 Cast of Goods Sold Gross profit Selling general and administrative expenses 10% Revenues Earnings before interest, taxes, depr. & amort. (EBITDA) Depreciation and amortization use MACRS Earnings before Interest and taxes (EBIT) No Interest payments now Federal and State Income Taxes (30%) Net Operating Profit After Tax (NOPAT = EBIT - Tax) Add Back Depreciation of the project 1,000,000.00 Sale of Fixed Asset, 2025 Capital Gain/Loss Tax Liability (Capital Gains tax of 20%) FCF from termination of project Recover A NOWC Annual Free Cash Flow from above Discount rate from WACC sheet NPV IRR MIRR At Reinvestment Rate of 12% Discounted Payback Present Value of Free Cash Flows + ANOWC @ WAEC Net Cumulative Discounted Free Cash Flow Discounted Payback Student instructions: Use the forecasting variables to complete the discounted free cash flow forecast and Valuation shown below. Enter formules in the blanks where indicated to complete the calculations needed. These incremental cash flows would require an initial $9,000,000 equipment investment. Terminal Cash flow would be an inflow of $1,000,000 (don't forget to add this in the end AFTER TAXES). Discount rate is highest Marginal Cost of Capital from the previous tab, but reinvestment rate is 12%. Find NPV, IRR, MIRR, and Discounted Payback The Discounted Free Cash Flow Model for Total Equity Barking Dog Corporation Initial Capital Invesment 9,000,000 Salvage (Terminal) value at the end of 2025 1,000,000 Income tax rate 30% Assumed long term sustainable growth rate 5% Capital Gains Tax Rate 20% Discount rate Use the most expensive WACC Reinvestment rate 12% Forecasting Variables: 2025 20% Sales units growth factor Price growth Factor Expected Cost of Goods Sold (COGS) of Revenues 5.G. & A expense of revenues 2022 5% 7% GON 10% 2023 10% 7% SOX 10% 2024 15% 7% 45% 10% 7% 40% 10% Forecasting Variables: Sales units growth factor Price growth Factor Expected Cost of Goods Sold (COGS) of Revenues S, G, & A expense of revenues Dept. & Amort. % of Gross Capital Investment 2022 2023 2024 5% 10% 15% 2% 7% 7% 60% 45% 10% 10% 10% MACRS 3 Year Depreciation (spread over 4 years) 33.33% 44.45% 14,81% 2025 20% 7% 40% 10% SOX 14 7.41% Actual Problem: 26 TREBAZE Initial Capital Invesment Salvage (Terminal) value at the end of 2025 Increase in inventory and AR (for ANOWC) Increase in accruals and AP (For A NOWC) Income tax rate Assumed long-term sustainable prowth rate scount rate 9,000,000 1,000,000 1,500,000 1,000,000 30% 6 30 Use the most expensive WACC from previous tab Discounted Free Cash Flow Model Barking Dog Corporation Years Ending December 31 Operating Cash Flow Actual Base Y 2021 Years Ending December 31 -Forecast 2022 2023 2024 2025 Total unit sales Price Total Revenues 1,000,000 $6 $6,000,000 Cast of Goods Sold Gross profit Selling general and administrative expenses 10% Revenues Earnings before interest, taxes, depr. & amort. (EBITDA) Depreciation and amortization use MACRS Earnings before Interest and taxes (EBIT) No Interest payments now Federal and State Income Taxes (30%) Net Operating Profit After Tax (NOPAT = EBIT - Tax) Add Back Depreciation of the project 1,000,000.00 Sale of Fixed Asset, 2025 Capital Gain/Loss Tax Liability (Capital Gains tax of 20%) FCF from termination of project Recover A NOWC Annual Free Cash Flow from above Discount rate from WACC sheet NPV IRR MIRR At Reinvestment Rate of 12% Discounted Payback Present Value of Free Cash Flows + ANOWC @ WAEC Net Cumulative Discounted Free Cash Flow Discounted Payback

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started