Please help ASAP

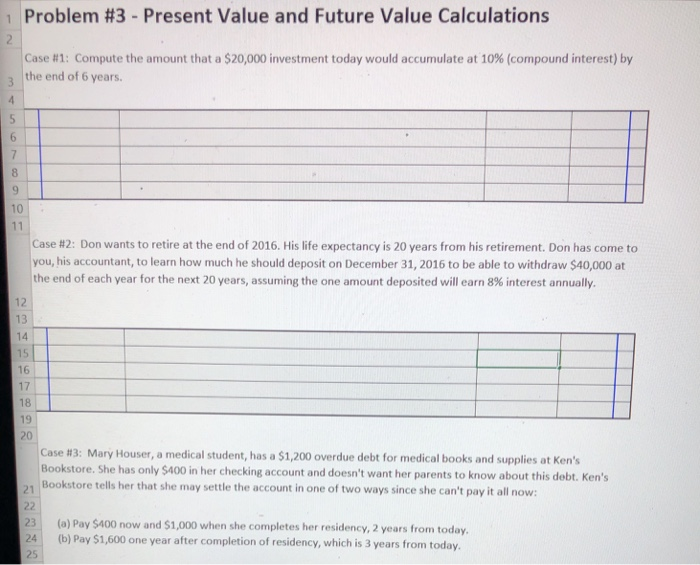

1 Problem #3-Present Value and Future Value Calculations Case #1: Compute the amount that a $20,000 investment today would accumulate at 10% (compound interest) by the end of 6 years. 3 8 10 Case #2: Don wants to retire at the end of 2016. His life expectancy is 20 years from his retirement, Don has come to you, his accountant, to learn how much he should deposit on December 31, 2016 to be able to withdraw $40,000 at the end of each year for the next 20 years, assuming the one amount deposited will earn 8% interest annually. 12 14 16 17 18 20 Case #3: Mary Houser, a medical student, has a $1,200 overdue debt for medical books and supplies at Ken's Bookstore. She has only $400 in her checking account and doesn't want her parents to know about this debt. Ken's 21 Bookstore tells her that she may settle the account in one of two ways since she can't pay it all now: 23 (a) Pay $400 now and $1,000 when she completes her residency, 2 years from today. 4(b) Pay $1,600 one year after completion of residency, which is 3 years from today 25 Assuming that the interst rate or cost of money is the only factor in Mary's decision and that the cost of money to her is 8%, which alternative should she choose? 0 32 34 35 36 37 38 39 40 Case #4: Cline Company has entered into two lease agreements. In each case, the cash equivalent purchase price of the asset acquired is known and you wish to find the interest rate which is applicable to the lease payments 41 42 Lease A- Lease A covers office equipment which could be purchased for $36,048. Cline Company has, however, chosen to lease the equipment for $10,000 per year, payable at the end of each of the next 5 years. Find the interest rate. 43 Lease B -Lease B applies to a machine which can be purchased for $52,263. Cline Company has chosen to lease the machine for $12,000 per year on a 6-year lease. Payments are due at the end of each year. Find the interest rate. 45 46 47 48 49 47 48 49 50 51 52 53 54 56 57 58 Case #5: Baker Company owns a plot of land on which buried toxic waste have been discovered. It will require several years and a considerable sum of money before the property is fully detoxified and capable of generating revenues, Baker wishes to sell the land now. 59 Baker has located two potential buyers: Buyer A is willing to pay $450,000 for the land now. Buyer B is willing to pay S5000 today and also make 20 annual payments of S50.000 each. If the market rate of interest is 9%, to whom should Baker sell the land? Show all calculations. 60 61 62 63 64 65 67 68 69 70 72