Answered step by step

Verified Expert Solution

Question

1 Approved Answer

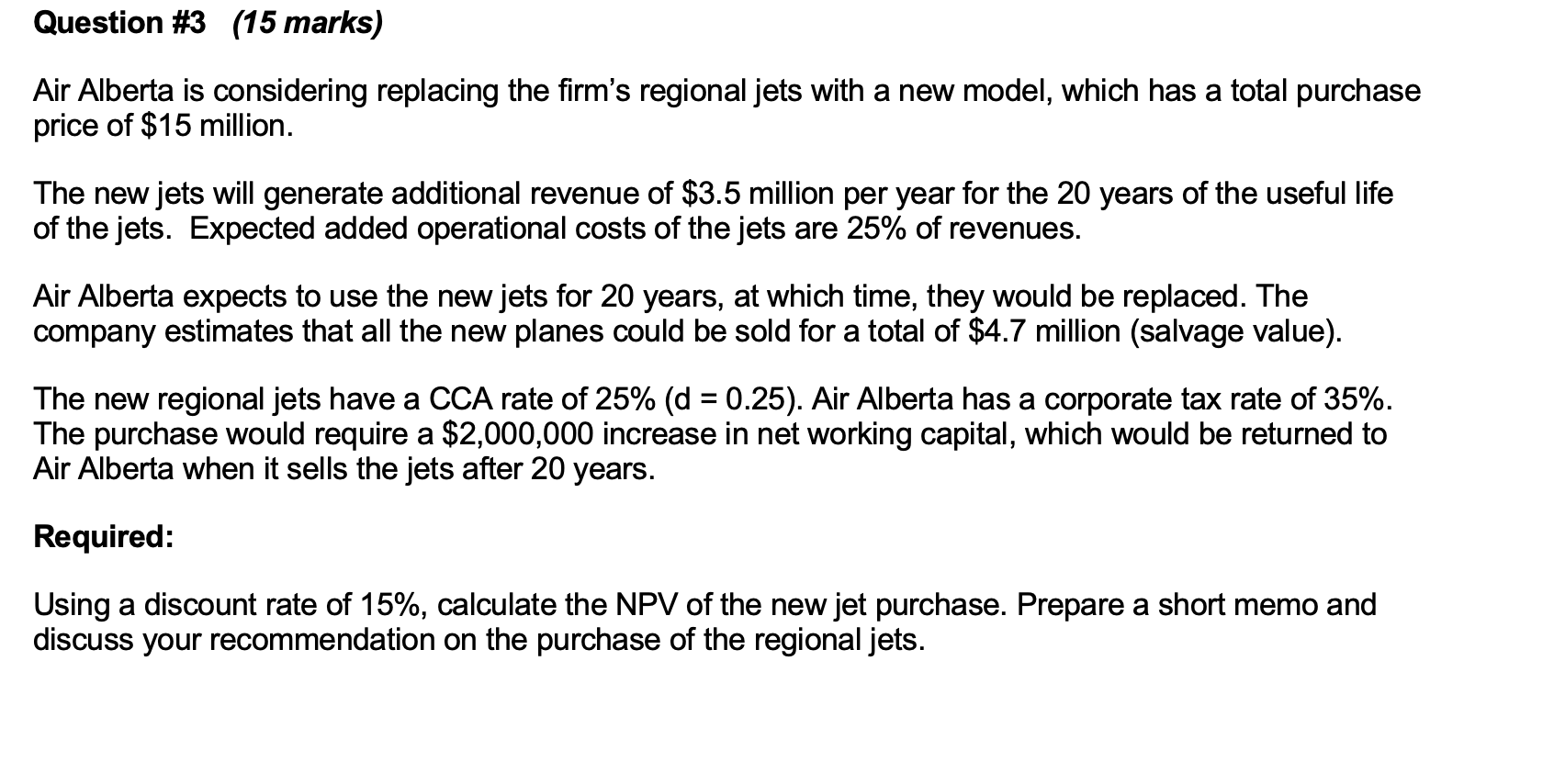

PLEASE HELP ASAP! Question # 3 ( 1 5 marks ) Air Alberta is considering replacing the firm's regional jets with a new model, which

PLEASE HELP ASAP! Question # marks

Air Alberta is considering replacing the firm's regional jets with a new model, which has a total purchase

price of $ million.

The new jets will generate additional revenue of $ million per year for the years of the useful life

of the jets. Expected added operational costs of the jets are of revenues.

Air Alberta expects to use the new jets for years, at which time, they would be replaced. The

company estimates that all the new planes could be sold for a total of $ million salvage value

The new regional jets have a CCA rate of Air Alberta has a corporate tax rate of

The purchase would require a $ increase in net working capital, which would be returned to

Air Alberta when it sells the jets after years.

Required:

Using a discount rate of calculate the NPV of the new jet purchase. Prepare a short memo and

discuss your recommendation on the purchase of the regional jets.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started