Answered step by step

Verified Expert Solution

Question

1 Approved Answer

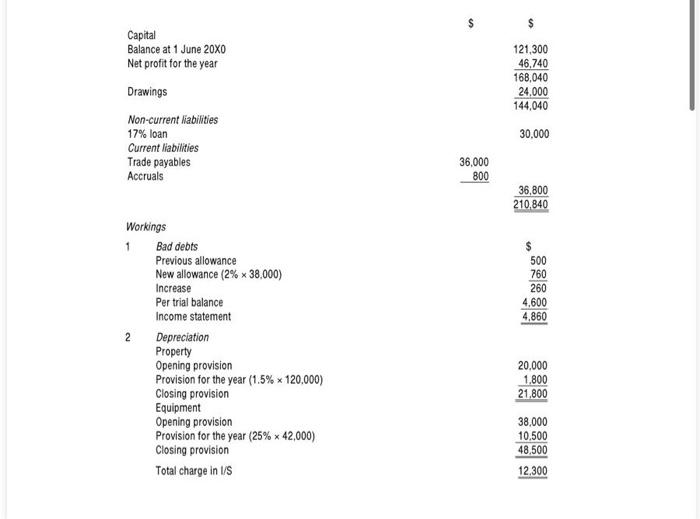

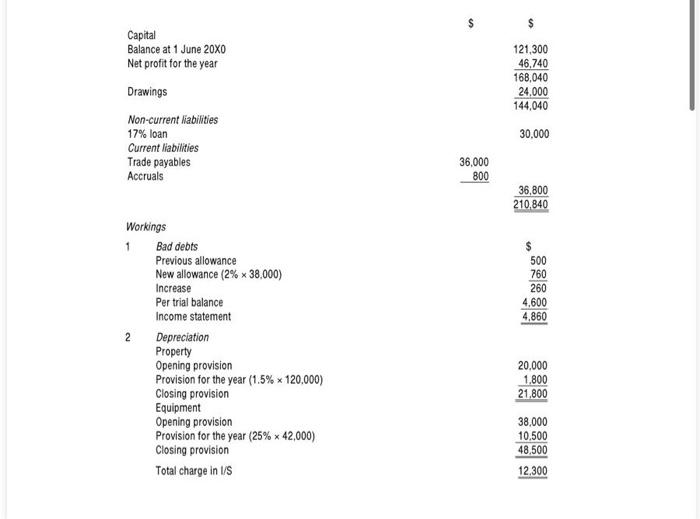

please help $ Capital Balance at 1 June 20x0 Net profit for the year Drawings Non-current liabilities 17% loan Current liabilities Trade payables Accruals 121,300

please help

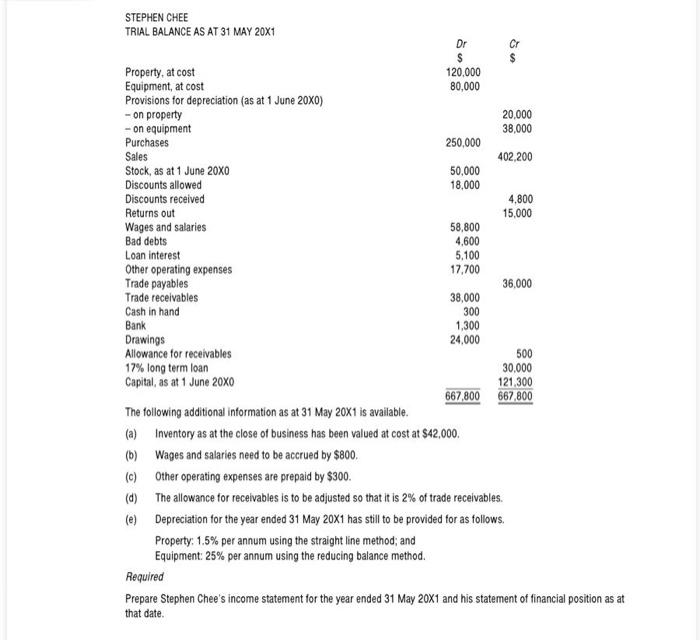

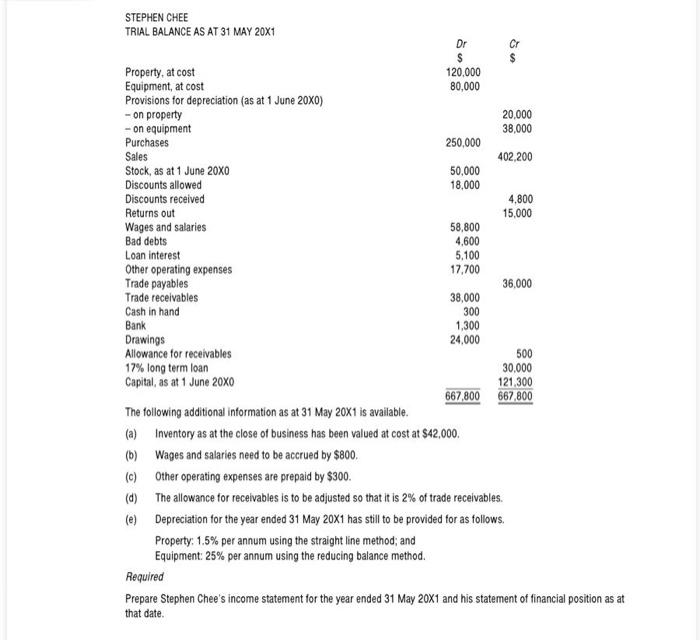

$ Capital Balance at 1 June 20x0 Net profit for the year Drawings Non-current liabilities 17% loan Current liabilities Trade payables Accruals 121,300 46.740 168,040 24.000 144,040 30,000 36,000 800 36,800 210,840 $ 500 760 260 4,600 4,860 Workings 1 Bad debts Previous allowance New allowance (2% x 38,000) Increase Per trial balance Income statement 2 Depreciation Property Opening provision Provision for the year (1.5% 120,000) Closing provision Equipment Opening provision Provision for the year (25% x 42,000) Closing provision Total charge in I/S 20,000 1.800 21.800 X 38,000 10.500 48,500 12.300 Cr is STEPHEN CHEE TRIAL BALANCE AS AT 31 MAY 20X1 Dr $ Property, at cost 120.000 Equipment, at cost 80,000 Provisions for depreciation (as at 1 June 20x0) - on property 20,000 - on equipment 38,000 Purchases 250,000 Sales 402,200 Stock, as at 1 June 20X0 50,000 Discounts allowed 18,000 Discounts received 4,800 Returns out 15,000 Wages and salaries 58,800 Bad debts 4,600 Loan interest 5.100 Other operating expenses 17,700 Trade payables 36,000 Trade receivables 38,000 Cash in hand 300 Bank 1,300 Drawings 24,000 Allowance for receivables 500 17% long term loan 30,000 Capital, as at 1 June 20x0 121,300 667,800 667,800 The following additional information as at 31 May 20X1 is available. (a) Inventory as at the close of business has been valued at cost at $42,000. (6) Wages and salaries need to be accrued by $800. (0) Other operating expenses are prepaid by $300. (d) The allowance for receivables is to be adjusted so that it is 2% of trade receivables. (e) Depreciation for the year ended 31 May 20X1 has still to be provided for as follows. Property 1.5% per annum using the straight line method; and Equipment: 25% per annum using the reducing balance method. Required Prepare Stephen Chee's income statement for the year ended 31 May 20X1 and his statement of financial position as at that date

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Income Statement for the Year Ended 31 May 20X1 Sales Sales Revenue 402200 Cost of Sales Opening Inventory 50000 Purchases 250000 Closing Inventory 42...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started