Answered step by step

Verified Expert Solution

Question

1 Approved Answer

wacc is 5%, pv shield on cca for buying asset is 122857. pv for tax salvage is 18000. caculate npv and irr for both options

wacc is 5%, pv shield on cca for buying asset is 122857. pv for tax salvage is 18000. caculate npv and irr for both options buying and leasing

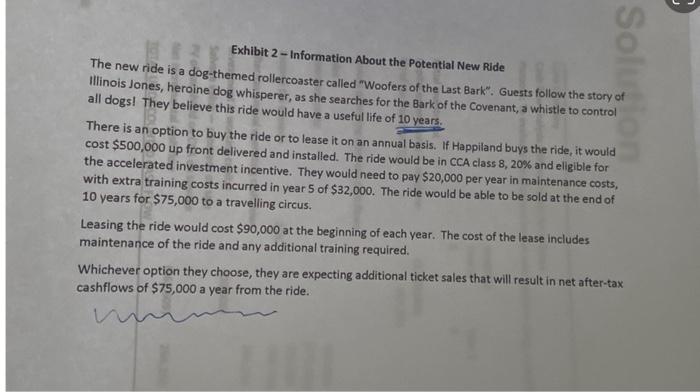

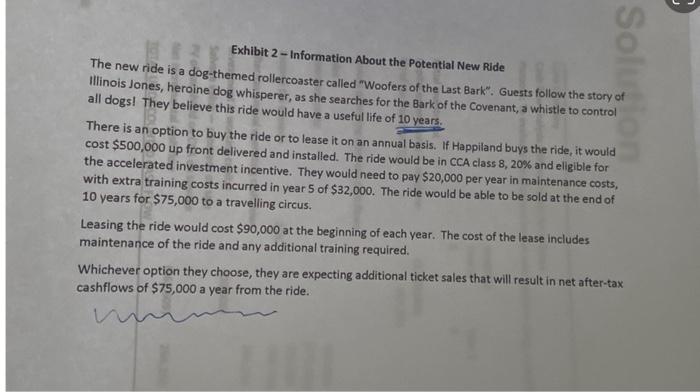

Soliton Exhibit 2 - Information About the potential New Ride The new ride is a dog-themed rollercoaster called "Woofers of the Last Bark". Guests follow the story of Illinois Jones, heroine dog whisperer, as she searches for the Bark of the Covenant, a whistle to control all dogs! They believe this ride would have a useful life of 10 years. There is an option to buy the ride or to lease it on an annual basis. If Happiland buys the ride, it would cost $500,000 up front delivered and installed. The ride would be in CCA class 8, 20% and eligible for the accelerated investment incentive. They would need to pay $20,000 per year in maintenance costs, with extra training costs incurred in year 5 of $32,000. The ride would be able to be sold at the end of 10 years for $75,000 to a travelling circus. Leasing the ride would cost $90,000 at the beginning of each year. The cost of the lease includes maintenance of the ride and any additional training required. Whichever option they choose, they are expecting additional ticket sales that will result in net after-tax cashflows of $75,000 a year from the ride. Soliton Exhibit 2 - Information About the potential New Ride The new ride is a dog-themed rollercoaster called "Woofers of the Last Bark". Guests follow the story of Illinois Jones, heroine dog whisperer, as she searches for the Bark of the Covenant, a whistle to control all dogs! They believe this ride would have a useful life of 10 years. There is an option to buy the ride or to lease it on an annual basis. If Happiland buys the ride, it would cost $500,000 up front delivered and installed. The ride would be in CCA class 8, 20% and eligible for the accelerated investment incentive. They would need to pay $20,000 per year in maintenance costs, with extra training costs incurred in year 5 of $32,000. The ride would be able to be sold at the end of 10 years for $75,000 to a travelling circus. Leasing the ride would cost $90,000 at the beginning of each year. The cost of the lease includes maintenance of the ride and any additional training required. Whichever option they choose, they are expecting additional ticket sales that will result in net after-tax cashflows of $75,000 a year from the ride

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started