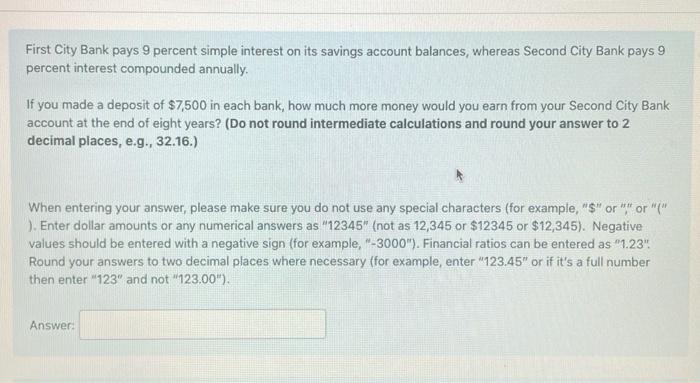

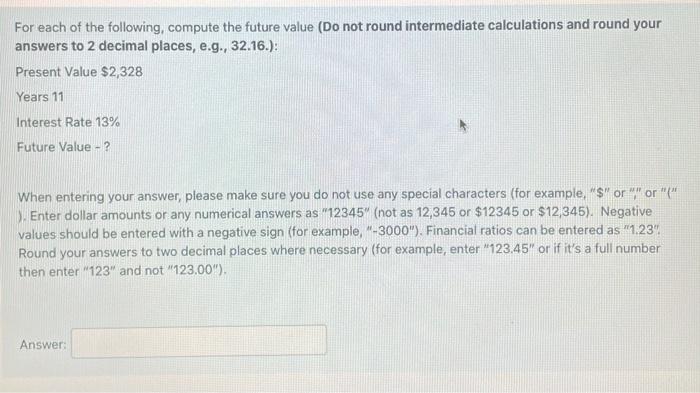

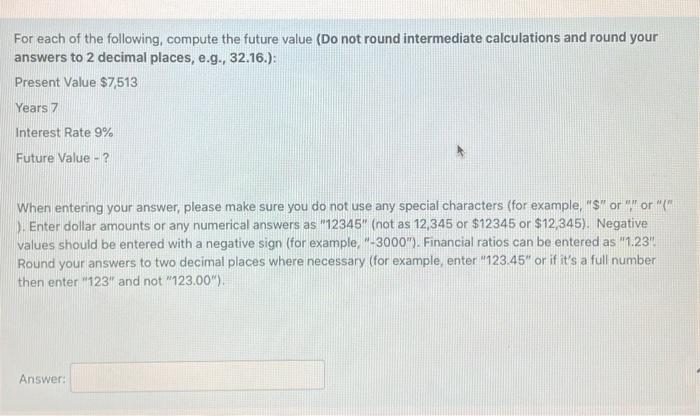

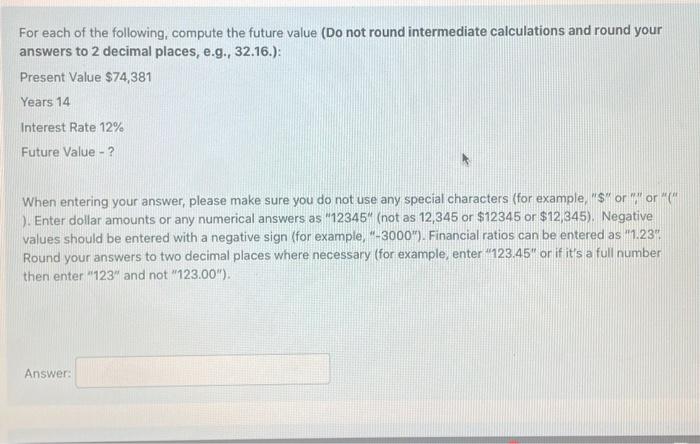

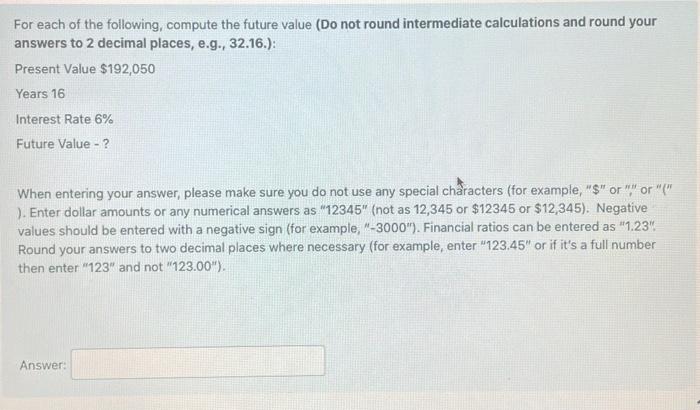

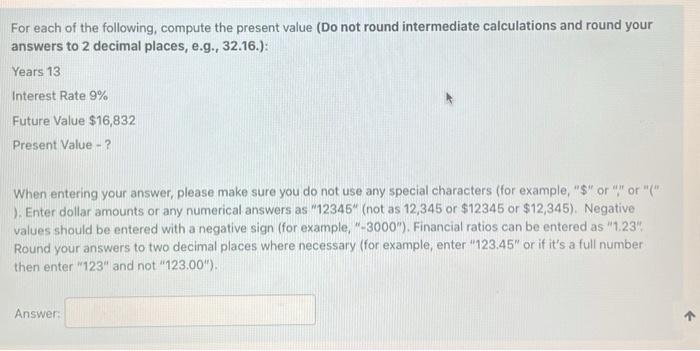

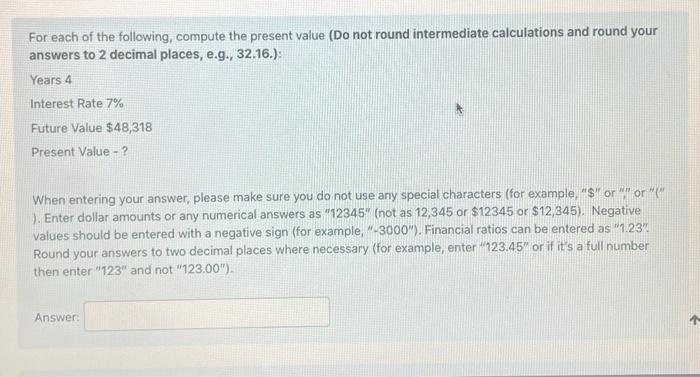

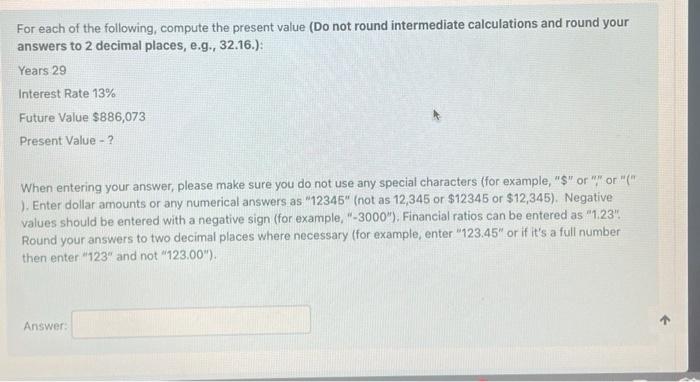

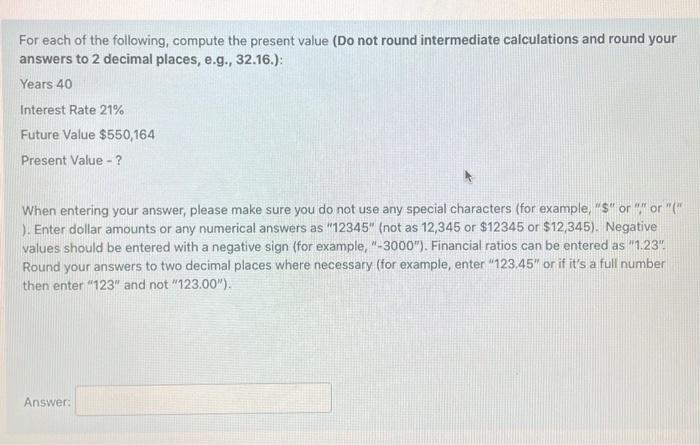

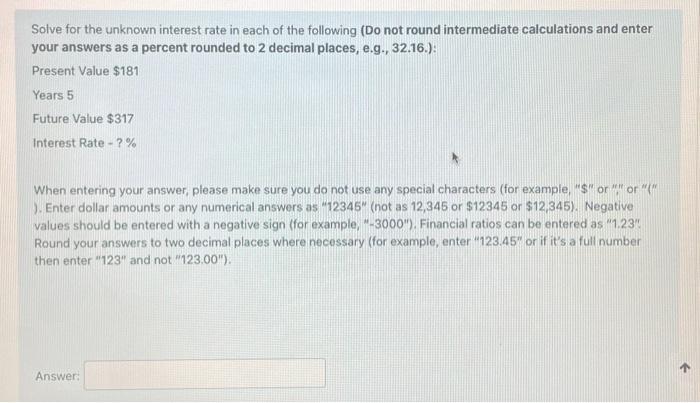

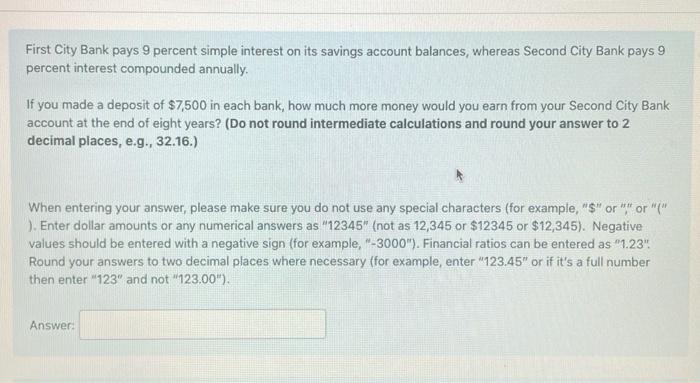

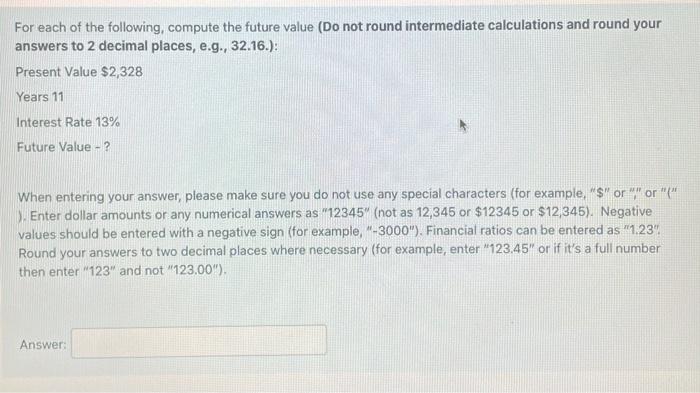

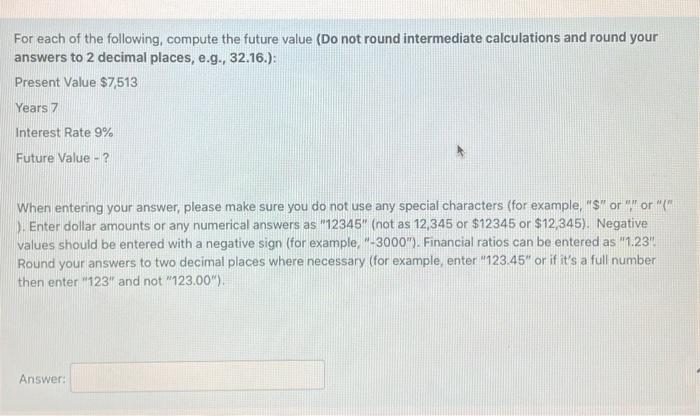

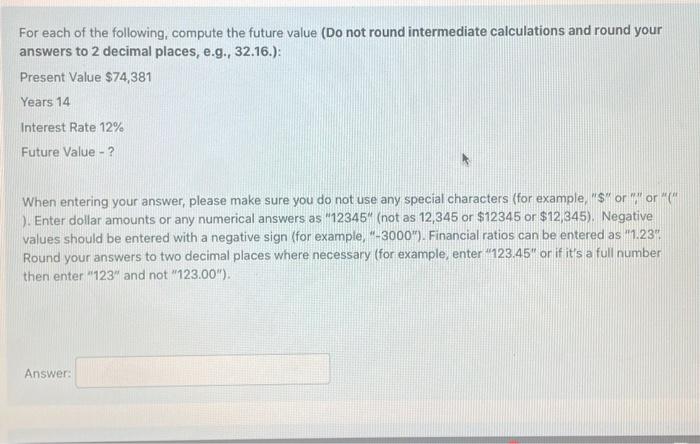

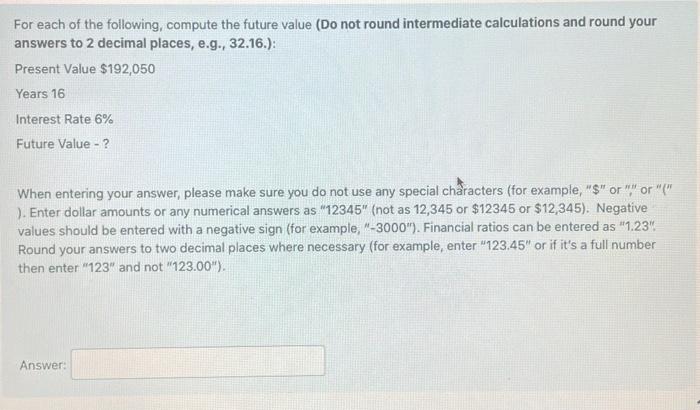

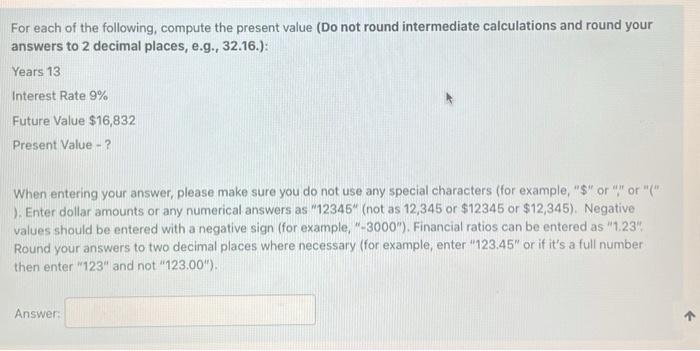

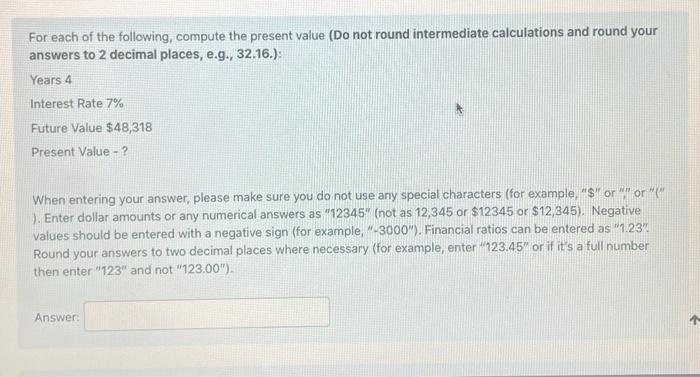

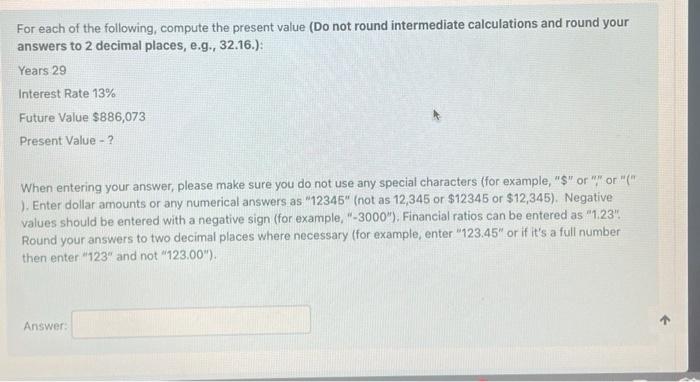

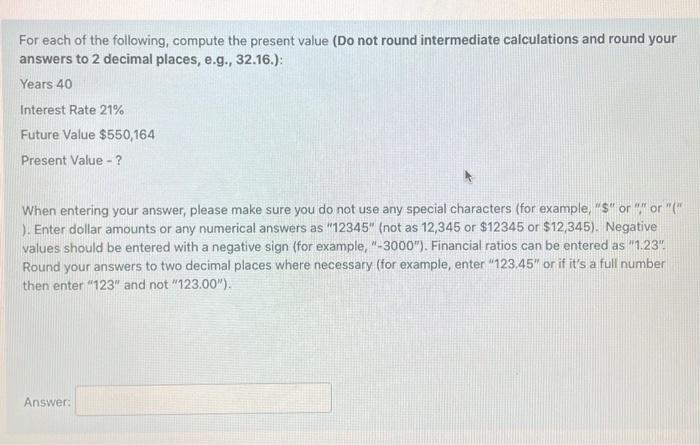

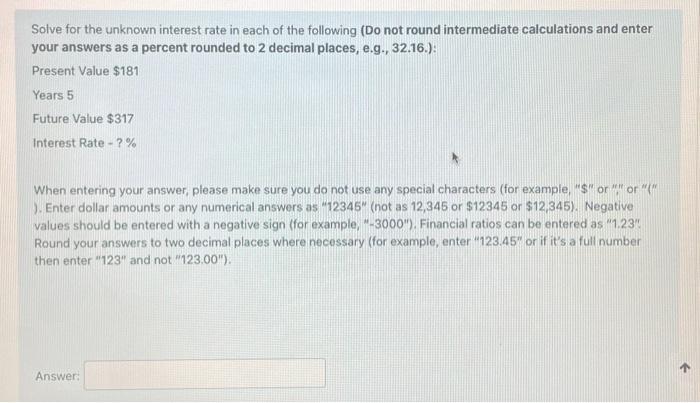

First City Bank pays 9 percent simple interest on its savings account balances, whereas Second City Bank pays 9 percent interest compounded annually. If you made a deposit of $7,500 in each bank, how much more money would you earn from your Second City Bank account at the end of eight years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) When entering your answer, please make sure you do not use any special characters (for example, "S" or " or "" ). Enter dollar amounts or any numerical answers as "12345" (not as 12,345 or $12345 or $12,345). Negative values should be entered with a negative sign (for example, "-3000"). Financial ratios can be entered as "1.23" Round your answers to two decimal places where necessary (for example, enter "123.45" or if it's a full number then enter "123" and not "123.00"). Answer: For each of the following, compute the future value (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.): Present Value $2,328 Years 11 Interest Rate 13% Future Value - ? When entering your answer, please make sure you do not use any special characters (for example, "$" or "or" 5. Enter dollar amounts or any numerical answers as "12345" (not as 12,345 or $12345 or $12,345). Negative values should be entered with a negative sign (for example, "-3000"). Financial ratios can be entered as "1.23 Round your answers to two decimal places where necessary (for example, enter "123.45" or if it's a full number then enter "123" and not "123.00"). Answer: For each of the following, compute the future value (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.): Present Value $7,513 Years 7 Interest Rate 9% Future Value - ? When entering your answer, please make sure you do not use any special characters (for example, "Soror" ). Enter dollar amounts or any numerical answers as "12345" (not as 12,345 or $12345 or $12,345). Negative values should be entered with a negative sign (for example, -3000"). Financial ratios can be entered as "1.23". Round your answers to two decimal places where necessary (for example, enter "123.45" or if it's a full number then enter 123" and not "123.00") Answer: For each of the following compute the future value (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.): Present Value $74,381 Years 14 Interest Rate 12% Future Value - ? When entering your answer, please make sure you do not use any special characters (for example, "Soror ). Enter dollar amounts or any numerical answers as "12345" (not as 12,345 or $12345 or $12,345). Negative values should be entered with a negative sign (for example, "-3000"). Financial ratios can be entered as "1.234 Round your answers to two decimal places where necessary (for example enter "123.45" or if it's a full number then enter "123" and not "123.00"). Answer: For each of the following, compute the future value (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.): Present Value $192,050 Years 16 Interest Rate 6% Future Value - ? When entering your answer, please make sure you do not use any special characters (for example, "$" or " or "" ). Enter dollar amounts or any numerical answers as "12345" (not as 12,345 or $12345 or $12,345). Negative values should be entered with a negative sign (for example, M-3000"). Financial ratios can be entered as "1.23" Round your answers to two decimal places where necessary (for example, enter "123.45" or if it's a full number then enter "123" and not "123.00"). Answer: For each of the following, compute the present value (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.): Years 13 Interest Rate 9% Future Value $16,832 Present Value - ? When entering your answer, please make sure you do not use any special characters (for example, "$" or "or"(". ). Enter dollar amounts or any numerical answers as "12345" (not as 12,345 or $12345 or $12,345). Negative values should be entered with a negative sign (for example, M-3000"). Financial ratios can be entered as "1.23 Round your answers to two decimal places where necessary (for example, enter "123.45" or if it's a full number then enter "123" and not "123.00"). Answer: For each of the following, compute the present value (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Years 4 Interest Rate 7% Future Value $48,318 Present Value - 2 When entering your answer, please make sure you do not use any special characters (for example, "S" or or " ). Enter dollar amounts or any numerical answers as "12345" (not as 12,345 or $12345 or $12,345). Negative values should be entered with a negative sign (for example, "-3000"). Financial ratios can be entered as "1.23" Round your answers to two decimal places where necessary (for example, enter "123.45" or if it's a full number then enter "123" and not "123.00"). Answer: For each of the following, compute the present value (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.): Years 29 Interest Rate 13% Future Value $886,073 Present Value - 2 When entering your answer, please make sure you do not use any special characters (for example, "$" or "or" ). Enter dollar amounts or any numerical answers as "12345" (not as 12,345 or $12345 or $12,345). Negative values should be entered with a negative sign (for example, "-3000"), Financial ratios can be entered as "1.23" Round your answers to two decimal places where necessary (for example, enter "123.45" or if it's a full number then enter *123" and not "123.00"). Answer: For each of the following, compute the present value (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.): Years 40 Interest Rate 21% Future Value $550,164 Present Value - ? When entering your answer, please make sure you do not use any special characters (for example, "$" or "or"(" ). Enter dollar amounts or any numerical answers as "12345" (not as 12,345 or $12345 or $12,345). Negative values should be entered with a negative sign (for example, "-3000"). Financial ratios can be entered as "1.23" Round your answers to two decimal places where necessary (for example, enter "123.45" or if it's a full number then enter "123" and not "123.00"), Answer: Solve for the unknown interest rate in each of the following (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.): Present Value $181 Years 5 Future Value $317 Interest Rate - 7% When entering your answer, please make sure you do not use any special characters (for example, "$" or more ). Enter dollar amounts or any numerical answers as "12345" (not as 12,345 or $12345 or $12,345). Negative values should be entered with a negative sign (for example, M-3000"), Financial ratios can be entered as "1.23" Round your answers to two decimal places where necessary (for example, enter "123.45" or if it's a full number then enter 123" and not "123.00")