please help .. i keep messing up on this question

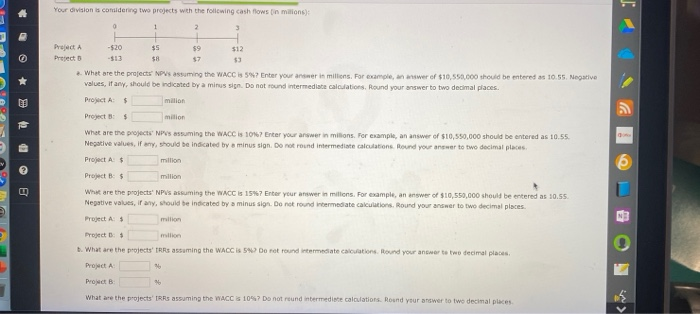

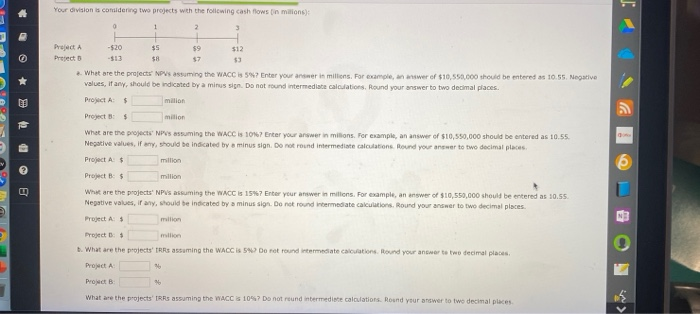

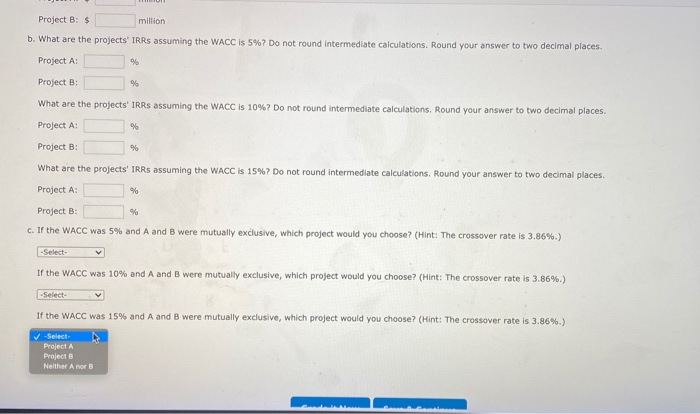

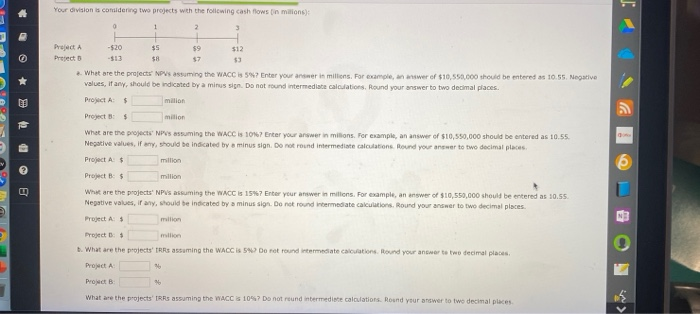

Your division is considering two projects with the following cash flows in millions 1 Project -520 $5 $9 $12 Prorecto $8 $7 53 2. What are the projects NPVs assuming the WACC 5 Enter your answer in millions. For example, answer of $10.550.000 should be entered as 10.55. Negative values, if any, should be indicated by a minus sign. Do not found intermediate calculations. Round your answer to two decimal places. Project $ million Project million $ What are the projects PVs assuming the WACC is 1047 Enter your answer in milions. For example, an answer of $10,550,000 should be entered as 10.55 Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to two decimal places Project AS million Projects million What are the projects PVs assuming the WACC is 1517 Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55 Negative values, if any, should be indicated by a minus sign. Do not round Intermediate calculations. Round your answer to two decimal places. Project AS milion Project : $ million . What are the projects' TRRs assuming the WACC Dorot round intermediate calculation Round your answer to two decimal places Project A Project B What are the projects' RRs assuming the WACC 10%? Do not reund intermediate calculations. Round your answer to two decimal places Project B: $ million b. What are the projects' IRRs assuming the WACC is 5%? Do not round Intermediate calculations. Round your answer to two decimal places. Project A: 96 Project B: 96 What are the projects' IRRs assuming the WACC is 10%? Do not round intermediate calculations. Round your answer to two decimal places. Project A: % Project B: 96 What are the projects' TRRs assuming the WACC is 15%? Do not round intermediate calculations. Round your answer to two decimal places. Project A: % Project B: % c. If the WACC was 5% and A and B were mutually exclusive, which project would you choose? (Hint: The crossover rate is 3.86%) -Select- If the WACC was 10% and A and B were mutually exclusive, which project would you choose? (Hint: The crossover rate is 3.86%) -Select If the WACC was 15% and A and B were mutually exclusive, which project would you choose? (Hint: The crossover rate is 3.86%.) -Select Project A Project B Nelther Anor